![]()

Rel Home Finance Ltd:

How funds are diverted to promoters pocket – An order worth reading

This 100 pg order is worth reading to see how funds are diverted to promoters pocket .

This interim order may be of help to the statutory auditors or Internal Auditors and CFOs , Company secretaries etc

The copy of the order is as under:

WTM/SM/CFID /57/2021-22

BEFORE THE SECURITIES AND EXCHANGE BOARD OF INDIA

CORAM: S. K. MOHANTY, WHOLE TIME MEMBER

INTERIM ORDER CUM SHOW CAUSE NOTICE

Under Sections 11(1), 11(4) and 11B (1) of the Securities and Exchange Board of

India Act, 1992

In respect of:

Sr.no. |

Name of the Noticee |

PAN |

1. |

Reliance Home Finance Limited |

AAECR0305E |

2. |

Anil D. Ambani |

AADPA3703D |

3. |

Amit Bapna |

AAYPB9659A |

4. |

Ravindra Sudhalkar |

AGGPS1926B |

5. |

Pinkesh R. Shah |

ABAPS2169R |

6. |

Adhar Project Management and Consultancy Private Limited |

AAHCA1962F |

7. |

Indian Agri Services Private Limited |

AACCI7169M |

8. |

Phi Management Solutions Private Limited |

AAECP7111Q |

9. |

Arion Movie Productions Pvt. Ltd. |

AARCA6056E |

10. |

Citi Securities and Financial Services PrivateLimited |

AACCC9559M |

11. |

Deep Industrial Finance Limited |

AAACV1614N |

12. |

Azalia Distribution Private Limited |

AAECB2295B |

13. |

Vinayak Ventures Private Limited |

AADCV3723H |

14. |

Gamesa Investment Management Private Limited |

AADCG2093F |

15. |

Medybiz Private Limited |

AACCM0084D |

16. |

Hirma Power Limited |

AABCH3229C |

17. |

Tulip Advisors Private Limited |

AADCT0485A |

18. |

Mohanbir Hi-Tech Build Private Limited |

AAJCM6196R |

19. |

Netizen Engineering Private Limited |

AABCR7570C |

20. |

Crest Logistics and Engineers Private Limited (Now Known As CLE PRIVATE LIMITED) |

AACCR7266A |

21. |

Reliance Unicorn Enterprises Private Limited |

AAACC2436P |

22. |

Reliance Exchange next Limited |

AABCR7567D |

23. |

Reliance Commercial Finance Limited |

AABCR6898M |

24. |

Reliance Cleangen Limited |

AAACR2664L |

25. |

Reliance Business Broadcast News Holdings Limited |

AABCU0804C |

26. |

Reliance Broadcast Network Limited |

AADCR1885L |

27. |

Reliance Big Entertainment Private Limited |

AAFCA6658L |

28. |

Reliance Capital Limited |

AAACR5054J |

(The aforesaid entities are hereinafter individually referred to by their respective names/Entity no. and collectively as “Entities”, unless the context specifies otherwise)

In the matter of Reliance Home Finance Limited

Background

-

The root of the present proceedings can be traced to multiple sources inter alia, a letter of Price Waterhouse & (“PWC”) addressed to Reliance Home Finance Limited (hereinafter referred to as “RHFL/the Company/Noticee no.1”) intimating their resignation as the Statutory Auditor of the Company citing various grounds & reasons; certain complaints received by Securities and Exchange Board of India (hereinafter referred to as “SEBI”) alleging siphoning off/diversion of funds of RHFL by promoters and management of the Company; and also receipt of multiple Fraud Monitoring Returns (“FMRs”) from Banks alleging, therein amongst others, that funds borrowed by RHFL from different lenders were partly used towards repayment of loans etc. It was also complained that various, connected parties and companies with weak financials were used as conduits to siphon off funds from RHFL to entities connected to the promoter company viz., Reliance Capital Limited (hereinafter referred to as “RCL/Noticee no. 28”).

-

Based on the aforesaid complaints, an investigation was undertaken by SEBI for the period of FY 2018-19. The focus of the said investigation was broadly to investigate into the manner in which the loans were disbursed by RHFL during the period of 2018-19 to several borrowing entities, so as to ascertain if any provision of Securities and Exchange Board of India Act, 1992 (hereinafter referred to as the “SEBI Act, 1992”), Securities Contracts (Regulation) Act, 1956 (hereinafter referred to as the “SCRA”), Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR Regulations/SEBI (LODR Regulations)”), Securities and Exchange Board of India (Prohibition of Fraudulent and Unfair Trade Practices) Regulations, 2003 (“PFUTP Regulations”) , have been violated.

-

In pursuance of the said investigation, SEBI has examined information from various sources, such as publicly available information, information provided by the Bank of Baroda including a copy of the report of Forensic Audit conducted by the bank into the affairs of the Company, information provided by the Company itself, information gathered from the borrowers of the Company, statements recorded by different Key Managerial Persons under oath during the investigation The relevant facts about the background of the Company and the facts as gathered by SEBI from various other sources including the report of Forensic Audit conducted by a lender bank, are being discussed under different subject heads in the following paragraphs of this order:

4. General Information about the Company

I. RHFL (Noticee no. 1) a subsidiary of Reliance Capital Limited (Noticee no. 28) (at the relevant times) is engaged in the business of Housing Finance and is also registered in that capacity with National Housing Bank (NHB). The shares of RHFL are listed on National Stock Exchange of India Limited (NSE) and BSE Limited (BSE). In terms of information furnished by RHFL vide its letter dated November 24, 2020, it (RHFL) is currently undergoing Resolution Process in terms of RBI’s circular dated June 07, 2019 pertaining to Prudential Framework for Resolution of Stressed

II. The shareholding pattern of RHFL, as noted from the website of BSE is as follows:

Table no. 1

Sr.No. |

Name of the Promoter &Promoter group |

Year endedMarch 31,2018 |

Year endedMarch 31,2019 |

Year endedMarch 31,2020 |

Year endedMarch 31,2021 |

1 |

Mr. Anil D. Ambani |

0.06 |

0.06 |

0.06 |

0.06 |

2 |

Ms. Tina A Ambani |

0.05 |

0.05 |

0.05 |

0.05 |

3 |

Jai Anmol A Ambani |

0.02 |

0.02 |

0.02 |

0.02 |

4 |

Jai Anshul A Ambani |

0.00 |

0.00 |

0.00 |

0.00 |

5 |

Kokila D. Ambani |

0.11 |

0.11 |

0.11 |

0.11 |

6 |

Reliance Inceptum PrivateLimited |

20.14 |

20.14 |

0.00 |

0.00 |

7 |

Reliance Innoventures PrivateLimited |

0.12 |

0.12 |

0.00 |

0.00 |

8 |

Reliance InfrastructureConsulting & Engineers Private Limited |

5.77 |

5.62 |

0.61 |

0.61 |

9 |

Crest Logistics and EngineersPvt. Ltd. |

0.67 |

0.67 |

0.67 |

0.67 |

10 |

Reliance InfrastructureManagement Private Limited |

0.14 |

0.14 |

0.14 |

0.14 |

11 |

Reliance Capital Limited(RCAP) |

47.91 |

47.91 |

47.91 |

47.91 |

Total |

74.99% (ofthe same 21.62% have |

74.85%(ofthe same 31.80% have |

49.58% |

49.58% |

beenpledged) |

beenpledged) |

III. From the aforementioned shareholding pattern, it is noted that Reliance Capital Limited (RCAP/Noticee no. 28) was the major promoter of RHFL (Noticee no. 1) during the relevant period holding 47.91% of its shares. Mr. Anil D. Ambani (Noticee 2) was also the Promoter and Non-executive and Non-Independent Director of RCAP, during FY 2018-19. Further, in terms of the Related Party disclosure made in the Annual Report of RCAP, Noticee no.2 has been disclosed as an Individual Promoter being ‘the person having significant influence during the year’. Furthermore, Noticee no.2 is also found to be a significant beneficial owner of the companies mentioned at Sr. no. 6, 7 and 8 in the table above.

IV. The details of Directors of RHFL during the Financial Year 2018-19 are as under:

Table no. 2

Sr.No. |

Name of the Director |

Type of Director |

From |

To |

1 |

Mr. Padmanabh Vora |

Independent Director |

01-07- |

29-04- |

2008 |

2019 |

|||

2 |

Ms. Deena Mehta |

Independent Director |

24-03- |

30-03- |

2015 |

2019 |

|||

3 |

Lt Gen Syed Ata Hasnain |

Independent Director |

26-02- |

– |

(Retd.) |

2018 |

|||

4 |

Mr. Gautam Doshi% |

Non-Executive & Non- |

01-07- |

02-05- |

Independent Director |

2008 |

2019 |

||

5 |

Mr. Jai Anmol A. Ambani |

Additional, Non- |

24-04- |

31-05- |

#% |

Executive & Non- |

2018 |

2019 |

|

Independent Director |

||||

6 |

Mr. Amit Bapna |

Non-Executive Director |

24-04- |

23-06- |

2017 |

2020 |

|||

CFO |

08-09- |

07-08- |

||

2017 |

2018 |

|||

7 |

Mr. Ravindra Sudhalkar |

Executive Director |

24-04- |

24-01- |

2017 |

2020 |

|||

CEO |

01-10- |

Continuing |

||

2016 |

#Appointed as an Additional Director on April 24, 2018 % Source: Annual Report of RHFL for FY 2017-18 (page no. 43)

V. The details of the Key Managerial Personnel (KMP) of RHFL during the year 2018- 19 are as under:

Table no. 3

Sr.No. |

Name of KMP |

Designation |

1 |

Mr. Ravindra Sudhalkar (Noticeeno. 4) |

Executive Director & CEO |

2 |

Mr. Amit Bapna* (Noticee no.3) |

Non-Executive Director & CFO |

3 |

Mr. Pinkesh R Shah** (Noticeeno. 5) |

Chief Financial Officer |

4 |

Ms. Parul Jain |

Company Secretary & ComplianceOfficer |

*Chief Financial Officer till August 07, 2018

**Chief Financial Officer w.e.f. August 07, 2018

VI. The key financial highlights of RHFL for the investigation period (FY 2018-19) and the preceding year (FY 2017-18) are as follows:

Table no. 4

(INR In crore)

Liabilities |

FY 2017-18 |

FY 2018-19 |

Borrowings other than debt Securities |

6,156.12 |

8,819.67 |

Other liabilities include trade payables, debt securities,subordinate liabilities, provisions and other financial liabilities |

7,427.11 |

7,463.77 |

Shareholder funds |

1,824.52 |

1,842.00 |

Total |

15,407.75 |

18,125.44 |

Assets |

||

Loans & Advances |

14,410.45 |

16251.09 |

Other assets include advance income tax, deferred taxassets (net) and other financial assets. |

613.93 |

794.46 |

Fixed Assets |

329.31 |

393.52 |

Investments |

54.06 |

93.46 |

Total |

15,407.75 |

18,125.44 |

(INR In Crore)

Profit and Loss Statement |

FY2017-18 |

FY 2018-19 |

Operating Income |

1622.75 |

1986.03 |

Other income includes profit on sale of investments,interest on income tax refund and miscellaneous income |

60.59 |

16.56 |

Total Income |

1683.34 |

2002.59 |

Profit Before Tax |

246.93 |

101.60 |

VII. RHFL as part of its business, provides Housing Loans, Loan against property and Construction Finance etc. The details of the loans extended by RHFL under various heads for the Financial Years 2017-18 and 2018-19, as recorded in the Annual Report for the year 2018-19 is as under:

Table no. 5

(INR in Crore)

Loans given to |

FY 2017-18 |

FY 2018-19 |

Corporates |

3742.60 |

8670.80 |

Small Business |

5073.73 |

3824.00 |

Residential Mortgagees |

5823.40 |

4034.67 |

Total |

14,639.73 |

16,529.47 |

(Source: Annual Report of RHFL for the year 2018-19)

VIII. The details captured in the Table 5 above indicate that the loans extended by RHFL to the Corporates has significantly increased from an amount of INR 3742.60 Crore in 2017-18 to INR 8670.80 Crore in the year 2018-19.

5. Information submitted by PWC:

IX. On June 12, 2019, a corporate announcement was made by RHFL wherein it was informed that its statutory auditor, PWC, has resigned e.f June 11, 2019.

X. In their letter dated June 11, 2019, addressed to the Board of Directors of RHFL, PWC had expressed that due to certain acts on the part of the Company such as non- receipt of substantive/satisfactory responses to the queries raised by them during the audit; failure to call the meeting of Audit Committee within the prescribed time after issuance of letter dated April 18, 2019 by PWC; and threatening PWC with legal proceedings, it (PWC) was compelled to withdraw from the audit engagement in compliance with the Code of Ethics issued by the Institute of Chartered Accountants of India and the applicable standards on Auditing. RHFL, however, vide its letter dated June 12, 2019 addressed to NSE and BSE, expressed its disagreement with the reasons cited by PWC for its resignation.

XI. PWC has also filed a report under Section 143 (12) of Companies Act, 2013 to Ministry of Corporate Affairs (MCA), and the said fact of reporting to MCA was informed to SEBI by

XII. Prior to the aforesaid events, in its letter dated April 18, 2019 addressed to the CEO and CFO of RHFL, PWC while highlighting certain observations made by it during the ongoing (at that stage) Statutory Audit, and also sought responses of the management and Audit Committee on those observations. The said letter, inter alia, highlighted the fact that the amount of loans disbursed by RHFL under General Purpose Corporate Loans (GPC loans) have increased exponentially from around INR 900 Crore as on March 31, 2018 to around INR 7900 Crore as on March 31, Further, based on their examination of different samples of borrowers of such loans advanced by RHFL, PWC had highlighted certain issues of serious concern largely pertaining to the net-worth of such borrowers being negative; having limited/nil revenue or profit; no business activity of those borrowing companies other than entering into the transaction of borrowing from RHFL and lending the said borrowed sum onward; low equity capital in comparison to debt; incorporation of certain borrowers companies shortly before the receipt of the loans disbursed by RHFL; and in some cases the loan sanction dates are found to be on the same date as the date of application for loan or even before the dates of applications made by these borrowers.

XIII. Further, the aforesaid examination of loan accounts by PWC revealed that several of such borrower companies are also found to be group companies of RHFL. This finding was made based on various peculiar attributes found in these companies such as: email id of borrower company having email domain address of Reliance ADA group; brand name of “Reliance” appearing in the name of borrower company; Directors of such companies being employees of Reliance ADA group; and multiple borrower companies having same registered address, etc.

XIV. Based on the aforesaid information, PWC in its letter sought answers to various queries such as what was the rationale behind sanctioning of such loans to those apparently group entities; procedures followed to monitor the end use of such loans; and also about the default committed by RHFL on its debt repayments. This apart, the said letter also highlighted as to why should the afore-stated borrowers be not considered as group companies under various statutes like Companies Act

XV. Answering to the issues so raised by PWC, RHFL, vide its letter dated May 09, 2019, while justifying such loans advanced to those apparently group company borrowers as pointed out by PWC, stated that: (a) the credentials of those borrowers were assessed based on their positive track records and it has advanced short term loans (upto 1 year) to these companies for meeting short term working capital requirements; (b) end use can be verified from the borrower entities only; (c) loans are extended on the strength of promoters/project/collateral; (d) loans have limited risk of weak collaterals or value erosions; (e) RHFL has been successful in recovering money in the past; (f) appropriate KYC/AML norms have been put in place; (g) top ten exposures are always presented to the Risk Management Committee and Audit Committee; and (h) that such loans do not fall under the definition of group companies and quantum/proportion of such loans were duly reported to NHB. Further, RHFL also informed that after being affected by timing mismatch with regard to the ongoing securitization/monetization proposals with banks , it has resulted in minor delay on recovering principal repayment of an amount of INR 735 Crore and the regularization of such repayments is expected shortly.

6. Forensic Audit Conducted for Bank of Baroda

XVI. A Forensic Audit was conducted by the lead bank of the consortium of lenders of RHFL, viz., Bank of Baroda into its loan transactions with RHFL. The scope of work of such audit was to conduct a detailed review for identifying the movement of funds wherein disbursals of loans were apparently made by RHFL to Potentially Indirectly Linked Entities (“PILEs”) during the period of April 01, 2016 to June 30, 2019 (“review period”). In pursuance of the same, the Forensic Auditor has submitted two reports, viz: (i) Report dated January 02, 2020 pertaining to Forensic Review (“1st Report”) and Report dated May 06, 2020 (“2nd Report”) pertaining to Fund Tracing

7. Observations in the 1st Report

XVII. In the 1st report, the Forensic Auditor has observed that an amount of INR 14, 577.68 Crore was disbursed by RHFL to numerous entities as General Purpose Corporate Loans (GPCL) over the review period and out of the said amount, an amount of INR 12, 487.56 Crore has been disbursed to 47 PILEs. Out of the aforesaid loan amount of 12, 487.56 Crore, as much as INR 7,984.39 Crore was outstanding (including interest) as on October 31, 2019. Further, out of the aforesaid outstanding amount, an amount of INR 2,727.59 Crore has been declared as Non-Performing Asset (“NPA”) as on October 31, 2019. Further, the report observed notable instances where (08) eight borrower entities were earlier being reflected as Related Parties of Reliance Power Limited and Reliance Infrastructure Limited (i.e. the group companies of RHFL), however, just before disbursal of such loans, these entities were reclassified as non-related party from the category of related party of such group companies (Rpower and Rinfra). To such 08 reclassified entities, a total loan amount of INR 1,323.43 Crore was found to have been disbursed.

XVIII.Further, in a number of loan transactions, the repayment pattern of the borrower entities indicated certain trends like circular transactions, ever greening of loans, which are highlighted in the following table:

Table no. 6

Observations |

No. of Instances |

Amount (INR Cr.) |

Potential evergreening of loans |

15 |

785.80 |

Potential circular transactions |

3 |

412.89 |

Total amount potentially received back to Target Entity (i.e. RHFL) as repayment ofexisting loans |

1198.69 |

XIX. The loan files review conducted by the Forensic Auditors has highlighted anomalies in the loan approval process followed by RHFL which includes deviation from credit policy and appraisal of loan applications in the absence of various relevant documents like financial statements, income tax returns, contact details

XX. The 1st report has also highlighted various serious anomalies in the credit appraisal process of It was noticed that loans have been disbursed by RHFL prior to the sanction date of such loans; loans have been disbursed to parties with weak financials; and loans have been disbursed to entities which were incorporated recently thus having no significant business track record. There were other potential anomalies noticed in creation of charge on the security provided by the borrowers to RHFL. It was noticed that RHFL had disbursed loans aggregating INR 324.95 Crore during the review period to four (04) entities which had apparently inadequate repayment capacity. As a result, against the aforesaid loan amount, an amount of INR 310.02 Crore remained outstanding as on October 31, 2019 and all such four accounts have been declared as NPA by RHFL.

XXI. As per the 1st report, around INR 12, 574 Crore (approximately) was disbursed to entities falling in PILEs category and some of such amounts were further lent by these PILEs onwards to other PILEs/Related parties/Group A large portion of such loans was found to have been extended without adhering to prudential lending norms related to repayment capacity, adequacy of security/collateral, other relevant key financial matrix of the borrowers and relevant documentations.

8. Observations in the 2nd Report:

XXII. The 2nd report which deals in detail with ‘Fund tracing activity’ with respect to the loans advanced by RHFL, indicated that an amount of INR 12,573.06 Crore1 has been disbursed under 150 Loan Cases falling under the category of PILEs during the review period (FY 2016-17 to 2018-19), out of which 100 Loan Cases amounting to INR 8,884.46 Crore were still open, or in other words, such Loan Cases were still outstanding in the books of RHFL. The details of such loan accounts are tabulated herein below:

Table no. 7

For the period of 2016-17 to 2018-19 INR Cr.

Sr.No. |

Disbursed to PILE |

No of Loans |

Amount |

% to total Disbursement |

1 |

Open LAN cases |

100 |

8,884.46 |

71% |

2 |

Closed LAN cases |

50 |

3,688.60 |

29% |

Total |

150 |

12,573.06 |

100% |

LAN:- Loan Application Number

XXIII. The amount of INR 8,884.46 Crore was first transferred to 43 PILEs (in 100 open loan cases referred to above), out of which an amount of INR 8,847.74 Crore was onward transferred to 19 entities and out of the said 19 entities, 14 entities were reportedly found to be Group Companies/other PILE entities bearing close nexus with the Promoter group:

Table no. 81 It is observe that there are certain discrepancies in the total figures of GPCL as mentioned in the two reports of forensic auditors.

Table no. 8

Sr.No. |

Name of PILE/ Group Company |

Group CO/PILE |

Amount in Crores |

1 |

Reliance Capital Limited |

Group Co. |

2359.91 |

2 |

Reliance Commercial Finance Limited |

Group Co. |

2278.58 |

3 |

Reliance Infrastructure Limited |

Group Co. |

1559.78 |

4 |

Reliance Home Finance Limited |

Group Co. |

1514.46 |

5 |

Reliance Big Entertainment Private Limited |

Group Co. |

254.09 |

6 |

Reliance Broadcast Network Limited |

Group Co. |

218.19 |

7 |

Reliance Business Broadcast NewsHoldings Limited |

Group Co. |

200.50 |

8 |

Reliance Power Limited |

Group Co. |

135.64 |

9 |

Crest Logistics And Engineers PrivateLimited |

PILE |

106.00 |

10 |

Gamesa Investment ManagementPrivate Limited |

PILE |

100.00 |

11 |

Kunjbihari Developers Private Limited |

PILE |

70.00 |

12 |

Reliance Mediaworks Financial ServicesPrivate Limited |

Group Co. |

14.73 |

13 |

Reliance Nippon Life Insurance Limited |

Group Co. |

11.00 |

14 |

Unlimit IOT Private Limited |

Group Co. |

5.00 |

Total |

8827.88 |

XXIV. Apart from the aforesaid onward lending, the Forensic Audit Report has also given a classification of an amount of INR 8,842. 87 Crore (Out of INR 8,884.46 Crore involving 100 loan cases mentioned in Table 7 above), based on utilization of such loans. A scrutiny of such 100 Open Loan cases indicated that some amount of funds advanced by RHFL have returned back to RHFL through circular transactions and also substantial amounts of such loans have been used by the borrowing entities for repayment of existing loans availed by them earlier from RHFL which means, such huge amounts of loans have been used by the borrowing entities for ever- greening of earlier loans. These broad findings about end use of such loans advanced by RHFL that were onward lent to those 14 Group companies/PILE, as noted from the said 2nd report of the Forensic Auditors are highlighted as below:

Table no. 9

Sr.No. |

Particulars |

Paid to Banks |

Paid to Non- Banks |

Potential Circular Transactions |

Total |

1 |

Reliance Home Finance Limited |

1610.13 |

1610.13 |

||

2 |

Repayment of loan / borrowings |

1029.13 |

276.86 |

1305.99 |

|

3 |

Bank statement not available |

1238.73 |

1238.73 |

||

4 |

Repayment of Commercial Paper |

125.51 |

860.59 |

986.10 |

|

5 |

Investment in fixed deposit/Auto-sweep and mutual funds |

819.10 |

819.10 |

||

6 |

Group Company / Third Party(nature of transaction not known) |

3.82 |

660.11 |

663.93 |

|

7 |

Transfer to another bank account –further details not made available |

567.73 |

567.73 |

||

8 |

Interest on NCDs |

551.12 |

551.12 |

||

9 |

NCD Repayment |

522.73 |

522.73 |

||

10 |

Reliance Capital Limited Dividend account |

210.00 |

210.00 |

||

11 |

Repayment of Cash Credit Facility |

180.00 |

180.00 |

||

12 |

Payee/ Beneficiary name notAvailable |

128.42 |

128.42 |

||

13 |

Other miscellaneous payments |

23.86 |

23.86 |

||

14 |

Loan Disbursements |

18.91 |

18.91 |

||

Grand Total |

1338.46 |

5835.39* |

1610.13 |

8842.87 |

The same is mentioned as INR 5894.28 crores in Forensic Audit Report, however, correct figures are INR 5835.39

XXV. The Forensic Auditors have also identified the connections between various entities involved in the end use of the funds advanced as loans by RHFL, to the extent On further analysis of the broad classification of different end uses of the loans advanced by RHFL with respect to the afore-stated open (LAN) loan cases, the Forensic Auditors have reported that around 40% of such loan funds aggregating to INR 3,573.06 Crore were utilized by the borrowers towards debt repayment/servicing of PILEs/other group companies against term loans, NCDs, commercial papers etc., availed by them. It is stated that an amount of INR 1,338.46 Crore has been utilized towards payment of banks and that INR 2,238.42 Crore has been utilized towards payment to NBFC/third party entities. Further, around 18% of the funds aggregating to INR 1,610.13 Crore is the amount that was involved in potential circular transactions, where the funds were routed back to RHFL via third parties, while around 9% of the funds aggregating to INR 819.10 Crore appears to have been used towards investments made in fixed deposits and mutual funds. The Forensic Auditors were however reportedly unable to trace out complete end utilization of around 22% of the funds aggregating to INR 1,934.88 Crore due to information limitations.

Findings from SEBI’s investigation

-

In the context of the aforesaid factual findings from the two Forensic Audit Reports, and based on the quantum of loan disbursement made during the FYs 2016-17 to 2018-19, comprising “Review Period” of the Forensic Audit Report, I find that SEBI’s investigation has primarily focused on the lending operations of RHFL during the FY 2018- 19 (investigation period).

-

In terms of information submitted by RHFL, it had extended an amount of INR 65 Crore as GPC loans to 45 unique entities during the investigation period (FY 2018- 19). On further analysis of Loan portfolio especially GPC loans advanced by RHFL during the investigation period on which Forensic Audit Report 1 and 2 have made various adverse findings, it is observed that the top 14 GPCL Borrower accounted for around 51.75% of the total GPC loans advanced by RHFL during the Financial Year 2018-19, to whom an amount of INR 4,383.62 Crore was lent out of the total GPC lending of INR 8470.65 Crore. The said details are enumerated herein below:

Table no. 10

Total GPC Loansadvanced |

No. of entitiesinvolved |

51.75% of the total GPCL |

No. of entities |

INR 8470.65 Crore |

45 |

INR 4,383.62 Crore |

14 |

-

In order to scout for further information, SEBI issued summons to the said 14 GPCL Borrower entities asking them to provide certain information with respect to the loans extended to them by RHFL. Subsequently, based on the responses received from 13 such entities (one entity did not respond to the summons issued by SEBI), further information was sought from the onward borrower entities to whom the aforesaid GPCL Borrower entities had onward lent/transferred the borrowed funds received by them from Besides the aforesaid, various other details including information like minutes of Audit Committee Meeting etc., were also sought from RHFL.

-

The crucial facts that have emanated from the examination of the aforesaid documents/information and replies received in course of the investigation with respect to the aforesaid 45 GPCL Borrower entities including the top 13 Borrowers and their onward loan transactions, which are relevant for the present proceedings are highlighted in the following

-

It is noted that the responses of the 13 GPCL Borrower entities reflected that an amount of INR 60 Crore extended to them as GPCL has not been accounted for by RHFL in its submissions made to SEBI. The said revelation enhanced the total GPCL to INR 9295.25 Crore (INR 8470.65 Crore as mentioned in Table no. 10 above + INR 824.60 Crore). The details of such unaccounted disbursals are mentioned in the table below:

Table no. 11

Sr.No. |

Borrower Entity Name |

Date |

Loan Amount(INR Cr.) |

1 |

Medybiz Private Limited |

10-Oct-18 |

40.00 |

2 |

08-Aug-18 |

50.00 |

Adhar Project Management and Consultancy Private Limited |

09-Aug-18 |

43.48 |

|

10-Aug-18 |

51.12 |

||

06-Sep-18 |

45.00 |

||

04-Oct-18 |

25.00 |

||

27-Apr-18# |

100.00 |

||

3 |

Mohanbir Hi-Tech Build Private Limited |

19-Sep-18 |

70.00 |

4 |

Indian Agri Services Private Limited |

18-Apr-18 |

200.00 |

12-Jul-18 |

100.00 |

||

5 |

Gamesa Investment Management PrivateLimited |

06-Nov-18 |

100.00 |

Total |

824.60 |

||

Clarification for this loan was not sought from RHFL as the same was identified on the basis submission of the Borrower entity at a later stage.

-

When RHFL was confronted with the aforesaid suspected unaccounted disbursals, it replied vide email/letter dated December 23, 2021 that since these amounts were repaid during the year of disbursal itself (2018-19), details of the same were not provided vide its earlier communication dated December 01,

-

The aforesaid revelation, therefore, indicates that the actual total disbursement under GPCL during the investigation period was INR 9295.25 Crore (INR 8470.65 Crore+ INR 824.60 Crore). The said amount was extended to 45 GPCL Borrower entities., in which the share of top 14 GPCL Borrower entities aggregated to INR 5208.23 Crore2 (INR 62 Crore+ INR 824.60 Crore, as referred in Table no. 10 and 11). However, as stated in the beginning of this order, one entity out of the said top 14 entities viz. Vinayak Ventures Private Limited did not respond to the summons issued by SEBI, therefore, the factual findings and the analysis of the alleged fraudulent lending activities of RHFL are primarily based on the responses received by the top 13 GPCL Borrower entities, who have been advanced the following GPC Loans during FY 2018-19:

Table no. 122 This includes an entry of INR 40 Crore (Approx.) as GPC Loan extended to Indian Agri (Noticee no. 6) by RHFL. In its submissions Indian Agri has stated the said amount was received in FY 2019-20, however, as per RHFL, the said loan was disbursed to them in the FY 2018-19. Accordingly, the total GPC Loans extended to the top 14 entities has been considered as INR 5,165.47 Crore.

Table no. 12

Sr.No. |

Name of the GPCL Borrower entity |

Amount of GPCL |

1. |

Adhar Project Management and Consultancy Pvt. Ltd. (Noticee no. 6) |

534.60 |

2. |

Indian Agri Services Pvt. Ltd. (Noticee no. 7) |

693.00 |

3. |

Phi Management Solutions Pvt. Ltd.(Noticee no. 8) |

430.00 |

4. |

Arion Movie Productions Pvt. Ltd. (Noticee no. 9) |

400.00 |

5. |

Citi Securities and Financial Services Pvt. Ltd. (Noticee no. 10) |

220.80 |

6. |

Deep Industrial Finance Ltd. (Noticee no. 11) |

220.00 |

7. |

Azalia Distribution Pvt. Ltd. (Noticee no. 12) |

386.50 |

8. |

Gamesa Investment Management Pvt. Ltd.(Noticee no. 14) |

664.00 |

9. |

Medybiz Pvt. Ltd. (Noticee no. 15) |

365.90 |

10. |

Hirma Power Ltd. (Noticee no. 16) |

225.00 |

11. |

Tulip Advisors Pvt. Ltd. (Noticee no. 17) |

215.00 |

12. |

Mohanbir Hi-Tech Build Pvt. Ltd. (Noticee no. 18) |

375.00 |

13. |

Netizen Engineering Pvt. Ltd. (Noticee no. 19) |

214.54 |

Total |

13 GPCL borrower entities |

INR 4,944.34 Crore |

-

It is observed that apart from offering various loan products pertaining to Housing Finance, RHFL also had a policy for providing General Purpose Corporate Loan (GPCL) under the nomenclature of Demand/Call Loan. As approved by the Board of Directors of RHFL (vide Policy on Demand/ Call Loan R No. RHF/CRT/MOP/112018/20.0, effective from November 01, 2018) such Demand/Call Loan carried certain broad features which postulated that:

-

RHFL can extend such loans to its customers who do not have a fixed and structured income streams but have short term, temporary requirements for funds on a frequent

-

Demand/Call loans would be considered by the Company both under Secured loan as well as unsecured loan and the maximum period for a Demand/Call loans would normally be 12 months from the date of sanction of such

-

All such loans having stipulated a period beyond 6 months shall be subjected to review of performance not exceeding 6 months either on discrete or on a summary Such Demand/Call loans shall not be renewed unless the periodical review has shown satisfactory performance/compliance with the terms of sanctions.

-

GPCLs processed under the Branch Code of ‘Corporate Branch’ shall have a portfolio cap of INR 6750 Crore. Any deviation or any transaction beyond this threshold limit shall require confirmation by its Holding Company viz., Reliance

17. In terms of the Board Resolution passed by the Board of Directors of RHFL in the meeting held on April 24, 2017, Credit Authority Delegations (CADs) were approved, in terms of which loans upto INR 5.00 Crore was to be approved by the Specific Credit Hierarchy (upto National Credit Manager). Further, in respect of the loans greater than INR 00 Crore, the approving authority was the Credit Committee comprising of Chief Risk Officer (CRO), Chief Executive Officer (CEO) and One Director. It has been informed that during the Financial Year 2018-19, the members of the said Credit Committee were:

-

Upto November 20, 2018 – Mr. Ravindra Sudhalkar (CEO), Mr. Amit Bapna (Director), Krishnan Gopalkrishnan (CRO).

-

After November 20, 2018 – Mr. Ravindra Sudhalkar (CEO), Mr. Amit Bapna (Director), and Raj Kumar M (Head – Real Estate Credit & Credit Risk).

18. In terms of information submitted by RHFL, it had during the investigation period (FY 2018-19), disbursed 97 GPC loans amounting to INR 65 Crore to 45 GPCL Borrowers entities. The status of these loans as on November 30, 2020 as submitted by RHFL was as under:

Table no. 13: GPC loan status as on November 30, 2020

Classification |

Number of Loan applications |

Amount of Disbursement (INR Cr.) |

No. of Unique GPCLBorrowers |

Amount Outstanding as on November 30,2020 |

Standard |

32 |

3,153.30 |

16 |

2,920.50 |

NPA |

63 |

5,165.05 |

27 |

3,858.51 |

Write-Off |

2 |

152.30 |

2 |

152.30 |

Total |

97 |

8,470.65 |

45 |

6,931.31 |

-

Further, the Company vide its letter dated November 24, 2021, provided updated information about the loan accounts, which is tabulated herein below:

Table no. 14: GPCL Classification as on September 30, 2021

Classification |

No. of loan accounts |

Amount of Disbursement (INRIn Crore) |

NPA |

95 |

8,318.35 |

Write-off |

2 |

152.30 |

Total |

97 |

8,470.65 |

-

A conjoint reading of the aforesaid two tables would indicate the following:

I. As per the claim of the Company, a total amount of INR 8,470.65 Crore was extended as GPC Loans to 45 unique entities in 97 different loan

II. Only an amount of INR 2,920.50 Crore was considered as “Standard” in the books of accounts of RHFL, as on November 30, 2020 (Ref. Table 13 above)

III. Out of the total loans, two accounts for two entities have been written off which included an amount of INR 30 Crore (Table no. 13).

IV. Further, out of total 97 GPC Loans, 27 unique GPCL Borrower entities were given an amount of INR 5,165.05 under 63 different loan applications. As on November 30, 2020, out of the said amount of INR 5,165.05 Crore, an amount of INR 3,858.51 Crore was still outstanding as due towards RHFL and due to the said fact, such 63 accounts (pertaining to amount of INR 5,165.05 Crore) were declared as NPA. (Ref. Table no. 13 above).

V. However, after passage of 10 months (i.e. as on September 30, 2021), RHFL has not recovered any further amount either from the loans which were earlier (as on November 30, 2020) stated to be Standard (INR 2,920.50 Crore) or from the outstanding amounts from the accounts declared as NPA (INR 3,858.51 Crore). Eventually, all the 95 Accounts (2 accounts out of 97 accounts were already written off from the books of RHFL), containing a total amount of INR 8,318.35 (Ref. Table 14 above) have been declared as NPA as on September 30, 2021.

VI. The said fact shows that RHFL has not recovered any amount from such GPCL Borrower entities since November, 2020 and the total outstanding amount which was pending to be received by RHFL was INR 6,931.31 (a sum total of Standard, NPA and write off amount as reflected under Table no. 13).

-

Additionally, it is also worthy to mention here that an amount of INR 160.50 Crore extended as GPCL to Crest Logistics and Engineers Ltd. (Noticee no. 20) by RHFL has also been declared as NPA. The said company is a Promoter Group Entity, however, while furnishing information regarding GPCL to SEBI, RHFL has disclosed/classified the said entity as “Not Related party”, instead of providing the correct picture that the said company is a promoter group entity.

-

During the investigation, SEBI had sought copies of certain Loan Application Documents pertaining to the GPC loans. An analysis of such documents (total 70 Loan Application Documents for the loans amounting to INR 6187.78 Crore for GPCL disbursed in FY 2018-19) as furnished by RHFL to SEBI vide its letter dated December 23, 2021, has revealed the following facts:

a. As many as 62 Loan Applications covering an amount of INR 5552.67 Crore (65.55% of INR 65 Crore) were approved on the date of loan application itself, and 27 Loan Applications amounting to INR 1940.58 Crore (22.90% of INR 8470.65 Crore) were disbursed to the account of borrower entities on the date of the application itself.

b. In the Credit Approval Memo (CAM) of loans amounting to INR 19 Crore, deviations from due process have been recorded. The nature of various deviations so recorded in the CAMs are: Field Investigation waived, Probability of Default waived, eligibility criteria not as per the norms, no creation of security, no customer rating undertaken, escrow account not opened, etc. Further, the loan approval documentations were not properly executed and it has been noted that most of the loan application forms were left blank and the authorized signatories have merely signed on the last page of such application form (s).

c. GPC Loans amounting to INR 4715.62 Crore (involving 56 applications) were approved by Credit Committee/Leadership Committee and out of the said loans, deviations as noted above, have been recorded by RHFL in the CAMs of as many as 50 such loans amounting to INR 4378.03 Crore. As stated earlier, senior key functionaries of the Company were entrusted with the task of approving loans involving amounts greater than INR 5.00 Crore, however, despite the constitution of the Credit Committee and even after recording deviations in the CAMs, serious aspects of the borrower entities like negative net worth, weak financials , have been completely overlooked and the loans have been sanctioned by the Credit Committee/Leadership Council, inspite of the aforesaid deviations and deficiencies in the financial conditions of the applicants.

d. Furthermore, certain loans (14 cases) amounting to INR 1472.16 Crore were found to have been approved by the Noticee no. 2 in the capacity of Chairman of Reliance ADA Group and similar deviations in the sanctioning process as highlighted above have been observed in all the CAMs of all such The aforesaid observations as noted from the examination of the loan documents in respect of 70 Loan Applications, furnished by the Company (RHFL) are being summarized in the following table:

Table no. 15:Summary of Loan Approvers and deviations recorded in CAM of GPC loans is as under:

ApproverDetails |

No. of LoanApplications |

Amount ofDisbursement (INR Cr.) |

Deviations RecordedIn no. of Loan applications |

LeadershipCouncil/Credit Committee |

56 |

4715.62 |

50 |

Chairman ofReliance ADA Group (Noticee no. 2) |

14 |

1472.16 |

14 |

Total |

70 |

6187.78 |

64 |

-

Further, it is noticed that out of 45 unique GPCL borrower entities, 41 entities were such, each of which was sharing common addresses with at least one of such other borrower In fact, all such 41 entities are found to be located at 8 such common addresses in Mumbai. Few of such entities were also sharing common email addresses The total amount extended as GPCL to these 41 entities was around INR 7,822.90 Crore (92.35% of total amount of GPCL of INR 8470.65 Crore), and the details of such common addresses have been highlighted in row A to H in the table below, while the details of common email address are mentioned in the subsequent table:

Table No. 16– (GPCL borrowers having same addresses)

Sr.No. |

Name of GPCL Borrower entities |

Amount of GPCL (In INR Crore) |

1. |

Deep Industrial Finance Limited |

220.00 |

2. |

Neptune Steel Strips Limited |

102.50 |

3. |

Pearl Housing Finance India Limited |

200.00 |

4. |

Traitrya Construction Finance Limited |

185.00 |

5. |

Valuecorp Securities and Finance Limited |

118.49 |

6. |

Vishvakarma Equipment Finance (India) Limited |

200.00 |

7. |

CITI Securities and Financial Services Pvt. Ltd. |

220.80 |

A |

Common Address : 24/26, Cama Building, 1st Floor, DalalStreet, Fort, Mumbai |

|

8. |

RPL Solar Power Pvt. Ltd. |

85.00 |

9. |

RPL Star Power Pvt. Ltd. |

100.00 |

10. |

RPL Sunlight Power Pvt. Ltd. |

47.00 |

11. |

RPL Surya Power Pvt. Ltd. |

64.00 |

B |

Common Address: 502, Plot No. 91/94, Prabhat Colony, SantaCruz East, Mumbai |

|

12. |

Adhar Project Management and Consultancy Pvt. |

220.00 |

13. |

Gamesa Investment Management Pvt. Ltd. |

564.21 |

14. |

Medybiz Pvt. Ltd. |

325.90 |

15. |

Netizen Engineering Pvt. Ltd. |

214.54 |

16. |

Phi Management Solutions Pvt. Ltd. |

430.00 |

17. |

Adhar Property Consultancy Pvt. Ltd. |

189.20 |

18. |

Adhar Real Estate Consultancy Pvt. Ltd. |

202.40 |

19. |

Nationwide Communication Pvt. Ltd. |

175.00 |

C |

Common Address: 6th Floor, Manek Mahal, 90 Veer NarimanRoad, Mumbai |

|

20. |

Skyline Global Trade Pvt. Ltd. |

91.00 |

21. |

Space Trade Enterprises Pvt. Ltd. |

136.612 |

22. |

Species Commerce and Trade Pvt. Ltd. |

121.00 |

23. |

Crest Logistics and Engineers Pvt. Ltd. |

160.50 |

24. |

Hirma Power Limited |

225.00 |

25. |

Jayamkondam Power Limited |

104.00 |

26. |

Summit Ceminfra Pvt. Ltd. |

83.00 |

27. |

Tulip Advisors Pvt. Ltd. |

215.00 |

28. |

Worldcom Solutions Limited |

50.00 |

D |

Common Address: 7th Floor, Raheja Point I, Jawaharlal NehruNagar, Vakola Market, Santa Cruz East, Mumbai |

|

29. |

Accura Productions Pvt. Ltd. |

186.74 |

30. |

Arion Movie Productions Pvt. Ltd. |

402.39 |

31. |

Celebrita Mediahouse Pvt. Ltd. |

210.00 |

32. |

Edrishti Movies Pvt. Ltd. |

200.96 |

33. |

Ippy Entertainment Pvt. Ltd. |

196.33 |

34. |

Pifiniti Movies Pvt. Ltd. |

188.66 |

35. |

Wallace Movies and Entertainment Pvt. Ltd. |

178.41 |

E |

Common Address: 8th Floor, 803/804, Lotus Grandeur, VeeraDesai Road, Andheri West, Mumbai |

|

36. |

Indian Agri Services Pvt. Ltd. |

433.15 |

37. |

Mohanbir Hi-Tech Build Pvt. Ltd. |

305.00 |

F |

Common Address: Dev House, 260-261, Tribhuvan Complex,Ishwar Nagar, New Friends Colony New Delhi |

|

38. |

Reliance Cleangen Limited |

40.48 |

39. |

Vinayak Ventures Pvt. Ltd. |

221.13 |

G |

Common Address: H Block, 1st Floor, Dhurubhai AmbaniKnowledge City, Kopar Khairane, Navi Mumbai |

|

40. |

Kunjbihari Developers Pvt. Ltd. |

70.00 |

41. |

RPL Aditya Power Pvt. Ltd. |

139.50 |

H |

Common Address: Plot Bearing CTS No. C/1361 B1/1 of atPali Hill, Bandra West, Mumbai |

|

Total |

41 entities |

7822.90 |

(Source: Reply of RHFL to SEBI dated December 01, 2020)

Table no. 17

Sr. No. |

Registered email ID |

Details of GPCL Borrower entity |

1 |

adhar.project@gmail.com |

Entities at serial no. 12, 13 and 37 in Table no. 16 |

2 |

taxcompliance2022@gmail.com |

Entities at serial no. 31, 32 and 33 in Table no. 16 |

3 |

vijayakar@vbdesai.com |

Entities at serial no. 1, 2, 3, 4, 5, 6 and 7 in Table no. 16 |

-

The investigation has further brought to light that some of the GPCL Borrower entities, and the entities to whom funds were lent onward by such borrower entities, were enjoying the same address. The details of such connected companies (GPCL Borrower entities and onward borrower entities) found in common addresses are captured in the table below:

Table no 18.: Common address and email id

Common Address |

GPCL Borrower entities |

Onward Borrowers |

Manek Mahal, 6th Floor, 90Veer Nariman Road, Mumbai Mumbai City MH 400020 IN |

1. Adhar Project Management& Consultancy Pvt. Ltd.2. Gamesa Investment Management Pvt. Ltd.3. Medybiz Pvt. Ltd.4. Netizen Engineering Pvt. Ltd.5. Phi Management Solutions Pvt. Ltd. |

1. Reliance Business Broadcast News Holding Ltd.2. Reliance Unicorn Enterprises Pvt. Ltd. |

“Raheja Point Wing B, 7thFloor, Nehru Rd. Nr Shamrao Vithal Bank, Vakola, Santacruz (East) Mumbai – 400 055″ |

1. Tulip Advisors Private Limited2. Hirma Power Limited |

1. Crest Logistics and EngineersPvt. Ltd. |

-

This apart, it is also noted during the investigation that GPCL borrowers and the onward borrower entities are having same persons as Directors on their respective Boards, details of a few such instances are furnished herein below:

Table no. 19: Common directorships

Name of the Director |

GPCL Borrower |

Onward Borrowers |

Ashok Kumar RamnivasThalia |

1. Hirma Power Limited2. Medybiz Private Limited3. Tulip Advisors Private Limited |

1. Jayamkondam Power Limited2. Skyline Global Trade Private Limited |

3. Space Trade Enterprises PrivateLimited |

||

Basant Kumar Vijay Singh Varma |

1. Adhar Project Management & Consultancy Private Limited2. Indian Agri Services Private Limited3. Phi Management Solutions Private Limited |

* |

Ekta Yadav |

1. Mohanbir Hi-Tech Build Private Limited |

1. Adhar Property Consultancy Private Limited2. Reliance Alpha Services Private Limited3. Reliance Entertainment Networks Private Limited (Formerly Reliance Land Private Limited)4. Reliance Venture Asset Management Private Limited |

Laxminarayan Ramlal Sharma |

1. Arion Movie2. Hirma Power Limited |

1. Jayamkondam Power Limited2. Reliance Value Services Private Limited |

Mayank Chimanbhai Padiya |

1. Hirma Power Limited2. Tulip Advisors Private Limited3. Vinayak Ventures Private Limited |

1. Skyline Global Trade Private Limited2. Space Trade Enterprises Private Limited |

Narendra Laxminarayan Sharma |

1. Azalia Distribution Private Limited2. Gamesa Investment Management Private Limited |

|

Nishant Sinha |

1. Netizen Engineering PrivateLimited |

2. Sapphire Cable & Services PrivateLimited |

Sachin Seth |

1. Adhar Project Management & Consultancy Private Limited2. Gamesa Investment Management Private Limited3. Indian Agri Services Private Limited4. Medybiz Private Limited5. Phi Management Solutions Private Limited |

1. Adhar Property Consultancy Private Limited2. Adhar Real Estate Consultancy Private Limited3. Reliance Alpha Services Private Limited4. Reliance Entertainment Networks Private Limited (Formerly Reliance Land Private Limited)5. Reliance Value Services Private Limited |

(Source: MCA Website and information submitted by above-mentioned entities to SEBI)

Indian Agri Services Private Limited and Phi Management Solutions Private Limited, both have received GPCL from RHFL. Further, the amount of INR 20 Crore as received by Indian Agri Services Private Limited from RHFL on November 05, 2018, was transferred to Phi Management Solutions Private Limited making it as an onward borrower also. In a similar transaction, Phi Management Solutions Private Limited has onward lent INR 100 Crore to Indian Agri Services Private Limited on October 12, 2018, after taking the same from RHFL as GPCL.

-

Apart from the common directorship, it is noted from the statement of certain Directors recorded under oath during the investigation that few of such Directors of the GPCL Borrower entities are past/current employees of Reliance ADA Group The details of some such Directors are enumerated below:

Table no. 20

Sr.No. |

Name of the person |

Current Directorships |

Joining Date |

Recommendedfor appointment by |

Other Employment |

1 |

Basant Verma |

Adhar Project Mgt. &Consultancy Pvt. Ltd. |

22/01/2020 |

Satish Kadakia (also Director in Phi Mgt & Reliance Unicorn) |

CFO at Reliance Media Works Ltd. |

Reliance UnicornEnterprises Pvt. Ltd. |

22/01/2020 |

||||

Phi ManangementSolutions Private Limited |

29/09/2019 |

||||

Indian Agri servicesPvt. Ltd. |

17/12/2018 |

||||

2 |

Ramakant Govale |

Arion Movie Productions Private Limited |

27/11/2018 |

Mr. Ambar Basu (Director of Reliance Big Entertainment Pvt. Ltd.) |

Director atZapak Mobile Games Pvt.Ltd. (Subsidiary of Reliance Big EntertainmentPvt. Ltd.) |

3 |

Sachin Madhusudan Seth |

Medybiz Pvt. Ltd. |

30/10/2020 |

Basant Verma (CFO of reliance Media Works Ltd.) |

Seniorexecutve Finance in Reliance MediaWorks Ltd. |

Gamesa Investment Management Pvt. Ltd |

30/10/2020 |

||||

4 |

Ekta Yadav |

Mohanbir Hi-tech BuildPvt. Ltd. |

30/10/2020 |

Basant Verma (CFO of reliance Media Works Ltd.) |

Employee at Reliance Media Works Ltd. |

Reliance Venture AssetManagement Pvt. Ltd. |

30/10/2020 |

-

It is also noted that certain GPCL Borrower entities have cross shareholding amongst themselves, details of which have been captured in the following table:

Table no. 21

|

Name of Shareholder |

Aadhar Project Mgt. Pvt.Ltd. (%) |

Azalia Distrib ution Pvt.Ltd. (%) |

Gamesa Investme nt Mgt. Pvt. Ltd. (%) |

Hirm a Powe r Ltd. (%) |

Indian Agri Service s Pvt.Ltd. (%) |

Medyb iz Pvt. Ltd. (%) |

Mohanbir Hi- Tech Build Pvt. Ltd.(%) |

PhiMgt. Soluti ons Pvt. Ltd.(%) |

RelianceEntertainment Networks Pvt. Ltd. (formerlyReliance Land Pvt. Ltd.) |

18 |

– |

– |

– |

12.34 |

– |

– |

– |

Reliance AlphaServices Pvt. Ltd. |

26 |

– |

– |

– |

40.74 |

– |

– |

40 |

Reliance Venture Asset Mgt. Pvt. Ltd. |

18 |

– |

– |

– |

– |

– |

– |

– |

Reliance FinancialAdvisory Services Ltd. |

19 |

– |

– |

– |

23.46 |

– |

– |

– |

Indian AgriServices Pvt. Ltd. |

19 |

– |

– |

– |

– |

– |

– |

– |

VrushvikBroadcast Pvt. Ltd. |

– |

75 |

– |

– |

– |

– |

– |

– |

Reliance Big BroadcastingPvt. Ltd. |

– |

25 |

– |

– |

– |

– |

– |

– |

Aadhar Project Mgt. Pvt. Ltd. |

– |

– |

99.99 |

– |

23.46 |

– |

99.99 |

– |

Jayamkondam Power Ltd. |

– |

– |

– |

99.99 |

– |

– |

– |

– |

RelianceInteractiveAdvisors Pvt. Ltd. |

– |

– |

– |

– |

– |

99.96 |

– |

– |

Reliance ValueServices Pvt. Ltd. |

– |

– |

– |

– |

– |

– |

– |

50 |

Phi Capital Services LLP |

– |

– |

– |

– |

– |

– |

– |

10 |

Total |

100 |

100 |

99.99 |

99.99 |

100 |

99.96 |

99.99 |

100 |

-

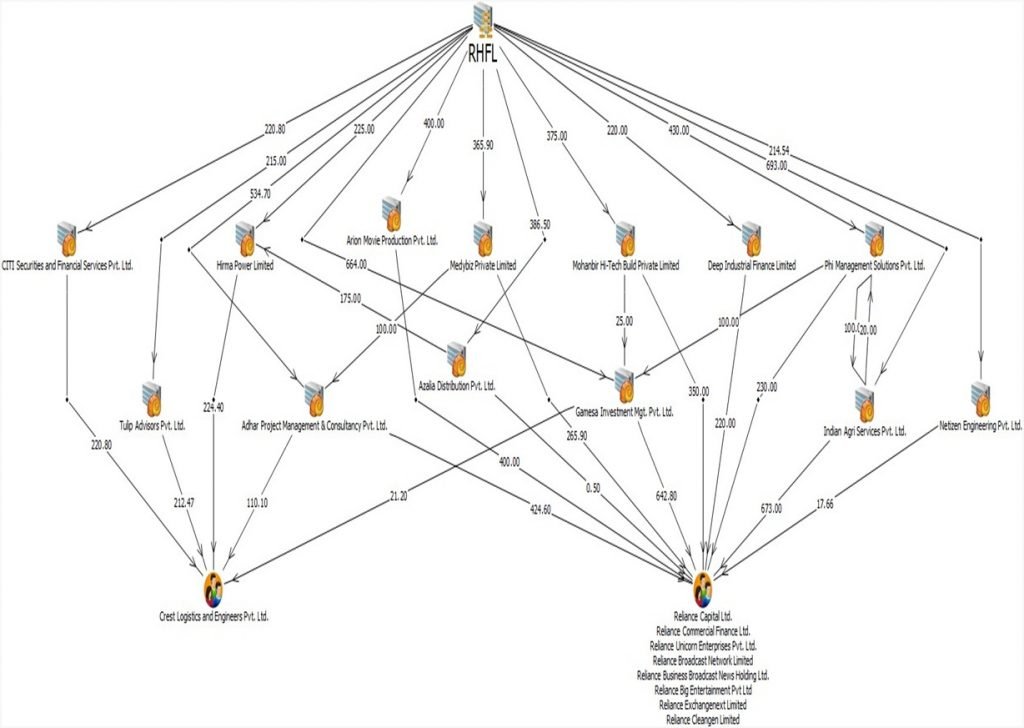

It is a matter of record that GPCL as the name suggests, has been extended for general corporate purpose and even in the loan documents, the said entities have mentioned that the purpose of the loan applied for is to meet their working capital requirement. It is however noticed that none of the aforesaid 13 borrower entities was involved in any business of ‘financial activities’ and their Memorandum of Association or their Financial statements do not indicate that these entities were undertaking any business activities of financing or financial services, so as to justify the usage of GPCL (received from RHFL) as working capital for onward lending to another entity. However, out of INR 4,944.34 Crore (including unaccounted disbursals of INR 824.60 Crore) (as stated earlier in Table no. 12) lent by RHFL to these 13 entities, it is noticed the said entities have onward lent around INR 4,533.43 Crore (i.e. around 91.69% of the funds were onward lent), giving a prima facie inference that those borrower entities did not have any actual corporate purpose for borrowing from RHFL nor did RHFL make any genuine evaluation of the corporate purposes for which such loans were advanced to such entities as GPCL. The details of such onward lending made by the GPCL Borrower entities of RHFL are tabulated herein below:

Table no. 22

Sr. no. |

Disbursal Date |

GPCL Borrower Entity |

Amount (INR Cr.) |

Date of onward lending |

Onward Borrower Entity |

Amount (INR Cr.) |

Percentag e of Onward Lending |

1. |

27-Apr-18 |

Adhar Project Management & Consultancy Pvt. Ltd. |

100.00 |

27-Apr-18 |

Reliance Unicorn Enterprises Pvt.Ltd. |

19.00 |

100.00% |

2. |

27-Apr-18 |

Crest Logistics and Engineers Pvt. Ltd. |

15.10 |

||||

3. |

27-Apr-18 |

Reliance CapitalLtd. |

65.90 |

||||

4. |

23-Jul-18 |

Adhar ProjectManagement & Consultancy Pvt. Ltd. |

25.00 |

23-Jul-18 |

Reliance Capital Ltd. |

25.00 |

100.00% |

5. |

08-Aug-18 |

Adhar Project Management &Consultancy Pvt. Ltd. |

50.00 |

08-Aug-18 |

Reliance Capital Ltd. |

50.00 |

100.00% |

6. |

09-Aug-18 |

Adhar Project Management & Consultancy Pvt.Ltd. |

43.48 |

09-Aug-18 |

Reliance Big Entertainment Pvt Ltd |

43.48 |

100.00% |

7. |

10-Aug-18 |

Adhar ProjectManagement & Consultancy Pvt.Ltd. |

51.12 |

10-Aug-18 |

Reliance Commercial Finance Ltd. |

51.12 |

100.00% |

8. |

06-Sep-18 |

Adhar Project Management & |

45.00 |

06-Sep-18 |

Reliance Big Entertainment PvtLtd |

24.20 |

100.22% |

Sr. no. |

Disbursal Date |

GPCL Borrower Entity |

Amount (INR Cr.) |

Date of onward lending |

Onward Borrower Entity |

Amount (INR Cr.) |

Percentag e of Onward Lending |

9. |

Consultancy Pvt.Ltd. |

06-Sep-18 |

Reliance CapitalLtd. |

20.90 |

|||

10. |

04-Oct-18 |

Adhar ProjectManagement & Consultancy Pvt. Ltd. |

25.00 |

04-Oct-18 |

Reliance Capital Ltd. |

25.00 |

100.00% |

11. |

30-Oct-18 |

Adhar Project Management &Consultancy Pvt. Ltd. |

95.00 |

30-Oct-18 |

Crest Logistics and Engineers Pvt. Ltd. |

95.00 |

100.00% |

12. |

01-Mar-19 |

Adhar Project Management & Consultancy Pvt.Ltd. |

100.00 |

01-Mar-19 |

Reliance Commercial Finance Ltd. |

100.00 |

100.00% |

13. |

11-Dec-18 |

Arion MovieProduction Pvt. Ltd. |

200.00 |

11-Dec-18 |

Reliance Broadcast |

200.00 |

100.00% |

14. |

25-Mar-19 |

Arion Movie Production Pvt.Ltd. |

200.00 |

25-Mar-19 |

Reliance CommercialFinance Ltd. |

200.00 |

100.00% |

15. |

19-Oct-18 |

Azalia Distribution Pvt.Ltd. |

121.50 |

19-Oct-18 |

Reliance Broadcast Network Limited |

0.30 |

0.25% |

16. |

05-Nov-18 |

AzaliaDistribution Pvt. Ltd. |

90.00 |

05-Nov-18 |

Reliance Broadcast Network Limited |

0.20 |

0.22% |

17. |

25-Mar-19 |

AzaliaDistribution Pvt. Ltd. |

175.00 |

26-Mar-19 |

Hirma Power Limited |

175.00 |

100.00% |

18. |

19-Mar-19 |

CITI Securities and FinancialServices Pvt. Ltd. |

220.80 |

19-Mar-19 |

Crest Logistics and Engineers Pvt. Ltd. |

220.80 |

100.00% |

19. |

02-Mar-19 |

Deep Industrial Finance Limited |

220.00 |

02-Mar-19 |

Reliance CommercialFinance Ltd. |

220.00 |

100.00% |

20. |

18-Sep-18 |

GamesaInvestment Mgt. Pvt. Ltd. |

200.00 |

18-Sep-18 |

Reliance Capital Ltd. |

200.00 |

100.00% |

21. |

15-Oct-18 |

Gamesa Investment Mgt.Pvt. Ltd. |

50.00 |

15-Oct-18 |

Reliance Capital Ltd. |

50.00 |

100.00% |

22. |

30-Oct-18 |

Gamesa Investment Mgt. Pvt. Ltd. |

55.00 |

30-Oct-18 |

Crest Logistics andEngineers Pvt. Ltd. |

21.20 |

100.00% |

23. |

30-Oct-18 |

Reliance BroadcastNetwork Limited |

22.00 |

||||

24. |

30-Oct-18 |

Reliance CleangenLimited |

11.00 |

||||

25. |

30-Oct-18 |

Reliance Unicorn Enterprises Pvt.Ltd. |

0.80 |

||||

26. |

06-Nov-18 |

Gamesa Investment Mgt.Pvt. Ltd. |

100.00 |

06-Nov-18 |

Reliance Capital Ltd. |

100.00 |

100.00% |

27. |

28-Feb-19 |

GamesaInvestment Mgt. Pvt. Ltd. |

60.00 |

28-Feb-19 |

RelianceCommercial Finance Ltd. |

60.00 |

100.00% |

Sr. no. |

Disbursal Date |

GPCL Borrower Entity |

Amount (INR Cr.) |

Date of onward lending |

Onward Borrower Entity |

Amount (INR Cr.) |

Percentag e of Onward Lending |

28. |

01-Mar-19 |

GamesaInvestment Mgt. Pvt. Ltd. |

20.00 |

01-Mar-19 |

RelianceCommercial Finance Ltd. |

20.00 |

100.00% |

29. |

13-Mar-19 |

Gamesa Investment Mgt. Pvt. Ltd. |

35.00 |

13-Mar-19 |

Reliance CapitalLtd. |

20.27 |

100.00% |

30. |

13-Mar-19 |

Reliance ExchangenextLimited |

14.73 |

||||

31. |

18-Mar-19 |

Gamesa Investment Mgt.Pvt. Ltd. |

144.00 |

18-Mar-19 |

Reliance CommercialFinance Ltd. |

144.00 |

100.00% |

32. |

29-May-18 |

Hirma Power Limited |

50.00 |

29-May-18 |

Crest Logistics and Engineers Pvt. Ltd. |

49.40 |

98.80% |

33. |

22-Mar-19 |

Hirma Power Limited |

175.00 |

22-Mar-19 |

Crest Logistics and Engineers Pvt. Ltd. |

175.00 |

100.00% |

34. |

18-Apr-18 |

Indian AgriServices Pvt. Ltd. |

200.00 |

18-Apr-18 |

Reliance CapitalLtd. |

200.00 |

100.00% |

35. |

12-Jul-18 |

Indian Agri Services Pvt. Ltd. |

100.00 |

12-Jul-18 |

RelianceCommercial Finance Ltd. |

100.00 |

100.00% |

36. |

20-Aug-18 |

Indian AgriServices Pvt. Ltd. |

100.00 |

20-Aug-18 |

Reliance CapitalLtd. |

100.00 |

100.00% |

37. |

06-Sep-18 |

Indian Agri Services Pvt. Ltd. |

198.00 |

06-Sep-18 |

Reliance BusinessBroadcasr News Holding Ltd. |

198.00 |

100.00% |

38. |

05-Nov-18 |

Indian Agri Services Pvt. Ltd. |

20.00 |

05-Nov-18 |

Phi Management Solutions Pvt. Ltd. |

20.00 |

100.00% |

39. |

01-Mar-19 |

Indian Agri Services Pvt. Ltd. |

50.00 |

01-Mar-19 |

Reliance CommercialFinance Ltd. |

50.00 |

100.00% |

40. |

13-Mar-19 |

Indian AgriServices Pvt. Ltd. |

25.00 |

13-Mar-19 |

Reliance CapitalLtd. |

25.00 |

100.00% |

41. |

10-Sep-18 |

Medybiz PrivateLimited |

150.00 |

10-Sep-18 |

Reliance CapitalLtd. |

150.00 |

100.00% |

42. |

10-Oct-18 |

Medybiz PrivateLimited |

40.00 |

10-Oct-18 |

Reliance CapitalLtd. |

40.00 |

100.00% |

43. |

12-Oct-18 |

Medybiz Private Limited |

100.00 |

12-Oct-18 |

Adhar Project Management &Consultancy Pvt. Ltd. |

100.00 |

100.00% |

44. |

19-Nov-18 |

Medybiz Private Limited |

75.90 |

19-Nov-18 |

Reliance Unicorn Enterprises Pvt.Ltd. |

75.90 |

100.00% |

45. |

10-Sep-18 |

Mohanbir Hi- Tech Build PrivateLimited |

80.00 |

10-Sep-18 |

Reliance Capital Ltd. |

80.00 |

100.00% |

46. |

19-Sep-18 |

Mohanbir Hi-Tech Build Private Limited |

70.00 |

19-Sep-18 |

Reliance Capital Ltd. |

70.00 |

100.00% |

47. |

14-Nov-18 |

Mohanbir Hi- Tech Build PrivateLimited |

200.00 |

14-Nov-18 |

Reliance Unicorn Enterprises Pvt.Ltd. |

200.00 |

100.00% |

Sr. no. |

Disbursal Date |

GPCL Borrower Entity |

Amount (INR Cr.) |

Date of onward lending |

Onward Borrower Entity |

Amount (INR Cr.) |

Percentag e of Onward Lending |

48. |

18-Mar-19 |

Mohanbir Hi-Tech Build Private Limited |

25.00 |

18-Mar-19 |

Gamesa Investment Mgt. Pvt. Ltd. |

25.00 |

100.00% |

49. |

21-Dec-18 |

NetizenEngineering Pvt. Ltd. |

32.38 |

NA |

NA |

– |

0.00% |

50. |

18-Dec-18 |

Netizen Engineering Pvt.Ltd. |

50.60 |

NA |

NA |

– |

0.00% |

51. |

20-Dec-18 |

NetizenEngineering Pvt. Ltd. |

80.96 |

NA |

NA |

– |

0.00% |

52. |

28-Dec-18 |

Netizen Engineering Pvt.Ltd. |

50.60 |

28-Dec-18 |

Reliance CommercialFinance Ltd. |

17.66 |

34.90% |

53. |

19-Oct-18 |

Phi Management Solutions Pvt. Ltd. |

210.00 |

19-Oct-18 |

Reliance Capital Ltd. |

210.00 |

100.00% |

54. |

12-Oct-18 |

Phi Management Solutions Pvt. Ltd. |

100.00 |

12-Oct-18 |

Gamesa Investment Mgt. Pvt. Ltd. |

100.00 |

100.00% |

55. |

12-Oct-18 |

Phi Management Solutions Pvt. Ltd. |

100.00 |

12-Oct-18 |

Indian Agri Services Pvt. Ltd. |

100.00 |

100.00% |

56. |

14-Nov-18 |

Phi Management Solutions Pvt. Ltd. |

20.00 |

14-Nov-18 |

Reliance UnicornEnterprises Pvt. Ltd. |

20.00 |

100.00% |

57. |

29-May-18 |

Tulip AdvisorsPvt. Ltd. |

60.00 |

29-May-18 |

Crest Logistics andEngineers Pvt. Ltd. |

59.30 |

98.83% |

58. |

30-May-18 |

Tulip AdvisorsPvt. Ltd. |

100.00 |

30-May-18 |

Crest Logistics andEngineers Pvt. Ltd. |

98.82 |

98.82% |

59. |

31-May-18 |

Tulip AdvisorsPvt. Ltd. |

55.00 |

31-May-18 |

Crest Logistics andEngineers Pvt. Ltd. |

54.35 |

98.82% |

Total |

4,944.34 |

Total |

4,533.43 |

91.69% |

|||

-

Investigation further reveals that RHFL, had received INR 300 Crore on September 10, 2018 from ICICI Bank. However, out of the said amount, INR 230 Crore was transferred to two PILEs viz., INR 150 Crore to Medybiz Private Limited (Noticee no. 15) and INR 80 Crore to Mohanbir Hi Tech Build Private Limited (Noticee 18), and the said two Companies, in turn transferred the amounts so received to Reliance Capital Limited (Noticee no. 28), on the same day itself. Further, RHFL extended GPCL of INR 20 Crore on November 05, 2018 to a PILE3 i.e. Indian Agri Services Private Limited (Noticee no. 7) which extended the said amount to another PILE viz., Phi Management Solutions Pvt. Ltd (Noticee no. 8). Similarly, on March 18, 2019, an amount of INR 25 Crore was extended by RHFL to another PILE i.e. Mohanbir HI Tech Build Private Limited (Noticee no. 18). The said Noticee no. 18 transferred that amount of INR 25 Crore to Gamesa Investment Management Private Limited (Noticee no. 14). The ultimate recipients of the funds viz., Noticee no. 8and Noticee no. 14transferred the said amounts back to RHFL, i.e., the Company from where such amounts had originated. The chain of events governing such transactions indicates that RHFL in connivance with the GPCL borrower entities was involved in ever- greening of its GPC lending business.3 PILE and GPCL Borrower Entities have been interchangeably used in the present order and both the terms are referring to the entities who have taken General Purpose Corporate Loans from RHFL

-

Thus, the investigation reveals that out of the total amount of GPCL of INR 4,944.34 Crore received by the aforesaid 13 entities, the major portion amounting to INR 4,533.43 Crore (91.69% of the total GPCL) was lent onward by such borrower entities. In around 40 instances of such onward lending (shaded in blue at Serial 1, 2, 3, 4 etc. in the Table no. 22 above), the amount that was lent onwards was 100% of the amount, which was lent by RHFL to the GPCL Borrower entities while in many other instances, the said amount of onward transfer was more than 98% of the total amount received from RHFL. Further, in 54 instances, such onward lending was done on the same date (dated highlighted in green shade in the Table above) by the borrower entities.

-

Apart from the aforesaid crucial findings, it is also noticed that out of 70 GPC loan documents furnished by RHFL, as many as 62 Loan Applications amounting to INR 67 Crore (65.55% of INR 8470.65 Crore) have been promptly approved on the date of application of such loans itself. Further, in 27 instances, loan amounts aggregating to INR 1940.58 Crore (22.91% of INR 8470.65 Crore) were both approved and disbursed on the same date on which the applications for availing loans were made by the GPCL Borrower entities The details of such cases are as under:

Table no. 23

Date of Application |

Name of the Borrower |

Amount ofDisbursement (INR Cr.) |

Date of disbursal |

29/03/2019 |

Summit Ceminfra Private Limited |

32.00 |

29/03/2019 |

28/02/2019 |

Gamesa Investment Management Private Limited |

60.00 |

28/02/2019 |

28/12/2018 |

Netizen Engineering Private Limited |

50.60 |

28/12/2018 |

29/10/2018 |

Azalia Distribution Private Limited |

121.50 |

29/10/2018 |

18/10/2018 |

Gamesa Investment Management Private Limited |

50.00 |

18/10/2018 |

01/10/2018 |

Crest Logistics And Engineers Private Limited |

11.00 |

01/10/2018 |

19/09/2018 |

Phi Management Solutions Private Limited |

210.00 |

19/09/2018 |

19/09/2018 |

Gamesa Investment Management Private Limited |

200.00 |

19/09/2018 |

12/09/2018 |

Reliance Cleangen Limited |

40.48 |

12/09/2018 |

11/09/2018 |

Mohanbir Hi-Tech Build Private Limited |

80.00 |

11/09/2018 |

11/09/2018 |

Medybiz Private Limited |

150.00 |

11/09/2018 |

24/08/2018 |

Rpl Star Power Private Limited |

50.00 |

24/08/2018 |

23/08/2018 |

Rpl Sunlight Power Private Limited |

47.00 |

23/08/2018 |

22/08/2018 |

Rpl Star Power Private Limited |

50.00 |

22/08/2018 |

22/08/2018 |

Rpl Solar Power Private Limited |

50.00 |

22/08/2018 |

22/08/2018 |

Worldcom Solutions Limited |

50.00 |

22/08/2018 |

22/08/2018 |

Species Commerce And Trade Private Limited |

50.00 |

22/08/2018 |

20/08/2018 |

Indian Agri Services Private Limited |

100.00 |

20/08/2018 |

09/08/2018 |

Rpl Surya Power Private Limited |

64.00 |

09/08/2018 |

08/08/2018 |

Crest Logistics And Engineers Private Limited |

42.00 |

08/08/2018 |

24/07/2018 |

Adhar Project Management And ConsultancyPrivate Limited |

25.00 |

24/07/2018 |

31/05/2018 |

Species Commerce And Trade Private Limited |

71.00 |

31/05/2018 |

31/05/2018 |

Tulip Advisors Private Limited |

55.00 |

31/05/2018 |

31/05/2018 |

Skyline Global Trade Private Limited |

71.00 |

31/05/2018 |

30/05/2018 |

Tulip Advisors Private Limited |

100.00 |

30/05/2018 |

29/05/2018 |

Tulip Advisors Private Limited |

60.00 |

29/05/2018 |

29/05/2018 |

Hirma Power Limited |

50.00 |

29/05/2018 |

Total |

1,940.58 |

Except first two loans, all the loans were approved by the Credit Committee

-

In this respect, it is noticed that the act of processing of loan application on the date of the application itself or within one day of receipt of application as well as the disbursal of the loan amounts on the same day of application and approval, explicitly displaying such undue haste and abnormal alacrity is indicative of the fact that RFHL may not have paid due regard to even the basic minimum due diligence process like document verification, credit evaluation, which are essentially expected to be performed for any loan applications received by any Housing Finance Company, but in the aforementioned instances, prima facie, such procedures were knowingly ignored and apparently not enough time was devoted by RHFL to take care of the basic due diligence and due processes in such cases. The aforesaid instances of apparently blatant irregularities in the processing of loans involving huge amounts, when read with the fact that loans instances cited at Serial no. 1, 2, 3, 7, 8 etc., in the above table no. 22 (collectively amounting to INR 4214.43 Crore), have been promptly lent onwards to promoter related entities on the same date of receipt, in the manner as have been elaborated above, give rise to a strong prima facie belief that the afore-stated financial transactions were not carried out by RHFL in due compliance with the procedures & processes established by its own board in letter & spirit as ordinarily expected to be followed by any prudent financing company. Therefore, such loan transactions cannot be termed as normal commercial transactions carried out in the course of normal lending business of the company. Rather, instances of such murky loan transactions between RHFL and the aforesaid borrowing entities who in turn have visibly acted as conduits to onward transfer those loan funds to promoter related entities, strongly indicate that the above transactions were executed with a malafide & deceitful intent which cannot be said to be in the best interest of the shareholders of RHFL or in the interest of the investors of securities market at large.

-

As already pointed out from the reports of the Forensic Auditors, that on certain occasions RHFL has also disbursed loans even before such loans were sanctioned, one such loan as found by SEBI in its investigation has been mentioned in the Table no. 24 Such an act on the part of RHFL not only shows that RHFL has deliberately ignored and omitted to follow the basic cannons of loan application evaluation exercise and documentation/ due diligence processes, but also has ex-post facto documented such loan which has been already disbursed prior to the actual receipt of loan application, thereby blatantly deviating from the normal conduct of a Housing Finance Company in the matter of disbursing loans to its borrower entities. Further, when one examines the poor financial conditions and business status of those companies (highlighted in the Table no. 25 presented below) to whom such loans were extended, it becomes clear that these borrower entities did not even possess any financial strength or viability so as to deserve any loans from any financing company in normal course, leave alone disbursal of loans prior to receiving loan application from one of them.

Table no. 24

Sr. No. |

Name of the borrower |

Amount Disbursed (INR Cr.) |

Date of Sanction letter |

Date ofdisburseme nt as per bank statement |

Differen ce (no. of days) |

1 |

Aadhar Project Management AndConsultancy Pvt. Ltd. |

100 |

30-Apr-18 |

27-Apr-18 |

3 |

Table no. 25: Financial Position of the 13 GPCL Borrowers entities

All amounts in INR Cr.

Name of the Borrower |

Revenues |

Profit |

Operating Cash flows |

Total Assets |

Tangible Assets |

Net Worth |

Loan disburs ed by RHFL in FY2018-19 |

Loan repaid in FY 2018-19 |

||||||||||||

FY16 |

FY1 7 |

FY1 8 |

FY1 6 |

FY1 7 |

FY1 8 |

FY1 6 |

FY1 7 |

FY1 8 |

FY1 6 |

FY17 |

FY18 |

FY1 6 |

FY1 7 |

FY1 8 |

FY1 6 |

FY17 |

FY1 8 |

|||

Gamesa Investment ManagementPvt. Ltd |

– |

– |

0.04 |

(0.01) |

0.00 |

(4.17) |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

128.70 |

51.63 |

51.63 |

51.63 |

0.00 |

0.00 |

(4.18) |