![]()

Improvements in GSTR-1 – Phase-II

-

The statement of outward supplies in FORM GSTR-1 is to be furnished by all normal taxpayers on a monthly or quarterly basis, as applicable. Quarterly GSTR-1 filers have also been provided with an optional Invoice Furnishing Facility (IFF) for reporting their outward supplies to registered persons (B2B supplies) in the first two months of the Continuous enhancements & technology improvementsin GSTR-1/IFF have been made from time to time to enhance the performance & user-experience of GSTR-1/IFF, which has led to improvements in Summary Generation process, quicker response time, and enhanced user-experience for the taxpayers.

-

The previous phase of GSTR-1/IFF enhancement was deployed on the GST Portal in November In that phase, new features like the revamped dashboard, enhanced B2B tables, and information regarding table/tile documents count were provided. In continuation to the same, the next Phase of the GSTR-1/IFF improvements would be implemented shortly on the GST Portal, details of which are discussed as below.

-

GSTR-1/IFF can be viewed as usual by navigating from:

Returns Dashboard > Selection of Period > Details of outward supplies of goods or services GSTR-1 > Prepare Online.

The following enhancements are being done in this phase of the GSTR-1/IFF improvement :

i.) Removal of ‘Submit’ button before filing: Earlier there was atwo step filing of GSTR-1/IFF. Taxpayers first clicked on the ‘Submit’ button and then clicked on the ‘File’ button to file the GSTR-1/IFF through DSC or EVC. No change in the data entered was allowed after pressing the ‘Submit’ button (post submission of GSTR- 1/IFF). In this phase of GSTR-1 enhancement, the ‘Submit’ button now will be removed from GSTR-1/IFF, and taxpayers will now have the flexibility to add or modify records till the Filing is completed by pressing the ‘File Statement’ button. Thus the two step filing process will now be a single step filing process.

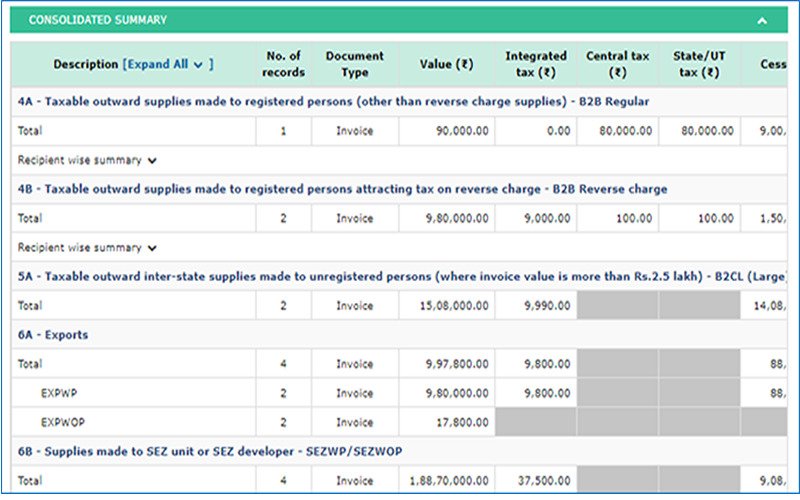

ii.) Consolidated Summary: Taxpayers will now be shown a table-wise consolidated summary before actual filing of GSTR-1/IFF. This consolidated summary will have a detailed & table-wise summary of the records added by the taxpayers. This will provide a complete overview of the records added in GSTR-1/IFF before actual filing.

iii.) Recipient wise summary: The consolidated summary page will also provide recipient-wise summary, containing the total value of the supplies & the total tax involved in such supplies. This summary will be made available in all cases where the recipient count is upto one hundred, which will cover more than 90 percent of the taxpayers. Viewing for more than one hundred recipients on the screen not being user friendly, and having technical constraints will be addressed in the next version of improvements. The recipient-wise summary will be made available with respect to the following tables of GSTR-1/IFF:

Table No. |

Description |

4A |

B2B supplies |

4B |

Supplies attracting reverse charge |

6B |

SEZ supplies |

6C |

Deemed exports |

9B |

Credit/Debit notes |

-

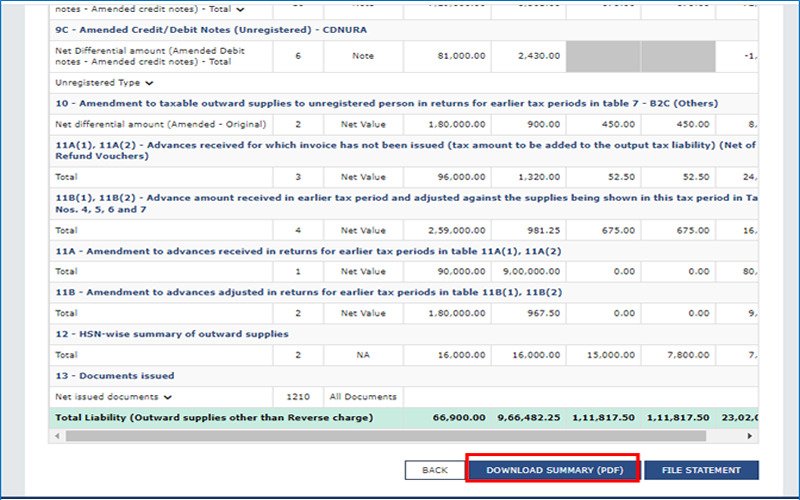

Summary PDF: Taxpayers can now view and download detailed summary of the GSTR-1/IFF in a new PDF The earlier format of the GSTR-1 summary was slightly different from the notified format, in which few tables of the notified format were clubbed together and made available to the users. The new summary format has been aligned with the notified format of GSTR-1. It will also contain the total outward supplies liability of the taxpayer (other than reverse charge), to be auto-populated in GSTR-3B.

-

Steps to file GSTR-1: The existing filing steps of form GSTR-1/IFF shall be replaced with the following steps : )

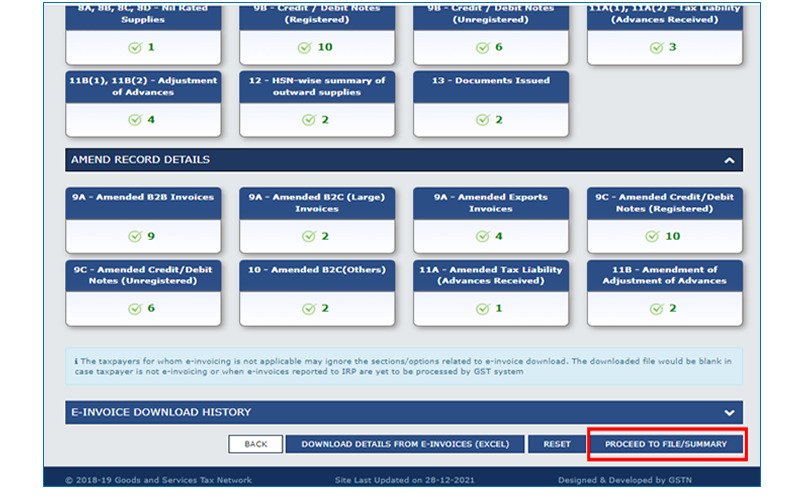

i) Click ‘Generate Summary’ button to generate the summary,

ii)Click ‘Proceed to File/Summary’ button to view the final summary before filing and

iii) Click ‘File Statement’ button to file GSTR-1/IFF.

-

It may be noted that with the removal of Submit button in GSTR-1/IFF, the information uploaded in GSTR-1/IFF shall now freeze only upon clicking the ‘File Statement’ button.

-

Any document if it is added after the Summary Generation, then the summary will have to be generated

-

In such cases, the ‘Proceed to File/Summary’ button will change to ‘Generate Summary’ button and taxpayer will have to click this ‘Generate Summary’ button again before filing.

Further details regarding the new steps in the filing process are mentioned below :

I. Generate Summary: Once the records are savedin GSTR-1/IFF, taxpayer shall be required to click on the new ‘Generate Summary’ System will acknowledge the request and taxpayer will then be required to refresh the GSTR-1/IFF dashboard page by clicking refresh icon at the top of page.

After successful generation of summary, taxpayer will see a new ‘Proceed to File/Summary’ button at the bottom of the GSTR-1/IFF page. In case any new record(s) are added after previous summary generation, the taxpayer will be required to click the ‘Generate Summary’ button again to get latest summary.

After this, the taxpayer will be navigated to the consolidated summary page containing table-wise summary of the total records added in GSTR-1 so far.

II. Consolidated Summary – After generation of GSTR-1/IFF summary, taxpayers may note the following changes :

-

-

Status change from ‘Not filed’ to ‘Ready to file’.

-

‘Generate Summary’ button will be replaced by ‘Proceed to File/Summary’

-

The summary table will also provide the recipient-wise summary in respect of B2B tables 4A, 4B, 6B, 6C & 9B of GSTR-1/IFF, in cases where the recipient count is upto one hundred.

III. File Statement – After verifying the consolidated summary, taxpayers need to click ‘File Statement’ button, which shall be available at the bottom of the consolidated summary

On clicking of ‘File Statement’ button, taxpayers will be navigated to the filing page to file GSTR-1/IFF using DSC/EVC