![]()

Daughters can inherit fathers’ self acquired, inherited properties: Supreme Court

Arunachala Gounder (Dead) Vs Ponnusamy (2022 LiveLaw (SC) 71)

Facts:

1. The Court was considering the question whether a sole daughter could inherit her father’s separate property dying intestate (prior to the enactment of Hindu Succession Act, 1956).

2. The property in question was admittedly the self-acquired property of the father.

3. The question was whether such property will devolve on to the daughter upon the death of her father, who died without a will, by inheritance or shall devolve on to “father’s brother’s son by survivorship prior to Hindu Succession Act.

Notes:

1. The Mitakshara law recognised inheritance by succession but only to the property separately owned by an individual, male or female. Females are included as heirs to this kind of property by Mitakshara law.

2. The Madras subschool recognized the heritable capacity of a larger number of females heirs that is of the son’s daughter, daughter’s daughter and the sister, as heirs who are expressly named as heirs.

3. According to Section 8 of the Hindu Succession Act 1956, read with the Schedule referred therein, daughters being Class I legal heirs, have the same rights as sons to the properties of their father, if the father dies intestate (without a will). So from the date of enactment of the Act, daughters are entitled to the share in father’s property.

The Hon SC held as below:

1. If a property of a male Hindu dying intestate (without a will) is a self-acquired property or obtained in the partition of a coparcenary or a family property, the same would devolve by inheritance and not by survivorship, and a daughter of such a male Hindu would be entitled to inherit such property in preference to other collaterals (such as sons/daughters of brothers of deceased father).

2. Right of a widow or daughter to inherit the self-acquired property or share received in the partition of a coparcenary property of a Hindu male dying intestate is well recognized not only under the old customary Hindu Law but also by various judicial pronouncements.

REPORTABLE

IN THE SUPREME COURT OF INDIA

CIVIL APPELLATE JURISDICTION

CIVIL APPEAL NO. 6659 OF 2011

ARUNACHALA GOUNDER (DEAD) BY LRS. ….. APPELLANT(S)

VERSUS

PONNUSAMY AND ORS……………………………………… RESPONDENT(S)

J U D G M E N T

KRISHNA MURARI, J.

Challenge has been laid in this Civil Appeal to the judgment and order dated 21.01.2009 passed by the High Court of Judicature at Madras (hereinafter referred to as ‘High Court’) dismissing a regular First Appeal being A.S. No. 351 of 1994 filed under Section 96 of the Code of Civil Procedure, 1908, challenging the judgment and decree dated 01.03.1994 rendered by the Trial Court dismissing Original Suit No. 295 of 1991 for partition filed by the appellant herein, claiming 1/5th share in the suit properties.

-

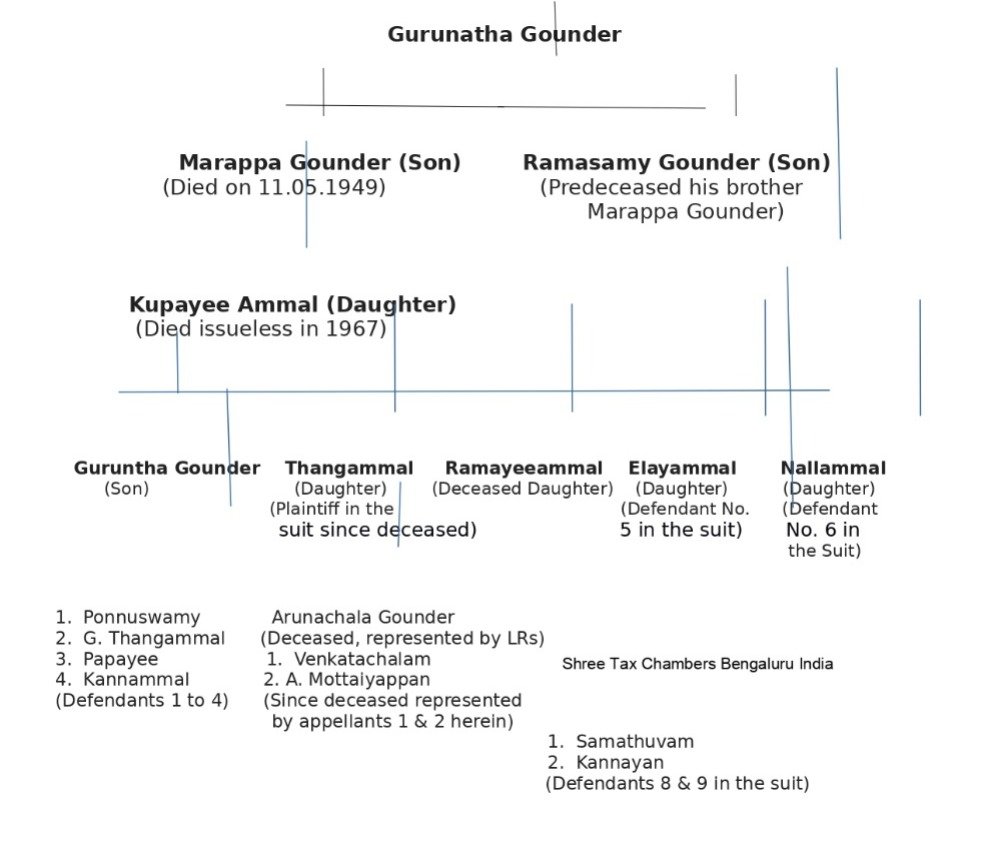

The following genealogy of the parties is necessary to be taken note of for appreciating their claims and contentions :

-

Suit for partition was filed by Thangammal, daughter of Ramasamy Gounder, claiming 1/5th share in the suit property on the allegations that the plaintiff and defendant 5 and 6, namely, Elayammal and Nallammal and one Ramayeeammal are sisters of Gurunatha Gounder, all the five of them being the children of Ramasamy Gounder. The said Ramasamy Gounder had an elder brother by the name of Marappa Gounder. Ramasamy Gounder, predeceased his brother Marappa Gounder who died on 14.04.1957 leaving behind the sole daughter by the name of Kuppayee Ammal who also died issueless in 1967. Further case set up by the plaintiff/appellant was that after the death of Marappa Gounder, his property was inherited by Kuppayee Ammal and upon her death in 1967, all the five children of Ramasamy Gounder, namely, Gurunatha Gounder, Thangammal (Original Plaintiff now represented by legal heir), Ramayeeammal, Elayammal and Nallammal are heirs in equal of Kuppayee and entitled to 1/5th share each.

-

Gurunatha Gounder, died leaving behind defendant 1 to 4 (Respondents herein) as heirs and legal representatives. Ramayeeammal died leaving behind defendants 7 to 9. The plaintiff-appellant, Thangammal, died leaving behind, appellant nos. 1, 3 and 4 herein and Appellant no. 1, Arunachala Gounder, since having died is represented by her legal representatives appellant no. 1, Venkatachalam and appeallant no. 2, A. Mottaiyappan.

-

The defence set up by the defendant-respondents was that Marappa Gounder died on 11.05.1949 and not on 14.04.1957 as alleged by the plaintiff-appellant and as per the provisions of Hindu Law prevailing prior to 1956, Gurunatha Gounder was the sole heir of Marappa Gounder and accordingly, he inherited the suit properties and was in possession and enjoyment of these properties and after his death the respondents herein, were continuing as lawful

-

It is an undisputed fact between the parties that the property in question i.e., the suit property, was independently purchased by Marappa Gounder in the year 1938 through the process of a Court auction and thus, it was his independent property. However, there was a issue between the parties in respect of the date of death of Marappa Gounder. The plaintiff – appellant asserted the date of death as 04.1957, whereas the defendant-respondent pleaded the date of death as 15.04.1949.

-

The Trial Court after considering the evidence brought on record of the case by the parties concluded that Marappa Gounder died on 15.04.1949 and thus, the suit property would devolve upon the sole son of deceased Ramasamy Gounder, the deceased brother of Marappa Gounder by survivorship and the plaintiff-appellant had no right to file the suit for partition and, accordingly, dismissed the suit.

-

The findings recorded by the Trial Court particularly in respect of the date of death of Marappa Gounder in 1949 was confirmed by the High Court in the first appeal and the decree dismissing the suit for partition was affirmed holding that the property would devolve upon the defendant by way of survivorship.

-

We have heard Shri V. Yogeswaran, learned counsel for the appellant and Shri K.K. Mani, learned counsel for the respondents.

Arguments on behlaf of Appellants

-

Shri P.V. Yogeswaran, learned counsel for the appellant submits that since the property was purchased through Court auction sale by the Marappa Gounder on 12.1938, hence, it is his independent property and it was never considered as a joint family property, as such on death of Marappa Gounder, this property would devolve by succession upon his daughter, Kupayee Ammal, who died in the year 1967. He further submitted that under the law of Mitakshara, the right to inheritance depends upon propinquity i.e., proximity of relationship. Since, the daughter has closer proximity of relationship, she would inherit the property from the father instead of the father’s brother’s son and daughter.

-

He further points out that there are three classes of heirs recognized by Mitakshara, namely, (a) Gotrajasapindas, (b) Samanodakas and (c)Bandhus. The first class succeeds before the second and the second succeeds before the To support the contentions, he made a reference to Mulla Hindu Law 23rd Edition. He also submitted that under the Hindu Law, a daughter is not disqualified to inherit in separate property of her father and when a male Hindu dies without a son leaving only daughter, his separate property would devolve upon the daughter through succession and the property will not devolve upon brother’s son through survivorship and the Courts below have wrongly applied the principles of Hindu Law and dismissed the suit. In support of his contention, he cited references from various commentaries which we shall deal with at appropriate place.

Arguments on behlaf of Respondents

-

Shri K. Mani, learned counsel representing respondents submitted that the property in question was purchased by Marappa Gounder in Court auction sale out of the family funds and thus, it was a joint property, and on his death, since he had no male heir, the defendant as a coparcener succeeded to the estate. He further submitted that the Trial Court after scrutinizing the evidence brought on record by the parties came to the conclusion that the paternal uncle of plaintiff, Marappa Gounder, died prior to the enforcement of Hindu Succession Act, 1956 and, therefore, the plaintiff and other sisters of the plaintiff were not the heirs as on the date of death of Marappa Gounder in the year 1949 and thus, plaintiff was not entitled to the partition of 1/5th share in the suit properties, and thus, the suit was rightly dismissed. He further submits that when the date of death of Marappa Gounder, was confirmed to be in the year 1949, the Succession to his properties would open in the year 1949 when Kupayee Ammal, the daughter of Marappa Gounder, was not having any right to inherit the property left by her deceased father. The only heir available at the time of death of Marappa Gounder was Guranatha Gounder, the son of Ramasamy Gounder, who was none other than the father of the Defendants 1 to 4. Once the properties of Marappa Gounder devolved upon Guranatha Gounder, it became his property and, therefore, it could not be made the subject matter of the partition after the promulgation of Hindu Succession Act, 1956. He also submitted that neither any issue was framed nor any evidence was led by the plaintiff-appellant throughout the entire proceedings to establish that property purchased in the Court auction in the year 1938 was a self-acquired property of Marappa Gounder and thus, it would be presumed that it was a joint family property leaving no rights in his daughter to inherit the same.

-

We have considered the arguments advanced by the learned counsel for the parties and with their assistance perused the record of the case and the various texts and commentaries pertaining to Hindu

-

Insofar as, the date of death of Marappa Gounder being 15.04.1949, it is a finding of fact affirmed by the two fact-finding Courts based on appreciation of material evidence existing on the record of the case and is not liable to be interfered with and we proceed to decide the issue between the parties taking the date of death of Marappa Gounder as 04.1949.

-

The other aspect of the matter is whether the suit property was exclusively purchased by Marappa Gounder in the Court auction and was his separate property or it was purchased out of the joint family fund making it a joint family property. It is correct that neither any issue was framed by Trial Court in this regard nor any evidence was led by the parties nor any finding has been returned. However, in view of the admission made by the defendant in para 3 of the written statement that suit properties are absolute properties of Marappa Gounder, he having purchased the same in a Court auction sale on 19.09.1938, there was hardly any necessity to frame any issue in this regard, once the fact was admitted in written statement.

-

It may be relevant to extract the relevant part of paragraph 3 of the written statement which reads as under :-

“3. It is true that the suit properties are the absolute properties of the Marappa Gounder, he having purchased the suit properties in the Court auction sale on 19.09.1938.”

-

Furthermore, the defendants themselves have nowhere pleaded that purchase of suit property was made by Marappa Gounder out of the joint family There is a clear admission in the written statement that property in question was the absolute property of Marappa Gounder, he having purchased the same in the Court auction sale.

17.1. In view of above facts, the arguments advanced by learned counsel for the respondent, in this regard, has no force and not liable to be

-

In the backdrop of the above facts, the primary issue which arises for our consideration is with respect to the right of the sole daughter to inherit the self-acquired property of her father, in the absence of any other legal heir having inheritable rights before the commencement of the Hindu Succession Act, 1956 or in other words, whether such suit property will devolve on to the daughter upon the death of her father intestate by inheritance or shall devolve on to father’s brother’s son by

-

The determination and adjudication of the issue depends upon the answers to the following questions :-

1. What is the nature of the property and what would be the course of succession if it is a separate property as opposed to undivided property?

2. Whether a sole daughter could inherit her father’s separate property dying intestate? And if so –

3. What would be the order of succession after the death of such daughter?

-

To answer these questions, we are required to delve into the concepts of old Hindu Law and its application. It is also imperative to look into it’s origin and Shree Tax Chambers Bengaluru India

Sources of Hindu Law

-

The exact origin of Hindu Law is shrouded in antiquity, however, the Hindus believe their laws to exist in the revelations preserved in ‘Vedas’, Shrutis (that which are heard and revealed) and Smritis in contradiction to Shrutis (that which is remembered). The Smritis comprise forensic law or the Dharma Shastra and are believed to be recorded in the very words of Lord The Dharma Shastra or forensic Law is to be found primarily in the institutes or collections known as ‘Sanhitas’, Smritis or in other words, the text books attributed to the learned scholarly sages, such as, Manu, Yajnavalchya, Vishnu, Parasara and Guatama, etc. Their writings are considered by the Hindus as authentic works. On these commentaries, digests and annotations have been written. These ancient sources have thus, charted the development of Hindu Law. These sources constantly evolved over the years, embracing the whole system of law, and are regarded as conclusive authorities. Besides these sources customs, equity, justice, good conscience and judicial decisions have also supplemented the development of Hindu Law.

-

The commentaries by various learned scholars have given rise to different schools of Hindu Law- like Daya Bhaga in Bengal, Mayukha in Bombay, Konkan and Gujarat and Marumakkattayam or Nambudri in Kerala and Mitakshara in other parts of India. The Mitakshara school of law is one of the most important schools of law having a very vide jurisdiction. It applies to majority of India with slight variations with the fundamental principles being the same. These slight variations formed various sub-schools, namely, Banaras School, Mithila School, Maharashtra/Bombay School, Dravida/ Madras School.

-

The Mitakshara is supposed to be the leading authority in the school of Benaras. Colebrooke, a famous sanskrit scholar of Bengal, writes “the range of its authority and influence is far more extensive than that of Jinota Vahanas Treatise for it is received in all other schools of Hindu Law, from Benaras to the southern extremity of the Peninsula of India, as the chief groundwork of the doctrines which they follow, and as an authority from which they rarely dissent”1. The Mitakshara has always been considered as the main authority for all the schools of law, with the sole exception of that of Bengal, which is mostly covered by another school known as Daya Bhaga.

-

Reference may also be made to another observation at Page-165, where it is stated as under :-

“Failing male issue, therefore, a widow takes the self- acquired property of her husband. No doubt, on failure of male issue and a widow, the daughter would take.”

-

The commentary also refers to a case of Pranjivandas Tulsidas Dev Kuvarbai, 1 Bomb. H.C., B. 131, wherein a Hindu owning separate property died without a male issue, leaving behind – a widow, four daughter and a brother and male issues of other deceased brothers. The Court observed that the widow was entitled to a life estate in the property and subject to her interest the property would devolve to the daughters absolutely in preference to the brother and the issue of the deceased brothers.

-

References to this case have also been made in numerous reported as well as unreported cases; as in the case of Tuljaram Morarji vs. Mathuradas, Bhagvandas, and Pranjivandas2, it was observed that :-

“…The decision in that case and that in Pranjivandas vs. Devkuvarbai have been steadily followed by the High Court in numerous unreported cases, and by the

legal profession…. Any departure now from those decisions would cause much confusion and injustice throughout this Presidency, and no advantage that we can perceive. We, therefore, must abide by the principles which they clearly indicate.”

-

In the case of Chotay Lall vs. Chunnoo Lall and Another3 the Court noted:-

“The following are the direct authorities on the point. Sir M. Sausse in 1859, in Pranjivandas Tulsidas v. Devkuvarbai (2), held that a daughter takes absolutely when inheriting from her father. In Bhaskar Trimbak

(3)

Acharya v. Mahadev Ramji , decided in January 1869 by Sir Joseph Arnould, the head note states that all property acquired by a married woman by inheritance (except from her husband) classes as stridhan, and descends accordingly. But this case is founded exclusively on the case of Pranjivandas Tulsidas v. Devkuvarbai.

-

However, despite our best efforts we could not get a copy of the judgment in the case of Pranjivandas (Supra), therefore, we are relying upon the aforesaid observations made in the said case by the Bombay High Court as mentioned in the commentary by Standish Grove Grady and the above-mentioned

-

One of the sub-schools of Mitakshara- the Madras school of law tends to cover most of the southern part of India. It exercises its authority under Mitakshara law sch The Mitakshara school derives majorly from the running commentaries of Smritis written by ‘Yajnavalkya’. Other important sources governing the Mitakshara school are ‘Vyavastha Chandrika’ and most importantly Smriti Chandrika.

-

The digest of ‘Yajnavalkya’ states that “What has been self-acquired by any one, as an increment, without diminishing the paternal estate, likewise a gift from a friend or a marriage gift, does not belong to the co- ”

-

It may also be relevant to refer to commentaries and annotations from The principles and elements of Hindu Law in the form of a digest by Shyama Charan Sarkar Vidya Bhushan, known as ‘Vyavastha Chandrika’4, a digest of Hindu Section II of the said digest deals with Daughters’ Right of Succession.

-

In Clause 118 of Section II of the commentary, it is stated as under :-

“In default of the widow, the daughters inherit the estate of the man who died separated (from his coparceners) and not re-united (with them).”

-

It also quotes ‘Vishnu’ and ‘Vrihaspati’ as under:-

“Vishnu : The wealth of a man who leaves no male issue goes to his wife; on failure of her, to his daughter.

Vrihaspati : The wife is pronounced successor to the wealth of her husband; in her default, the daughter. As a son, so does the daughter of a man proceed from his several limbs. How then, should any other person (b) take her father’s wealth?

(B) Any other person – These terms exclude the son and widow, (who are preferable heirs), and include the father and the rest. – Smriti Chandrika, Chapter- XI, Section (ii), Clause 5 and 6.

“The meaning is how could the father and the rest take the property of a son-less man, while the daughter is alive.”

-

It also quotes ‘Manu’ as under :-

“Manu :- The son of a man is even as himself, and the daughter is equal to the son. How then can any other inherit his property, notwithstanding the survival of her, who is, as it were, himself.”

-

Clause 120 of the ‘Vyavastha Chandrika’ reads as under :-

“120 :- A daughter being entitled to inherit the divided property of her father, it has been, by parity of reasoning, determined that, she is entitled to inherit also such property as was separately acquired or held by him, or was vested in him.”

-

The purport of the text of ‘Vrihaspati’ is that the brother or the father and like would not take the property of a man who died without leaving a male, when the daughter is alive. By springing from the same limbs of the father, a daughter has been treated in Smriti Chandrika as equal to a

-

‘NARADA’ aware of the equitableness of the proposition that it is the daughter who should succeed on the failure of the son and the widow, says, “on failure of male issue, the daughter inherits, for she is equally a cause of perpetuating the ”

-

Standish Grove Grady in his book ‘Treatise’ on Hindoo Law of Inheritance published in 1868, in Chapter IX – ‘Inheritance of Succession’ while discussing the line of descent, has observed as under:-

“Line of Descent – It will be seen in the course of this chapter that the Hindoo Law of inheritance

comprehends the deceased’s family and his near relations, viz, his issue, male and female; his widow, who takes immediately in default of sons- a term which includes grandsons and great-grandsons. On exhaustion of this line of descent, the succession ascends to his parents, brothers, nephews, and grand nephews, this line continuing upwards to the grandfather and great-grandfather, the grandmother and great grandmother, the latter being given precedence by those who have preferred the mother to the father. The succession then runs downwards to their respective issue, including daughter’s sons, but not daughters, the whole being preferred to the half blood; then follow the more remote kindred which we shall presently enumerate.

In proportion as the claimant becomes remote, the particulars vary with different schools and authors presently pointed out.

In default of natural kind, the series of heirs in all the classes, except that of Brahmins, closes with the preceptor of the deceased, his pupil, his priest, hired to perform sacrifices, or his fellow-student, each in his order and falling all these, the lawful heirs of the Kshtrya, Vashya and Soodra, who are learned and virtuous Brahmins, resident in the same town or village with the deceased.

If an estate should vest by succession in a Brahmin-as he, being such, cannot perform obsequies for one of an inferior caste – the duty may be discharged by substitution of a qualified person, equal in class with the deceased. In all cases where the heir is under disabilities, he must take the same course, paying the person employed for his services. The king too where the he takes by escheat, must cause obsequies to be performed for the deceased.

The Hindoos give the agnate succession the preference, the succession of females being deemed exceptions.

Females cannot on account of their sex perform obsequies. They do not, therefore, confer any benefit and are generally disqualified from inheriting. From this rule, there are only four exceptions for special reasons, viz, the widow, the daughter, the mother and the grandmother. According to the Benaras and Mithila Schools, the females above-mentioned inherit only when the family is divided. In an undivided family, females are not admitted as heirs. There are two modes of devolution of property :-

(I) From a sole separate owner

(ii) From a female.

Property of a united owner cannot be considered as devolving upon the rest, they being joint proprietors by birth. In the second class, the property will, in part, be affected by the rights of collateral sharers.

But even in undivided families, a widow takes the self-acquired property of her husband.

In the case of self-acquired property in the same Chapter, Grady states :-

“It may safely be stated as a true proposition that property, which is not ancesteral, is self-acquired, in whatever way the property may have been obtained, whether by gift or purchase or labour, mental or physical, or otherwise.

Referring to judgment of Katama Natchiar Vs. The Rajah of Shivagunga (which we shall deliberate in the later part of the judgment), he observes when a Zaminadari was escheated on the death of the last zamindar, the government granted it a new to a distant relation of his. This was treated as self-acquired property. That case has decided that all self-acquired property devolves in the same way as the family property of a divided member. Failing male issue, therefore, a widow takes the self-acquired property of her husband. No doubt, on the failure of male issue and a widow, the daughter would take”.

-

In the commentary titled as ‘Hindu Law and Judicature’ – from the Dharma-sastra of Yajnavalkya5 by renowned authors Edward Roer, D.,

M.D. and W.A. Montriou, in Clause 135, it is stated as under :-

“135. If a man depart this life without male issue; (i) his wife, (ii) his daughter, (iii) his parents, (iv) his brothers,

(v) the sons of his brothers, (vi) others of the same gotra, (vii) kindred more remote, (viii) a pupil, (ix) a fellow-student – these succeed to the inheritance, each class upon failure of the one preceding. This rule applies to all the caste.”

-

In another digest “Hindu Law as administered in the Courts of Madras Presidency6”, arranged and annotated by S. Cunningham, the then Advocate General of Madras, it is stated in Clause 203 of Chapter

-

Hindu Law and Judicature from the Dharma-Sastra of ‘Yajnavalkya’ published in 1859.

-

A Digest of Hindu Law- As administered in the Courts of The Madras Presidency, published in 1877 by HIGGINBOTHAM & VI, dealing with inheritance by daughters as under :-

“Clause-203 :- In default of sons, grandsons, great grandsons, and widows, the daughter succeeds to a life estate in her father’s property.

-

Clause 206 of the said commentary provides that ‘a married daughters and daughters who are widows succeed irrespectively of the fact of their being barren or having no male issue’ and similarly, Clause 207 reads as under :-

“Clause-207 :- Daughters of each class hold their estate jointly; the share of any daughter dying vests in the surviving daughter or daughters of the same class, and descends to the daughters of the next class only when all the daughters of the prior class are exhausted. In each class, a daughter who has not been endowed on marriage, succeeds in preference to the daughter who has been endowed.”

-

Clause 209 in the said commentary reads as under :-

“Clause 209 :- The daughter succeeds on the death of her father’s widow, notwithstanding that such widow be not her mother.”

-

‘Mulla’ in his book Hindu Law (22nd Edition), while discussing the law prior to the Hindu Succession Act, 1956 says that there are two systems of inheritance amongst the Hindus in India, namely, Mitakshara system and Dayabhaga system. The Dayabhaga system prevails in Bengal, while the Mitakshara system is applicable to other parts of India. The difference between the two systems arises from the fact that, while the doctrine of religious efficacy is the guiding principle under Dayabhaga School, there is no such definite guiding principle under the Mitakshara School. Sometimes consanguinity, and at the other times, religious efficacy has been regarded as the guiding principle. According to ‘Mulla’, Mitakshara recognises two modes of devolution of property, namely, survivorship and succession. The rules of survivorship apply to joint family property, and the rules of succession apply to property held in absolute severalty by the last owner.

-

It may also be relevant to refer to 34 regarding devolution of property according to Mitakshara Law7 – In determining the mode in which the property of a Hindu male, governed by Mitakshara Law, devolves on his death, the following propositions are to be noted :-

1. Where the deceased was, at the time of the death, a member of joint and undivided family, technically called coparcenary, his undivided interest in the coparcenary property devolves on his coparceners by survivorship.

2. (i) Even if the deceased was joint at the time of his death, he might have left self-acquired or separate property. Such property goes to his heirs by succession according to the order given in 43, and not to his coparceners;

(ii) If the deceased was at the time of his death, the sole surviving member of a coparcenary property, the whole of his property, including the coparcenary property, will pass to his heirs by succession according to the order given in 43;

(iii) If the deceased was separate at the time of his death from his coparceners, the whole of his property, however acquired, will pass to his heirs by succession according to the order given in 43;

3) If the deceased was re-united at the time of his death, his property will pass to his heirs by succession according to the Rule laid down in 60.

-

According to ‘Mulla’ under Mitakshara Law, the right to inherit arises from propinquity, i.e., proximity of relationship. Mitakshara divided blood relations into three classes, namely – ShreeTax Chambers Bengaluru India

a) Gotra-sapindas, e., Sapindas belonging to the same gotra or family as the deceased from 1st-7th degree;

b) Samanodaka, i.e., persons belonging to the same gotra or family as the deceased from 8th -14th degree; and

c) Bhinna gotra sapindas, e., Sapindas belonging to a different gotra or family from the deceased.

-

‘Gotra Sapindas’ and ‘Samanodaka’ are persons connected to the deceased by an unbroken line of male descendants i.e., all agantes; and Bhinna gotra sapindas are persons connected to the deceased through a female i.e, cognates such as a sister’s son. ‘Bhinna gotra sapindas’ are also known as ‘Bandhus’ in Mitakshara. These classifications while now archaic and delineated as class-I, class-II, class-III and class-IV heirs under the Hindu Succession Act, 1956, are of importance with respect to the property in question considering its succession opened before the commencement of the Hindu Succession Act,

-

The Gotra Sapindas of a person, according to Mitakshara are :-

i) His six male descendants in the male line; e., his son, son’s son’s son, etc.

ii) His six male ascendants in the male line, the wives of the first three of them, and probably also of the next three; ie, his father, father’s father, father’s father’s father, etc, being Fl to F6 in the table and their wives, that is Ml to M6, being the mother, father’s mother, father’s father’s mother,

iii) The six male descendants in the collateral male line of each of his male ascendants; i.e., to X6 in the line of F1, being his brother, brother’s son, brother’s son’s son, etc; to X6 in the line of F2, being his paternal uncle, paternal uncle’s son, etc; to X6 in the line of F3, being his paternal grand-uncle, paternal granduncle’s son, etc.; to X6 in the line of F4; to X6 in the line of F5′, and to x6 in the line of

iv) His wife, daughter, and daughter’s

-

The Sapinda relationship extends to seven degrees reckoned from and inclusive of the deceased and six degrees, if you exclude the The wife becomes a sapinda of the husband on marriage. The daughter’s son is not a gotraja sapinda, he is a bandhu because he is related to the deceased through a female. However, for the purpose of succession, he is ranked with gotraja sapindas.

-

The Hindu Law of Inheritance (Amendment) Act, 1929 was the earliest Statutory legislation which brought the Hindu females into the scheme of inheritance. The 1929 Act introduced certain female statutory heirs which were already recognized by the Madras School, i.e., the son’s daughter, daughter’s daughter, sister and sister’s son in the order so specified, without making any modifications in the fundamental concepts underlying the textual Hindu Law relating to inheritance; only difference being that while before the Act, they succeeded as bandhus, under the Act, they inherited as ‘gotra sapindas’.

-

The Mitakshara law also recognises inheritance by succession but only to the property separately owned by an individual, male or female. Females are included as heirs to this kind of property by Mitakshara law. Before the Hindu Law of Inheritance (Amendment) Act 1929, the Bengal, Benares and Mithila sub-schools of Mitakshara recognised only five female relations as being entitled to inherit namely – widow, daughter, mother paternal grandmother and paternal great-grand mother. The Madras sub- school recognized the heritable capacity of a larger number of females heirs that is of the son’s daughter, daughter’s daughter and the sister, as heirs who are expressly named as heirs in Hindu Law of Inheritance (Amendment) Act, 1929. The son’s daughter and the daughter’s daughter ranked as bandhus in Bombay and Madras. The Bombay school which is most liberal to women, recognized a number of other female heirs, including a half -sister, father’s sister and women married into the family such as stepmother, son’s widow, brother’s widow and also many other females classified as bandhus. From the above discussions, it is abundantly clear that a daughter was in fact capable of inheriting the father’s separate estate.

Judicial Precedents

-

Privy Council has delivered some notable judgments on the issue arising for adjudication in the case at hands. Reference may be made to the case of Katama Natchiar Srimut Rajah Mootoo Vijaya Raganadha Bodha Gooroo Sawmy Periya Odaya Taver8. The dispute in the appeal before the Privy Council was in respect of the Right of Inheritance of Shivagunga Zamindary, situate in the District Maduaa, Presidency of Madras. The Privy Council after noticing the facts of the long litigation and the three suits filed between the parties, which were dismissed by the Provincial Court and the appeal was filed in each of the three suits which were heard together and disposed of by the decree of the Sudder Court. The Privy Council noted the following arguments advanced before it, by Anga Moottoo Natchiar, as under :-

“She submitted as in issue of fact that the Zamindar had been acquired by the sole exertions and merits of her husband; and as an issue of law that what is acquired by a man, without employment of his patrimony, shall not be inherited by her brothers and co-heirs, but if he dies without male issue, shall descend to his widows, his daughters and the parents, before going to her brothers or remoter collaterals.

-

After analysing the factual aspects in details, the Privy Council posed three questions as under :-

“The substantial contest between the appellant and the respondent is, as it was between Anga Mootoo Natchiar and the respondent’s predecessors, whether the Zamindary ought to have descended in the male and collateral line; and the determination of this issue depends on the answers to be given to one or more of the following questions :

i) Were Gowery Vallabha Taver and his brother, Oya Taver, undivided in estate, or had a partition taken place between them?

ii) If they were undivided, was the zemindary the self- acquired and separate property or Gowery Vallabha Taver? and if so-

iii) What is the course of succession according to the Hindoo Law of the South of India of such an acquisition, where the family is in other respects an undivided family?

-

Insofar as, the first question is concerned, the Privy Council did not disturb the findings in the decree of 1847 that Gowery Vallabha Taver and his brother, after the acquisition by the former of the zemindary, lived very much as if they were separate. The second question was answered in With respect to the third question, the Privy Council observed as under :-

“The third question is one of nicety and of some difficulty. The conclusion which the Courts in India have arrived at upon it, is founded upon the opinion of the Pundits, and upon authorities referred to by them. We shall presently examine those opinions and authorities; but before doing so, it will be well to consider more fully the law of inheritance as it prevails at Madras and throughout the southern parts of India, and the principles on in these parts of India is to be found in the Mitacshara, and in ch.II., sec. 1, of that work the right of windows to inherit in default of male issue is fully considered and discussed.

The Mitacshara purports to be a commentary upon the earlier institutes of Yajnyawalcya; and the section in question begins by citing a text from that work, which. Affirms in general terms the right of the window to inherit on the failure of male issue. But then the author of the Mitacshara refers to various authorities which are apparently in conflict with the doctrines of Yajnyawalcya, and, after reviewing those authoritesi, seeks to re3concile them by coming to the conclusion “that a wedded wife, being chaste, takes the whole estate of a man, who, being separated from his co- heirs, and not subsequently re-united with them, dies leaving no male issue,” This text, it is true, taken by itself, does not carry the rights of widows to inherit beyond the cases in which their husbands have died in a state of separation from their co-heirs, and leaving no male issue; but it is to be observed that the text is propounded as a qualification of the larger and more general proposition in favour of widows; and, consequently, that in construing it, we have to consider what are the limits of the qualification, rather than what are the limits of the right. Now, the very terms of the text refer to eases in which the whole estate of the deceased has been his separate property, and, indeed, the whole chapter in which the text is contained, seems to deal only with cases in which the property in question has been either wholly the common property of a united family, or wholly the separate property of the deceased husband We find no trace in it of a case like that before us, in which the property in question may have been in part the common property of a unit4ed family, and in part the separate acquisition of the deceased; and it cannot, we think, be assumed that because widows take the whole estates of their husbands when they have been separated from, and not subsequently re-united with, their co-heirs, and have died leaving n™ male issue, they cannot, when their husbands have not been so separated, take any part of their estates, although it may have been their husband’s separate acquisition. The text, therefore, does not seem to us to govern this case.

There being then no positive text governing the case before us, we must look to the principles of the law to guide us in determining it. It is to be observed, in the first place, that the general course of descent of separate property according to the Hindoo law is no disputed. It is admitted that, according to that law, such property descends to windows in default of male issue. It is upon the Respondent, therefore, to make out that the property here in question, which was separately acquired, does not descend according to the general course of the law. The way in which this is attempted to be done, is by showing a general state of co- parcenaryship as to the family property; but assuming this to have been proved, or to be presumable from there being no disproof of the normal state of co- parcenaryship, this proof, or absence of proof, cannot alter the case, unless it be also the law that there cannot be property belonging to a member of a united Hindoo family, which descends in a course different from that of the descent of a. share of the property held in union; but such a proposition is new, unsupported by authority, and at variance with principle. Thai two courses of descent may obtain on a part division of join property, is apparent from a passage in W.H. Macnaghten’s “Hindu Law,” title “Partition,” vol. I. p. 53, where it is said as follows: “According to the more correct opinion, where there is an undivided residue, it is not subject to the ordinary rules of partition of join property; in other words, if at a general partition any part of the pro-perty was left joint, the widow of a deceased brother will not participate, notwithstanding the separation, but such undivided residue will go exclusively to the brother.”

Again, it is not pretended that on the death of the acquirer. of separate property, the separately acquired property falls into the common stock, and passes like ancestral property. On the contrary, it is admitted that if the acquirer leaves male issue, it will descend as separate property to that issue down to the third generation. Although, therefore, where there is male issue, the family property and the separate property would not descend to different persons, they would descend in a different way, and. with different con- sequences; the sons taking their father’s share in the ancestral property subject to all the rights of the co- parceners in that property, and his self-acquired property free from those rights. The course of succession would not be the same for the family and the separate estate; and it is clear, therefore, that, according to the Hindoo law, there need not be unity of laeirship.

But to look more closely into the Hindoo law. When property belonging in common to a united Hindoo family has been divided, the divided shares go in the general course of descent of separate property. Why, it may well be asked, should not the same rule apply to property which from its first acquisition has always been separate We have seen from the passage already quoted from Macnaghten’s “Hindu Law,” that where a residue is left un-divided upon partition, what is divided goes as separate property; what is undivided follows the family property; that which remains as it was, devolves in the old line; that which is changed and becomes separate, devolves in the new line. In other words, the law of succession follows the nature of the property and of the interest in it.

Again, there are principles on which the rule of succession according to the Hindoo law appears to depend: the first is that which determines the right to offer the funeral oblation, and the degree in which the person making the offering is supposed to minister to the spiritual benefit of the deceased; the other is an assumed right of survivorship. Most of the authorities rest the uncontested right of widows to inherit the estates of their husbands, dying separated from their kindred, on the first of these principles (1 Strange’s “Hindu Law,” p. 135). But some ancient authorities also invoke the other principle.

Again, the theory which would restrict the preference of the co-parceners over the windows to partible property is not only, as is shown above, founded upon an intelligible principle, but reconciles the law of inheritance with the law of partition. These laws, as is observed by Sir Thomas Strange, are so intimately connected that they may almost be said to be blended together; and it is surely not consistent with this position that co-parceners should take separate property by descent, when they take no interest in it upon partition. We may further observe, that the view which we have thus indicated, of the Hindoo law is not only, as we have shown, most consistent with its principles, but is also most consistent with convenience.”

-

On a complete reading of the judgment of Privy Council in extenso, the following legal principles are culled out:-

A) That the General Course of descends of separate property according to the Hindu Law is not disputed it is admitted that according to that law such property (separate property) descends to widow in default of male issue

B) It is upon Respondent therefore to make out that the property herein question which was separately acquired does not descends according to the general Course of Law.

C) According to the more correct opinion where there is undivided residue, it is not subject to ordinary rules of partition of joint property, in other words if it a general partition any part of the property was left joint the widow of the deceased brother will not participate notwithstanding with separation but such undivided residue will go exclusively to brother.

D) The law of succession follows the nature of property and of the interest in it.

E) The law of partition shows that as to the separately acquired property of one member of a united family, the other members of the family have neither community of interest nor unity of possession.

F) The foundation therefore of a right to take such property by survivorship fails and there are no grounds for postponing the widow’s right any superior right of the co-parcenars in the undivided property

G) The Hindu Law is not only consistence with this principle but is also most consistent with ”

55. Another case of the Privy Council is Sivagnana Tevar and Vs. Periasami & Ors.9. The aforesaid case, before the Privy Council was in continuity and of the consequence of the previous case Katama Natchiar (Supra) but of a different branch of the family. In the said case, it was observed as under :-

“Their Lordships then have come to the conclusion that, as between the descendants of Muttu Vaduga and Dhorai Pandian, the palayapat was the separate property of the latter; that on the death of Dhorai Pandian, his right, if he had any left undisposed of in the property, passed to his widow, notwithstanding the undivided status of the family; and that therefore, the case was one to which the rule of succession affirmed in the Shivagunga case (Supra) applies.”

-

The principles of law which can be deduced from reading of the aforesaid judgment can be summarized as under:-

“The law laid down in the case of Katama Natchiar Vs. Srimut Rajah Mootoo Vijaya Raganadha Bodha Gooroo Sawmy Periya Odaya Taver, that succession in the case of Hindu male dying intestate is to be governed by inheritance rather than survivorship, is reaffirmed.

In the absence of male member, the property devolves upon widow and thereafter to daughter.”

-

A Full Bench of Allahabad High Court, in the case of Ghurpatari & Vs. Smt. Sampati & Ors.10, while considering the question whether a custom under which daughters are excluded from inheriting the property of their father can by implication exclude the daughters’ issues both males and females, also from such inheritance, made the following observations in respect of Right of Inheritance of a widow or a daughter of a male Hindu dying intestate :-

“17. The rules relating to inheritance by widow and daughter were enunciated in the ancient past by various sages and were ultimately elaborated by Vijnyaneshwara in Mitakshara. We may quote from Colebrooke’s translation.”

Katyayan said “let the widow succeed to her husband’s wealth, provided she be chaste; and in default of her let the daughter inherit if married.” Brihaspati Said, “the wife is pronounced successor to the wealth of her husband; and in her default the daughter; as a son so does the daughter of a man proceed from his several limbs, how then shall any other person take the father’s wealth”? Vishnu laid down, “if a man leaves neither son, nor son’s son, nor wife, nor female issue, the daughter’s son shall take his wealth, for in regard to the obsequies of ancestors, daughter’s son is considered as son’s son.” Manu likewise declared that “by a male child, who were daughter whether formally appointed or not, shall produce from a husband of an equal class, the maternal grandfather becomes the grand sire of son’s son, let that son give the funeral oblation and possess the inheritance”. The right of daughter and daughter’s son to succeed to the property was thus well recognized in the Mitakshara Law. The daughter ranks fifth in the order of succession and the daughter’s son ranked sixth.”

-

Thereafter, the Court proceeded to consider the question of custom prevalent in a particular sect and whether they will have the sources of law with which we are not concerned in the case at

-

The Hindu Law of Inheritance (Amendment) Act II of 1929 (hereinafter called as ‘the Act of 1929), for the first time entitled the daughter’s daughter, subject to a special family or local custom, to succeed to the property of a male Hindu governed by Mitakshara Law. Daughter’s daughter then ranked 13th-B in the order of succession. The order of succession to the estate of a Hindu dying interstate and governed by Mitakshara Law are set out in Paragraph 43 of Mulla’s Principles of Hindu

Law11 as under :-Shree Tax Chambers

“The Sapindas succeeded in the following order :-

1-4 A son, grandson (son’s son) and great grandson (son’s son’s son) and (after 14th April, 1937) widow, predeceased son’s widow, and predeceased son’s son’s widow.

5. Daughter’s son

13. Father’s father

13.A. Son’s daughter’s

13.B. Daughter’s daughter

60. In the case of Lal Singh & Ors. Vs. Roor Singh & Ors.12, it was held that daughters and daughters son have a preferential claim to the non-ancestral property as against the

61. In the case of Gopal Singh & Ors. vs. Ujagar Singh & Ors.13, it was observed by this Court that the daughter succeeds to the self- acquired property of her father in preference to collaterals. This Court proceeded to rely upon the following observation in Rattigan’s Digest to ‘Customary Law’ :-

“In regard to the acquired property of her father, the daughter is preferred to the collaterals.”

-

Reference may also be made to the decision of Bombay High Court in Devidas & Ors. Vs. Vithabai & Anr.14. In the said case, one Arujna died in 1936, when succession opened and while determining the shares during partition daughter of one pre-deceased sons of Arjuna namely, Vithabai was held entitled for a The name of Vithabai was removed

55 Punjab Law Reporter 168 at 172

13 AIR 1954 SC 579

14 2008 (5) Mh.L.J. 296

from revenue record. She filed a suit for declaration claiming 1/3rd share with other reliefs. Trial Court dismissed the suit. The First Appellate Court held that plaintiff, Vithabai, being daughter of Zolu was a Class-I heir and thus, was entitled to 1/3rd share and accordingly, reversed the decree. The matter was carried in second appeal. The High Court while reversing the decree of Lower Appellate Court and confirming that of the Trial Court observed as under :-

“12. Zolu, when died in 1935 was joint with his father and brothers. Therefore, his share in the coparcenery would devolve by survivorship and not by succession. Zolu did not hold any separate property admittedly and therefore, there was no question of property passing over by succession. The following illustration to Section 24 in Mulla’s Hindu Law 19th Edition shall be enough to unfortunately negative the claim of the plaintiff. The case is squarely covered by this illustration.

(1) A and B two Hindu brothers, governed by the Mitakshara School of Hindu Law, are members of a joint and undivided family. A dies leaving his brother B and a daughter. A’s share in the joint family property will pass to his brother, the surviving coparcener, and not to his However, if A and B were separate, A’s property would on his death pass to his daughter as his heir.

The plaintiff due to the above proposition of law was not entitled to succeed to the estate of her father. The persons on whom the share of Zolu devolved were his brothers and father by survivorship. The share could not devolve on the daughter by succession since the plaintiff herself pleads that the property was joint and there was no partition. It was, therefore, not a separate estate of Zolu so that rule of succession could be applied. The property therefore passed over by survivorship in favour of brothers and father who were coparceners.”

-

The 174th Law Commission in its report on ‘Property Rights of Women’ while proposing reforms under the Hindu Law has observed as under :-

“1.3.3 The Mitakshara law also recognising inheritance by succession but only to the property separately owned by an individual, male or female. Females are included as heirs to this kind of property by Mitakshara law. Before the Hindu Law of Inheritance (Amendment) Act 1929, the Bengal, Benares and Mithila sub-schools of Mitakshara recognised only five female relations as being entitled to inherit namely;- widow, daughter, mother, paternal grandmother, and paternal great-grand mother.

-

The Madras sub-schools recognised the heritable capacity of a larger number of females heirs that is of the son’s daughter, daughter’s daughter and the sister as heirs were expressly named as heirs in Hindu Law of Inheritance (Amendment) Act,1929.

-

The son’s daughter and the daughter’s daughter ranked as Bandhus in Bombay and The Bombay School which is most liberal to women, recognised a number of other female heirs, including a half sister, father’s sister and women married into the family such as step-mother, son’s widow, brother’s widow and also many other females classified as Bandhus.”

-

From the above discussions, it is clear that ancient text as also the Smritis, the Commentaries written by various renowned learned persons and even judicial pronouncements have recognized the rights of several female heirs, the wives and the daughter’s being the foremost of

-

The rights of women in the family to maintenance were in every case very substantial rights and on whole, it would seem that some of the commentators erred in drawing adverse inferences from the vague references to women’s succession in the earlier Smritis. The views of the Mitakshara on the matter are unmistakable. Vijneshwara also nowhere endorses the view that women are incompetent to

Our Analysis– Shree Tax Chambers Bengaluru India

-

Right of a widow or daughter to inherit the self-acquired property or share received in partition of a coparcenary property of a Hindu male dying intestate is well recognized not only under the old customary Hindu Law but also by various judicial pronouncements and thus, our answer to the question 1 and 2 are as under :-

“If a property of a male Hindu dying intestate is a self- acquired property or obtained in partition of a co-parcenery or a family property, the same would devolve by inheritance and not by survivorship, and a daughter of such a male Hindu would be entitled to inherit such property in preference to other collaterals.”

-

In the case at hands, since the property in question was admittedly the self-acquired property of Marappa Gounder despite the family being in state of jointness upon his death intestate, his sole surviving daughter Kupayee Ammal, will inherit the same by inheritance and the property shall not devolve by survivorship.

-

Insofar as, question no. 3 is concerned under the old customary Hindu Law, there are contradictory opinions in respect of the order of succession to be followed after the death of such a daughter inheriting the property from his father. One school is of the view that such a daughter inherits a limited estate like a widow, and after her death would revert back to the heirs of the deceased male who would be entitled to inherit by While other school of thought holds the opposite view. This conflict of opinion may not be relevant in the present case inasmuch as since Kupayee Ammal, daughter of Marappa Gounder, after inheriting the suit property upon the death of Marappa Gounder, died after enforcement of Hindu Succession Act, 1956 (hereinafter referred to as ‘The Act of 1956’), which has amended and codified the Hindu Law relating to intestate succession among Hindus. The main scheme of this Act is to establish complete equality between male and female with regard to property rights and the rights of the female were declared absolute, completely abolishing all notions of a limited estate. The Act brought about changes in the law of succession among Hindus and gave rights which were till then unknown in relation to women’s property. The Act lays down a uniform and comprehensive system of inheritance and applies, inter-alia, to persons governed by the Mitakshara and Dayabhaga Schools and also to those governed previously by the Murumakkattayam, Aliyasantana and Nambudri Laws. The Act applies to every person, who is a Hindu by religion in any of its forms including a Virashaiva, a Lingayat or a follower of the Brahmo Pararthana or Arya Samaj and even to any person who is Buddhist, Jain or Sikh by religion excepting one who is Muslim, Christian, Parsi or Jew or Sikh by religion. Section 14 of the Act of 1956 declares property of a female Hindu to be her absolute property, which reads as under:-

“14. Property of a female Hindu to be her absolute property.-

1. Any property possessed by a female Hindu, whether acquired before or after the commencement of this Act, shall be held by her as full owner thereof and not as a limited

Explanation.—In this sub-section, “property” includes both movable and immovable property acquired by a female Hindu by inheritance or devise, or at a partition, or in lieu of maintenance or arrears of maintenance, or by gift from any person, whether a relative or not, before, at or after her marriage, or by her own skill or exertion, or by purchase or by prescription, or in any other manner whatsoever, and also any such property held by her as stridhana immediately before the commencement of this Act.

2. Nothing contained in sub-section (1) shall apply to any property acquired by way of gift or under a will or any other instrument or under a decree or order of a civil court or under an award where the terms of the gift, will or other instrument or the decree, order or award prescribe a restricted estate in such ”

-

The legislative intent of enacting Section 14(I) of the Act was to remedy the limitation of a Hindu woman who could not claim absolute interest in the properties inherited by her but only had a life interest in the estate so inherited.

-

Section 14 (I) converted all limited estates owned by women into absolute estates and the succession of these properties in the absence of a will or testament would take place in consonance with Section 15 of the Hindu Succession Act, 1956, which reads as follows:-

“Section -15. General rules of succession in the case of female Hindus.—

1. The property of a female Hindu dying intestate shall devolve according to the rules set out in section 16,—

a) firstly, upon the sons and daughters (including the children of any pre-deceased son or daughter) and the husband;

b) secondly, upon the heirs of the husband;

c) thirdly, upon the mother and father;

d) fourthly, upon the heirs of the father; and

e) lastly, upon the heirs of the

2. Notwithstanding anything contained in sub-section (1)-

a) any property inherited by a female Hindu from her father or mother shall devolve, in the absence of any son or daughter of the deceased (including the children of any pre-deceased son or daughter) not upon the other heirs referred to in sub-section (1) in the order specified therein, but upon the heirs of the father; and

b) any property inherited by a female Hindu from her husband or from her father-in-law shall devolve, in the absence of any son or daughter of the deceased (including the children of any pre-deceased son or daughter) not upon the other heirs referred to in sub-section (1) in the order specified therein, but upon the heirs of the ”

Section 16 – Order of Succession and manner of distribution among heirs of a female Hindu. –

The order of succession among the heirs referred to in Section 15 shall be, and the distribution of the intestate’s property among those heirs shall take place, according to the following rules, namely:—

Rule 1.—Among the heirs specified in sub-section (1) of Section 15, those in one entry shall be preferred to those in any succeeding entry and those included in the same entry shall take simultaneously.

Rule 2.—If any son or daughter of the intestate had pre- deceased the intestate leaving his or her own children alive at the time of the intestate’s death, the children of such son or daughter shall take between them the share which such son or daughter would have taken if living at the intestate’s death.

Rule 3.—The devolution of the property of the intestate on the heirs referred to in clauses (b), (d) and (e) of sub- section (1) and in sub-section (2) to Section 15 shall be in the same order and according to the same rules as would have applied if the property had been the father’s or the mother’s or the husband’s as the case may be, and such person had died intestate in respect thereof immediately after the intestate’s death.”

-

The scheme of sub-Section (1) of Section 15 goes to show that property of Hindu females dying intestate is to devolve on her own heirs, the list whereof is enumerated in Clauses (a) to (e) of Section 15 (1). Sub- Section (2) of Section 15 carves out exceptions only with regard to property acquired through inheritance and further, the exception is confined to the property inherited by a Hindu female either from her father or mother, or from her husband, or from her father-in-law. The exceptions carved out by sub-Section (2) shall operate only in the event of the Hindu female dies without leaving any direct heirs, e., her son or daughter or children of the pre-deceased son or daughter.

-

Thus, if a female Hindu dies intestate without leaving any issue, then the property inherited by her from her father or mother would go to the heirs of her father whereas the property inherited from her husband or father-in-law would go to the heirs of the husband. In case, a female Hindu dies leaving behind her husband or any issue, then Section 15(1)(a) comes into operation and the properties left behind including the properties which she inherited from her parents would devolve simultaneously upon her husband and her issues as provided in Section 15(1)(a) of the

-

The basic aim of the legislature in enacting Section 15(2) is to ensure that inherited property of a female Hindu dying issue less and intestate, goes back to the Source.

-

Section 15(1)(d) provides that failing all heirs of the female specified in Entries (a)-(c), but not until then, all her property howsoever acquired will devolve upon the heirs of the father. The devolution upon the heirs of the father shall be in the same order and according to the same rules as would have applied if the property had belonged to the father and he had died intestate in respect thereof immediately after her death. In the present case the since the succession of the suit properties opened in 1967 upon death of Kupayee Ammal, the 1956 Act shall apply and thereby Ramasamy Gounder’s daughters being Class-I heirs of their father too shall be heirs and entitled to 1/5th share each in the suit properties.

-

This Court while analysing the provisions of Sections 15 & 16 of the Act in the case of State of Punjab Vs. Balwant Singh & Ors.15, has held as under:-

“7. Sub-section (1) of Section 15 groups the heirs of a female intestate into five categories and they are specified under clauses (a) to (e). As per Sections 16 Rule 1 those in one clause shall be preferred to those in the succeeding clauses and those included in the same clause shall take simultaneously. Sub- section

(2) of Section 15 begins with a non-obstante clause providing that the order of succession is not that prescribed under sub-section (1) of Section 15. It carves out two exceptions to the general order of succes- sion provided under sub-section (1). The first exception relates to the property inherited by a female Hindu from her father or mother. That property shall devolve, in the absence of any son or daughter of the deceased (including the children of the pre-deceased son or daughter), not upon the other heirs referred to in sub-section (1) in the order specified therein, but upon the heirs of the father. The second exception is in relation to the property inherited by a female Hindu

15 1992 Supp. (3) SCC 108

from her husband or from her father-in-law. That property shall devolve, in the absence of any son or daughter of the deceased (including the children of the pre-deceased son or daughter) not upon the other heirs referred to under sub-section (1) in the order specified thereunder but upon the heirs of the husband.

-

The process of identifying the heirs of the intestate under sub-section (2) of Section 15 has been explained in Bhajya v. Gopikabai and Anr. [1978] 3 SCR 561. There this Court observed that the rule under which the property of the intestate would devolve is regulated by Rule 3 of Section 16 of the Act. Rule 3 of Section 16 provides that “the devolution of the property of the intestate on the heirs referred to in clauses (b), (d) and (e) of sub-section (1) and in sub-section (2) of Section

15 shall be in the same order and according to the same rules as would have applied if the property had been the father’s or the mother’s or the husband’s as the case may be, and such person had died intestate in respect thereof immediately after the intestate’s death”.

-

Again in the case of Bhagat Ram (dead) by LRs. Vs. Teja Singh (dead) by 16, a two-Judge Bench of this Court analysing the provisions of Sections 14, 15 and 16 of the Act reiterating the view taken in the State of Punjab Vs. Balwant Singh & Ors.(Supra), observed as under :-

16 (2002) 1 SCC 210

“The source from which she inherits the property is always important and that would govern the situation. Otherwise persons who are not even remotely related to the person who originally held the property would acquire rights to inherit that property. That would defeat the intent and purpose of sub-Section 2 of Section 15, which gives a special pattern of succession. “

-

Applying the above settled legal proposition to the facts of the case at hands, since the succession of the suit properties opened in 1967 upon death of Kupayee Ammal, the 1956 Act shall apply and thereby Ramasamy Gounder’s daughter’s being Class-I heirs of their father too shall also be heirs and entitled to 1/5th Share in each of the suit

-

Unfortunately, neither the Trial Court nor the High Court adverted itself to the settled legal propositions which are squarely applicable in the facts and circumstances of the Shree Tax Chambers Bengaluru India

-

Thus, the impugned judgment and decree dated 01.03.1994 passed by the Trial Court and confirmed by the High Court vide judgment and order dated 21.01.2009 are not liable to be sustained and are hereby set

-

The appeal, accordingly, stands allowed and the suit stands

-

Let a preliminary decree be drawn accordingly. It shall be open to the parties to invoke the jurisdiction of appropriate Court for preparation of final decree in accordance with

-

However, in the facts and circumstances of the case, we do not make any order as to