![]()

Strict disciplinary action against the officer for use of force or coercion for recovery of any due payment of GST liability through form DRC 03 at time of search, inspection or investigation

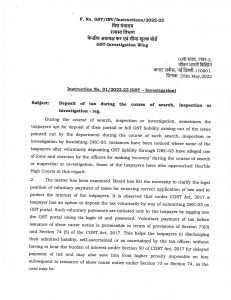

The CBIC has issued a taxpayer friendly instruction No. 01/2022-23 to regulate the harassment of the taxpayers by the GST department officials. This instruction provides relief to all the taxpayers who were harassed by the officers to pay GST through DRC-03 at the time of search, inspection or investigation.

The instructions are going to guard the taxpayers against use of force or coercion by any officer of department for recovery of any due payment of GST liability through form DRC 03 at time of search, inspection or investigation.

The instructions provide that if it is not done then strict disciplinary action will be taken against the officer. This instruction provides relief to all the taxpayers who were harassed by the officers to pay GST through DRC-03 at the time of search, inspection or investigation.

However, instructions provide that the taxpayer can make a voluntary payment of any tax liability ascertained by him or the tax officer in respect of such issues, either during the course of such proceedings or subsequently.