![]()

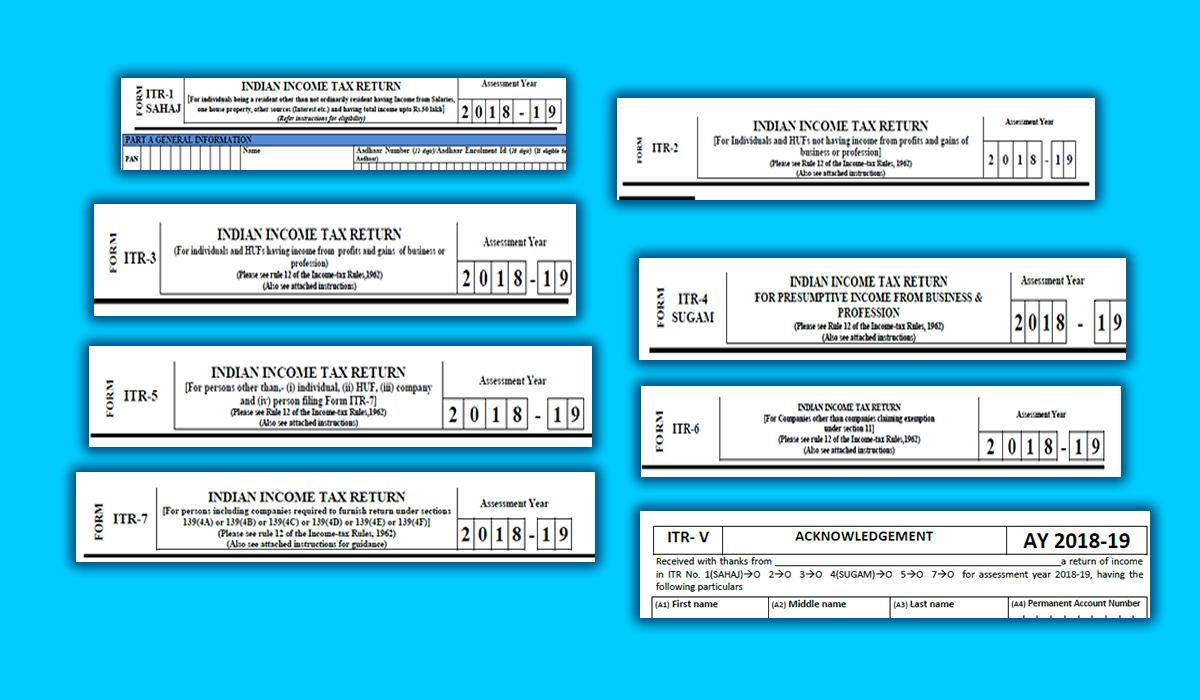

Change in the Income Tax Returns forms has become an annual feature. Some changes are incorporated every year.

For the current year, there is no change in the form number as was done in the last year wherein Form No. 4 was upgraded as Form No. 3.

In the last year, column were introduced in the ITR forms for showing the amount of cash deposits during demonetization period. The column for cash deposits is dropped from this year new ITR Forms.

All the returns are to be e-filed except ITR Form-1 (Sahaj) or ITR-4 (Sugam) which can be filed in paper forms subject to the the following conditions:

(i) an Individual of the age of 80 years or more at any time during the previous year; or

(ii) an Individual or HUF whose income does not exceed five lakh rupees and who has not claimed any refund in the Return of Income.

There is one more remarkable change in the ITR forms with regard to late filing fee. Forms has incorporated “Late filing fee u/s 234F” which is also to be shown in “Computation of Tax Payable”. It is expected that the scheme to be released shortly by the department would not validate the returns if the late fee is not paid before filing of the return. We, at www.theTAXtalk.com have well covered the same in our earlier write up that the new forms are sure to incorporate the late filing fee column u/s 234F. The late filing fee is not penalty and cannot be waived for any reason whatsoever.

However, above late filing fee would be applicable in case of firms and companies where filing is mandatory u/s 139 even if there is no business or there is no income by the said categories of “person”. There are other entities also where filing of return is mandatory without income also.

Even if the person with income below the taxable income and no liability to file the income tax liability wish to file the return voluntarily after the due date, it is not very clear whether the late filing fee would be leviable. However, levying late filing fee in such case, would not be in accordance with the provision of section 234F as it is applicable if ” a person liable to file return u/s 139″. Voluntary filing is just a voluntary filing and not filing mandated u/s 139.

One remarkable change in with regard to disclosure of turnover under GST in the new ITR forms which is made mandatory in ITR-4 under the column

“INFORMATION REGARDING TURNOVER/GROSS RECEIPT REPORTED FOR GST”

“INFORMATION REGARDING TURNOVER/GROSS RECEIPT REPORTED FOR GST”

The above reporting is further added by reporting of tax collected and tax paid to the Government.

Government has already launched e-sahyog project earlier whereby they were trying to match the data of various Government agencies with Income Tax return to plug the loop-holes. It will be an additional exercise for the taxpayer and tax professionals. Also, the column of SGST, CGST, IGST paid have been added at the relevant places in ITR-3,5 & 6.

In ITR-7, form is changed so as to make reporting of donation exceeding Rs. 2,000/ -received otherwise than by an account payee cheque etc.

Though all above may be just few lines for the Government, it is a bulk of information for the taxpayer while filing income tax returns.

With the late fee concept, taxpayer should speed up the process of return filing so as to avoid last minute rush.

We will try to cover various intricacies involved in the current year ITR filing law and procedure.

[button color=”” size=”” type=”outlined” target=”” link=”https://drive.google.com/file/d/1Nxdt0bB1vwY1gv2-wtzibiT-0lpDKEas/view?usp=sharing”]click to download ITR forms[/button]

[button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/”]home[/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/submit-article-publish-your-articles-here/”]Submit Article [/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/discussion-on-tax-problem/”]Discussion[/button]

[button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/”]home[/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/submit-article-publish-your-articles-here/”]Submit Article [/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/discussion-on-tax-problem/”]Discussion[/button]