![]()

ANOMALY IN RE-REGISTRATION OF EXISTING TRUSTS OR INSTITUTIONS U/S 12AB:

VERY NICE REPRESENTATION BY KSCAA

Date: 13th June 2021

To,

Shri. J B Mohapatra

The Chairman

Central Board of Direct Taxes,

New Delhi – 110001

Respected Sir,

SUBJECT: ANOMALY IN RE-REGISTRATION OF EXISTING TRUSTS OR INSTITUTIONS U/S 12AB

The Karnataka State Chartered Accountants Association (R) (in short ‘KSCAA’) is an Association of Chartered Accountants, registered under the Karnataka Societies Registration Act, in the year 1957. KSCAA is primarily formed for the welfare of Chartered Accountants and represents before various regulatory authorities to resolve the problems / hardships faced by Chartered Accountants and business community.

The relevant transcript of The Budget Speech of 2020-21 by Hon’ble Finance Minister of Union of India contains that “In order to simplify the compliance for the new and existing charity institutions, I propose to make the process of registration completely electronic under which a unique registration number (URN) shall be issued to all new and existing charity institutions. Further, to facilitate the registration of the new charity institution which is yet to start their charitable activities, I propose to allow them provisional registration for three years.” In line with this announcement in the Budget (The Finance Act, 2020) has made far reaching amendments in respect of all charitable trusts/institutions claiming exemption under section 10(23C) or 80G or 11 of the Income-tax Act, 1961. All these amendments were in abeyance till 31st of March 2021 due to Corona Pandemic situation prevailing in the Country; however these set of amendments in the Statute have now been made effective starting from 1st of April 2021 with relevant forms and rules also been notified through notification 19/2021 dated 26th March 2021 also effective from that date i.e. 1st April 2021.

As per newly inserted sub-clause (i) under clause (ac) in section 12A(1) w.e.f. 1st April, 2021 providing that where the trust or institution is already registered under Section 12A or under Section 12AA, it shall be required to make an application in the prescribed form (in Form 10A) to the Principal Commissioner or Commissioner for re-registration of trust within three months from 1st April 2021 and such trust or institution should obtain final registration under section 12AB to be valid for 5 years starting from previous year 2021-22. Thus, all existing trusts or institutions which are registered under Section 12A or Section 12AA will have to mandatorily be required to apply for re-registration within a period of three months starting from 1st April, 2021 i.e. up to 30th June, 2021 and obtain final registration under Section 12AB to be valid for next 5 years starting from previous year 2021-22. The corollary of not complying with this requirement by existing trusts or institutions could potentially result in burdensome tax implications for such trusts or institutions under section 115TD.

We congratulate and applaud the good intentions of the Government in leveraging on the benefits of technological advancements by bringing a uniformity in the process of registration in online mode and also to iron out the creases that are there in the existing registration process which is manual and is scattered all over the Country. In a way, in our considered view it is a project being undertaken by Government to bring in all the existing and future trusts or institutions on the same technology platform and treat them alike which has necessitated provisions being enacted for migration of existing registered trusts or institutions under new system and to obtain new 16 digit URN replacing the existing registration number if any allotted.

The going in position as envisaged in these amendments including the speech of Hon’ble Finance minister is that, the existing trusts or institution should remain unscathed from the burden of being subjected to verification and scrutiny by the department as to genuineness of their activities for at least first 5 years after obtaining new URN under new system. To be more specific, under newly inserted section 12AB(1)(a) read with section 12A(1)(ac)(i) and rule 17A, the Principal Commissioner or Commissioner shall pass an order registering the existing registered trust or institution without any enquiries being made as to genuineness of activities or any other matter related to such trusts of institutions.

In no case such existing registered trusts or institutions which have applied for re-registration by filling Form 10A under section 12A(1)(ac)(i) should be treated as trusts or institutions falling under 12A(1)(ac)(vi). Ironically, to our surprise, an anomaly which in our view is very fundamental has been observed by us in issuance of registration certificates to existing registered trusts or institutions by department through its income tax portal i.e. all the existing trusts or institutions which have applied for re-registration under section 12A(1)(ac)(i) are being, by default, wrongly issued Provisional registration certificates under section 12AB(1)(c) valid for 3/5 years instead of lawfully and rightfully issuing Final registration certificates to such trusts or institutions under section 12AB(1)(a) with a validity of 5 years.

For the sake of convenience, we have referred only to provisions of section 12A of the Act. While similar provisions are contained in section 10(23C)/80G/35, the below representation can be understood to cover similar provisions contained in other provisions of the Act.

1.1 Trust with Existing registration u/s 12A/12AA – Section 12(1)(ac)(i)

In case of trusts that were already registered u/s 12A or 12AA of the Act, the law envisaged to provide registration on an application being submitted u/s 12A(1)(ac)(i). The relevant extract of the same is given as under:

“ (i) where the trust or institution is registered under section 12A [as it stood immediately before its amendment by the Finance (No. 2) Act, 1996 (33 of 1996)] or under section 12AA [as it stood immediately before its amendment by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 (38 of 2020)], within three months from the first day of April, 2021; “

The above provision makes it ample clear that all assessees that are currently registered under section 12A/12AA, are required to apply for renewal of the same between the 3 months window i.e. April 2021 to June 2021. To make these provisions operational, Rule 17A was prescribed, requiring an assessee to file Form 10A for the cases covered u/s 12A(1)(ac)(i).

Once an application is filed, the same is considered as per the provisions of section 12AB of the Act. The relevant extract of the same is as follows:

“12AB. (1) The Principal Commissioner or Commissioner, on receipt of an application made under clause (ac) of sub-section (1) of section 12A, shall—

(a) where the application is made under sub-clause (i) of the said clause, pass an order in writing registering the trust or institution for a period of five years;

(b)

(c) where the application is made under sub-clause (vi) of the said clause, pass an order in writing provisionally registering the trust or institution for a period of three years from the assessment year from which the registration is sought”

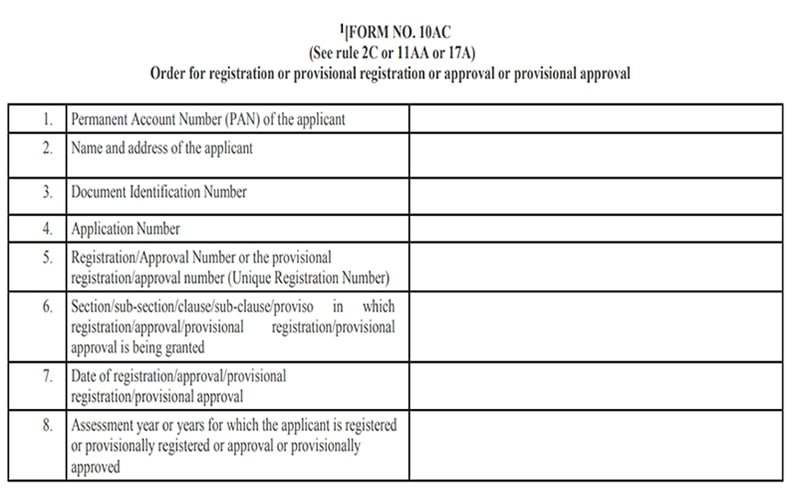

Therefore, as per section 12AB read with rule 17A, the Principal Commissioner or Commissioner, authorised by the Board shall pass an order in writing granting registration in Form No. 10AC. It is relevant to note from the above that the statute envisages grant of automatic (in accordance with Rule 17A of the Rules) registration for applications filed u/s 12A(1)(ac)(i) of the Act. It is our understanding that the same has to be final registration u/s 12AB(1)(a) and not provisional u/s 12AB(1)(c). The same is evident from the contrasting languages used in clause (c) vis-a-vis clause (a) of section 12AB(1) of the Act.

On making a reference to the Form 10AC (dealing with processing of Form 10A as referred above), it is relevant to note that the same provides for registration / approval in addition to provisional registration / provisional approval.

1.2 For new registration of trust – Section 12A(1)(ac)(vi)

The law provides for fresh registration of trusts u/s 12A(1)(ac)(vi), and there is no detailed scrutiny of documents/information to satisfy about the genuineness of the activities of the trust/institution, among other requirements. Such a provision is understandable as there is no activity to substantiate for the trust which is newly established. The registration under such instance would meet the condition of section 12A(1)(ac)(iii) wherein the law mandates such trusts to make an application by way for the filing of Form 10AB (as again form 10A filed previously) within 6 months from the commencement or at least six months prior to the expiry of 3 years, whichever is earlier.

Further, any applications which were filed before 1st of April 2021 and where no orders are passed u/s 12AA(1)(b), such applications shall be deemed to be applications made u/s section 12(1)(ac)(vi). However the anomaly which we wish to bring to your kindly consideration through this representation relates to the applications as submitted by existing trusts or institutions under section 12A(1)(ac)(i) envisaging issuance of final registration certificates under section 12AB(1)(a).

1.3 Analysis

To summarise, it is our submission that Form 10A/10AC is applicable in the following three scenarios

| Application for registration | Type of registration | Period | Pass order under section |

| Registration renewals

Section 12(1)(ac)(i) |

Final registration | 5 years | 12AB(1)(a) |

| Fresh registration

Section 12(1)(ac)(vi) |

Provisional registration | 3 years | 12AB(1)(c) |

| For registration applied earlier and no order was passed u/s 12AA (1)(b) | Provisional registration | 3 years | 12AB(1)(c) |

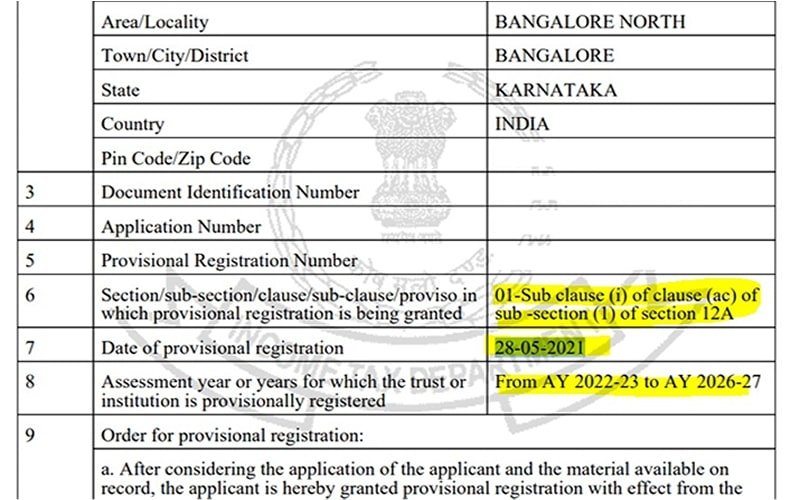

It is clear from the reading of section 12AB read with section 12A(1)(ac) with rule 17A, that the grant of registration for cases covered u/s 12A(1)(ac)(i) is for five years and final. However to our surprise, it has come to our notice that the applications made under section 12A(1)(ac)(i) of the Act [dealing with re-registrations] are processed by way of issue of provisional registration for 3/5 years.

The use of word provisional has been a differential indicator of approval for the cases covered under clause (a) and clause (c) of section 12AB(1). When Section 12AB makes clear distinction between use of word provisional in one case and not in other, the intent of the law is and must also be that of what it is. The clear demarcation of privilege amongst the clause (a) and (c) u/s 12AB(1) must not be mixed and it is an ‘intelligible differentia’. The current case of declaring all the trust under one category of ‘provisional’ shortens the difference which the law wanted to separate and highlight. The difference between such grant of approval and use of provisional for cases covered even u/s 12(1)(ac)(i) is arbitrary use of power. We are of the opinion that the section doesn’t not empower provisional registration for cases covered u/s 12(1)(ac)(i) and as such is a clear case of excess jurisdiction.

Now the fiction created by providing provisional registration for three years under section 12AB(1)(c) for the cases covered in Section 12(1)(ac)(i) is not only ultra-vires but puts the assessee in hardship of requiring him to apply under section 12A(1)(ac)(iii) of the Act. This, requires him to file for final registration at least six months prior to the expiry of a period of the provisional registration or within six months of commencement of its activities, whichever is earlier. This is something not at all envisaged in the law which could be also be inferred by referring to the speech of Hon’ble speech of Finance Minister covered elsewhere in this document.

Therefore we would like to submit to yourself that the current practice and procedure being followed by the department through the Income tax portal of wrong issuance of provisional registration certificate in place of final registration certificate falls foul of overall scheme, spirit and intent of these significant amendments brought in by the Parliament in the Income tax law.

Screenshot of a “Provisional” Certificate issued is given below for your ready reference-

1.4 Our Representation

We implore upon your goodself to take necessary corrective steps to fix the system bugs if any in the income tax Portal and to also issue relevant clarifications in relation to all the following points –

- For the cases where re-registration applications have been filed u/s 12A(1)(a)(i) in Form 10A, the Income tax portal should trigger final registration certificate and not provisional registration certificate as being generated at present.

- For the cases where incorrect provisional registration certificates having been already issued against applications filed u/s 12A(1)(a)(i) in Form 10A, proper and valid final registration certificate to be issued in replacement of existing provisional registration certificates already issued.

- To expedite on disposing off all the legacy cases covered u/s 12AB (2) by issuance of provisional registration certificates at the earliest opportunity / within the time limits provided in the Act.

We at KSCAA are sure that the anomaly in the re-registration process of existing trusts or institutions under the new system/process as highlighted by us in the foregoing pages along with corresponding suggestions and resolutions sought as above would invite your kind consideration for taking appropriate corrective steps.

Yours sincerely,

For Karnataka State Chartered Accountants Association ®

CA. Kumar S Jigajinni CA. Pramod Srihari CA. Ganesh V Shandage

President Secretary Chairman Representation Committee

Copy to –

- Nirmala Sitaraman, Hon’ble Union Minister for Finance and Corporate Affairs, Government of India

- Anurag Thakur, Hon’ble Union Minister of State for Finance, Government of India

- Tarun Bajaj, Revenue Secretary, Department of Revenue, Ministry of Finance, Government of India

Income Tax Act on Your Mobile Now Android Application For Income Tax Act – 1961 with Cost Inflation Index and other tools on Mobile now at following link:

Whatsapp Group at

-

https://chat.whatsapp.com/GcvtVy4wLF2A4iTnTXMIqQ

-

https://chat.whatsapp.com/FUFXI9CcLVsH5BActx7mtH