![]()

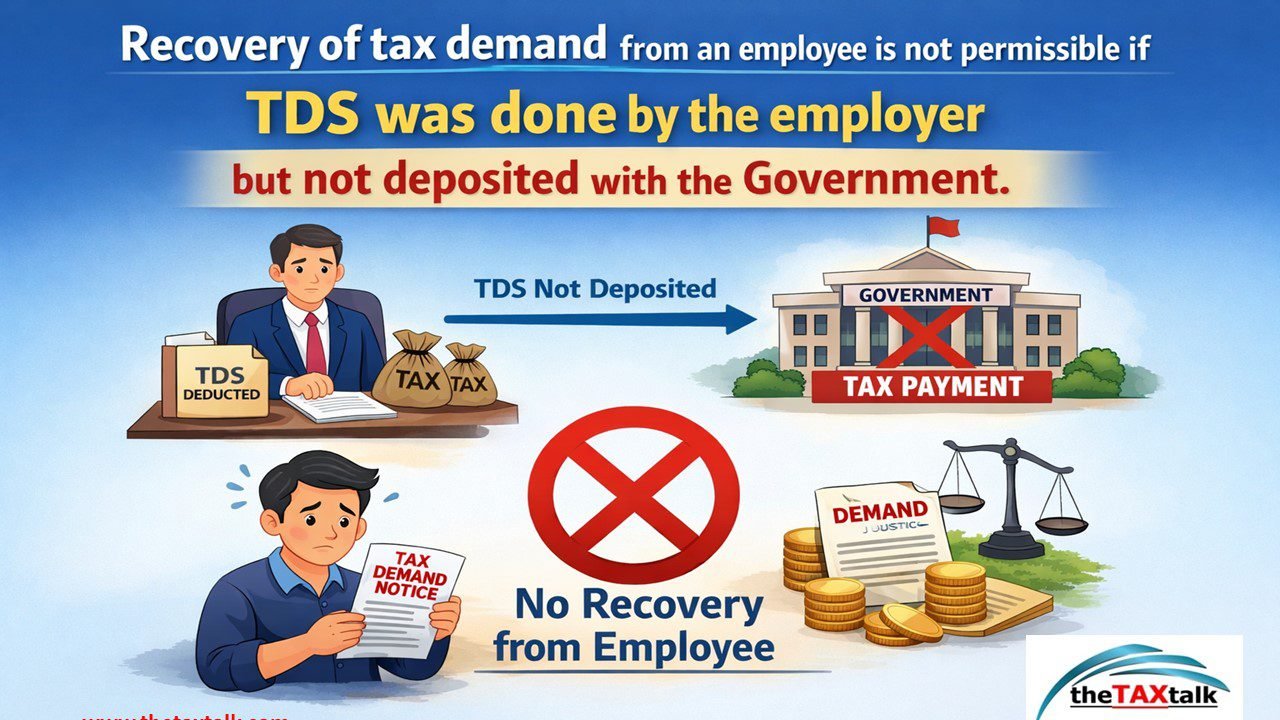

Recovery of tax demand from an employee is not permissible if TDS was done by the employer but not deposited with the Government.

Hon’ble Delhi High Court in Tarun Sabharwal Through Attorney Holder Rajneesh Raheja v. ITO, Ward 72(2), Delhi, W.P.(C) 17966/2025 (dated 08.12.2025) dealt with the issue of recovery of tax demand from an employee in cases where tax was deducted at source (TDS) by the employer but not deposited with the Government.

The Court noted that as per CBDT Circular dated 21.09.2023, tax demand in such circumstances cannot be recovered from the employee. It was observed that the said circular clearly provides that when TDS has been deducted by the employer but not deposited, recovery should not be enforced against the deductee-employee.

The Court further directed that since the demand had been adjusted against subsequent assessment years, the Assessing Officer shall treat the present writ petition as a representation and decide it within eight weeks in line with the CBDT instructions and the judgment in Sanjay Sudan v. ACIT & Anr., W.P.(C) 6610/2019 (NC: 2023/DHC/001342).

The copy of the order is as under:

high_court_order (1)