![]()

Issues in New Income Tax Portal :

An Excellent Compilation by Maharashtra Tax Practitioners’ Association

SS / MTPA /IT representation 21-22 / 0721

14th July 2021

To,

Shri. Narendraji Modi,

Prime Minister of India,

South Block, Raisina Hill,

New Delhi – 110 011

Ref:New Income-tax portal launched on 7th June 2021

Sub: Various practical problems faced by us & suggested solutions therefore regarding …

Our Association represents Tax Consultants, Advocates, Chartered Accountants, Company Secretaries & Cost Accountants practicing in direct & indirect taxes from whole Maharashtra state. Presently, we have around 1700 plus active members from the state. Our Association always represents the concerns and problems faced by these members before the respective tax authorities. This initiative of our Association has proved beneficial for the tax administering authorities, our members and ultimately the tax payers at large. Our Association was known as The Western Maharashtra Tax Practitioners’ Association; in a recent Special General Meeting of our members held on 6th June 2021, we have decided to expand our wings & made our area of operation as whole Maharashtra.

Our finance ministry & CBDT have taken a decision to switch over from the then incometax website www.incometaxindiaefiling.gov.in”to new website www.incometaxindia.gov.in”.The decision to switch must have been taken in broader interest of the taxpayers, income tax department by the respective authorities. We all the tax professionals & taxpayers of the county find it almost impossible to deal with the new website on account of the following factual issues put forth before you with the relevant proofs.

1. Profile completion issue:The profiles of all taxpayers in old website were complete & all the functions for these tax payers were active (could be complied with easily).However in new website these functions could not be complied without completing the assessees profile upto 100%.This discrepancy made the filing of returns & other compilation by assessee difficult in fact impossible through new website. Screenshot attached.

2. ITR-1 & 4 could only be filed: There are 7 different ITR forms those are Form No.1 to 7. Presently it is time to file Income – tax returns for AY 2021-22. However, the returns in from 1 & 4 only could be filed after facing various difficulties. Other ITR in form 2, 3, 5, 6, 7 could not be filed after making number of attempts.

3. Authorised Partner:In the new website login is made available to A) Chartered Accounts, B) Other authorised person. Whereas, the Income–tax department has forgotten the other important stakeholders supporting & playing important role in implementation of the Act, those arei) Income tax Practitioner, ii) Cost Accountants, iii) Advocates, iv) Company Secretaries, v) Tax Return Preparers. These important stakeholders must given separate login. There are thousands of Income tax Practitioners & Tax return preparers duly registered by the income – tax department in past years after due verification of procedure there for.

4. Digital signature registration: Existing digital signatures of the assessee were already registered on the old website. These existing digital signatures of the assessee are required to be registered on the new website again. These could not be registered easily & the assessee is facing no of problems in registering the digital signature.

5. TDS return could not be filed: TDS return could be filed through old Income-tax website. However, those could not be filed through new website those which have been filed their acknowledgment does not contain financial years, assessment years, quarter for which return filed, date of filing the return. This will lead to unnecessary litigation. Deductor has to rush to TAN facilitation center for filing theirTDS returns.

6. Acknowledgement of ITR filed: Those ITR’s which could be filed their acknowledgment disappears & could not be downloaded afterwards.

7. Funny dates appearing on acknowledgments: On the generated acknowledgments future dates are appearing & not the current date. Screenshot attached.

8. PAN not appearing on acknowledgments: Every assessee is identified more by its PAN rather than name. However, in case of returns filed PAN is not appearing on the generated acknowledgments. Screenshot attached.

9. Login takes time: One could very easily login to the old website in fraction of seconds, whereas login to the new website take much time leading to wastage of man-hours.

10. Mismatch in PAN data: In no of cases mismatch in PAN data is seen when there is actually no mismatch how to overcome this on the website is a big issue remaining unanswered.

11. Difference in PAN data & Aadhar data: The new website very surprisingly is trying to match PAN data with Aadhar data. In fact, in case of many Aadhar data birth yearis only appearing in place of birth date. Address on Aadhar in majority cases is residential address whereas address on PAN may be business / office address. This flaw must be removed from the new website immediately.

12. Problems for trust registration: In case of all trusts (new or old) registration u/s 12–AB is required to be carried out on or before 30th September (extended due date). However, the functionality to carry out the same is not yet available on the new website. In cases where the trust is required to renew their 80–G facility they could not do so.

13. From 10–A / 10-B could not be uploaded: Trusts requiring filing of form 10-A /10-B could not be uploaded. This will result in non compliance issue to the trusts.

14. E filed TDS data to be transferred to Traces for TDS credit: In case of efiled TDS returns through the website, the data is required to be picked up by traces site in order to give credit of TDS to the respective deductee. We find difficulty from the new website in doing so.

15. Grievances unanswered: Grievances filed by assessee through the new website has remained unanswered. Live cases of grievances filed on 3.7.2021 & 15.07.2021 are attached herewith for your verification. Screen shot attached.

16.Tax genie not working: A new feature in the name of tax genie is provided on the new website. No answers / solutions by tax genie are yet provided for any of the queries raised. In fact, appointment time decided along with mobile number has remained unanswered.

17. Form 15 – CA / 15- CB could not be filed: There is no functionality available on the new website for filing from 15 – CA & 15 – CB.

18.Income tax appeals could not be filed:After launching of new website cases where appeal is required to be filed could not be filed. Functionality to file Income–tax appeals is not available.

19. Vivad se Vishwas compliance window not available:The due date for DTVSV scheme application was finally extended to 31stMay 2021. Further compliances under Vivad se Vishwas scheme are to be complied thereafter. In many cases of DTVSV taxes have paid &Form–4 is pending for filing by assessee &Form- 5 is pending for issuance by Income tax department. There is no window available in the present website for these compliances.

20. In once login details of other assessee seen: In new website login of one assessee the details of other assessee are seen. Screenshot attached.

21. 3 Original returns of same assessee for same year with different acknowledgments: In case of one assessee 3 original returns of same assessment year with different acknowledgment number are seen. Screenshot attached.

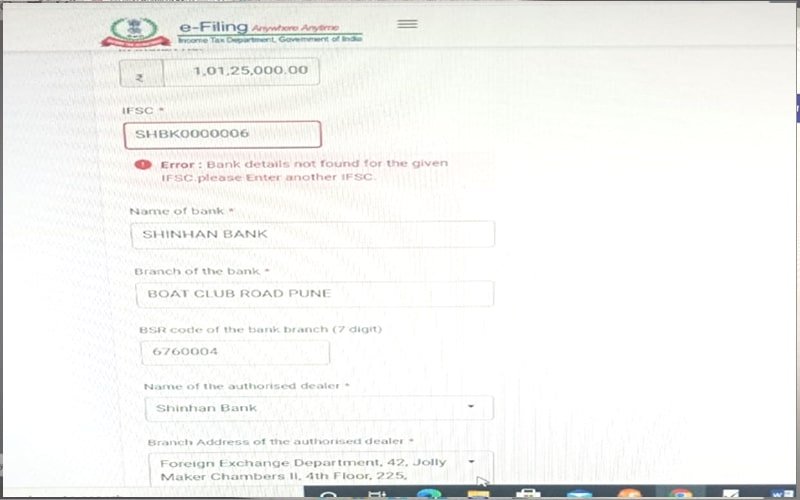

22. IFSC error: Despite putting correct IFSC on the website, IFSC error is shown in new website.

23. E verification could not be done:For e-filed returns e verification could not be done as OTP is not generated from the new website.

24. Returns u/s 153–C r w s 153–A could not be filed: In case where the assessee has got notices u/s 153–C rws 153-A, the assessee wants to file his returns under the above section. However, it could not be uploaded as the dropdown therefore on the new website is not available. How to file these returns is a big issue for taxpayers. We have 2 live cases for the issue. Copies of notices attached.

25. Finance department aware of the above issues: Our Union Finance department is aware of all the above issues regarding the problems in working of the new website. Our Union Finance Minister Mrs. Nirmala Sitaraman has arranged a meeting with Infosys(the new website provider) authorities somewhere in 2nd week of June. Infosys authorities have assured proper working of the website within next 15 days from the date of the meeting. This was tweeted by the Honourable Finance Minister. However, after more than 1 month from the assured date no progress could be seen in the working of the website.

26. Software allowability: Majority of the taxprofessionals are acquainted with one or the other private software. Presently, the returns etc. could not be filed through any private software. As the allowability tool for these softwares is not available in the new website. It is therefore suggested that the filing tool through the softwares may also be made available so as to expedite the compliances. We find it impossible to get these errors/flaws in the website corrected at an early moment.

The need for smooth running of the website is as follows:

- Financers, Bankers need to verify acknowledgements of ITR of their customers from website before disbursing loans.

- TDS returns are required to be filed intime, if not filed in time attracts late fees/ penalty.

- Trust registration, renewal, 80-G facility are held up for want of website working.

- Many assessees have finalised their accounts & ready to file ITR for AY 2021-22 which are held up on account smooth working of website.

- Form 15-CA/15- CB could not be filed.

- Appeals could not be uploaded,

- Vivad se Vishwas final compliance after tax payment is awaited.

- Scrutiny assessments to be completed by 30th June (due date extended twice) are held up. Date for scrutiny assessments now extended to 30th

- Existing profiles of taxpayers on the old portal disturbed.

- Grievances not addressed.

- Income tax refunds due for AY 2020-21 & 2021-22 are held up.

We therefore, urge that the new portal be launched:

- After various trials at various ends.

- We are ready to co-operate/ become part of trial submissions.

- The old portal was successful as it has introduced all the functions step by step over a period of time & not at a time.

- Completion of profile in each case isto be skipped till 28.02.2022.

- Profile completion be allowed between 01.03.2022 to 30.06.2022.

- Linking of PAN, Aadhar be extended till 30.06.2022.

- The website being new one extensive knowledge sessions by the Income-tax departmental staff to the tax payers, tax professionals be arranged all over the country by actual meetings as well as by zoom meetings.

Considering these genuine hardships we request your Honour to look in the matter & direct suspension of new website & relaunch of old website till all functionalities on the new website are properly activated. The above request is in the national interest & not in the interest of any single person.

We expect immediate direction of our genuine request put forth. The above flaws pointed out could also be independently got verified.

Thanking you,

Yours faithfully,

For Maharashtra Tax Practitioners’ Association

| (Manoj S Chitalikar) | (Santosh S Sharma) | (Narendra K Sonawane) |

| President | Past President & Chairman | Past President & Convener |

| Income tax representation Committee | ||

| 9822194015 | 9850053341 | 9822601617 |

CC to:

- The Union Finance Minister,

Union of India, North Block,

New Delhi – 110 001

- Ministerof State for Finance,

Union of India, North Block,

New Delhi – 110 001

- The Finance Secretary,

Union of India, North Block,

New Delhi – 110 001

- Shri P C Modi, Chairman,

Central Board of Direct Taxes,

North Block,New Delhi – 110 001

- The Principal Chief Commissioner of Income – Tax,

Sadhu Vaswani Square, Pune – 411 001

Dear Sir / Madam,

Do the needful in the matter after verifying the facts put forth by us.

Thanking you,

Yours faithfully,

For Maharashtra Tax Practitioners’ Association

| (Manoj S Chitalikar) | (Santosh S Sharma) | (Narendra K Sonawane) |

| President | Past President & Chairman | Past President & Convener |

| Income tax representation Committee | ||

| 9822194015 | 9850053341 | 9822601617 |