![]()

Respected Finance Minister, Please don’t extend the Date. But …… : Representation by Team www.theTAXtalk.com

On the one hand, we believe that the date extension should not be done and the tax compliances have to be done in a time bound manner.

However, there are enough reasons for due date extension for the current financial year for various reasons, many of which are not in the control of the taxpayers as under:

- Occasional problem in accessing the Form No. 26AS, AIS (Annual Information Return) & TIS (Tax Information Summary) of the taxpayers

- Unauthentic information at AIS/TIS consumes the time of the taxpayers for its cross verification and results in literal harassment of the taxpayers.

- High Time in responding by the portal on various occasions and for various requests/information. Even Form No. 26AS is not getting downloaded on various occasions.

- Floods situation in various parts of the country.

- Disturbances occurred during the FY 2021-22 as a result of covid which has severely disrupted the family algorithms and

- The information at the AIS/TIS is often available fully only after 15th June. The reason is obvious; the due date for various returns of TDS/SFT/TCS is also after 30th April from the end of the financial year. Effectively, the effective time with the taxpayers is only around one month for filing the income tax returns.

Normally, one member of the family has to take care of the returns of the entire family who has to ultimately be dependent on the consultant and the professionals for their compliance activities. This time is too short to make the compliances. - AIS/TIS is of recent origin and the taxpayers has not been accustomed to such a system and the general taxpayers need to be mentally prepared in records keeping and documentation so as to ensure proper compliance with the tax provisions.

- Not all the income is getting reflected in the AIS and so taxpayers cannot totally rely on AIS/TIS and will be required to cross check it with their internal records before filing the returns.

- There is an error in the Brought forwards and carry forward losses resulting in time consuming compliance work for the taxpayers.

- The Form No. 26AS is not showing the income tax refund issued status. Earlier, it was there in 26AS and as a result the taxpayers were rightly able to offer the interest on IT refund as income without killing any time on its verification and access.

- Independent survey carried out by The Economic Times Wealth ( July 22, 2022) conveys that around 54% taxpayers have yet to file ITR; 37% say it is difficult to do so by the deadline.

- There are significant glitches and in many cases as Chapter VI A deductions are not getting captured.

- AIS data keeps changing constantly as there is no cut-off procedure in place.

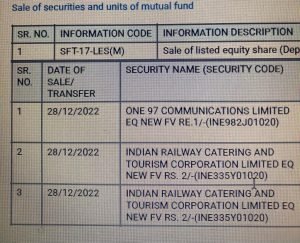

Some of the instances are as under:

- One case wherein the information regarding the date of sale/transfer of shares transaction is shows as 28th December 2022. The screenshot is attached herewith. Probably, the portal developed by Infosys is too futuristic to capture the future predictions. (ScreenShot attached)

- Another screenshot attached herewith shows that the portal was not available for filing due to the technical glitches best known to the Rs. 4242 Cr portal developers. Screenshot attached.

- The video link shared hereunder shows what is happening if someone is trying to view the Form No. 26AS at the portal:

https://www.linkedin.com/feed/update/urn:li:activity:6957764981622755329/

Conclusion:

- The country has too lesser number of taxpayers as compared to the population of the country.

- The taxpayers need to be respected and not ignored. It’s the taxpayers are only penalized for being the earning citizens in the country and not incentivized.

- With the presence of the most transparent and able administration of the Modi Government, Let us hope there is a change in the perspective and way in which the taxpayers of the country are treated.

- The date extension is not a relief but the way of treating the taxpayers is what is the relief we all are looking for.

The Team Tax Talk