![]()

Whether relief u/s 89(1) is available to arrears of family pension?

Query)

I have a query regarding family pension arrears.

Assessee is in receipt of family pension since 1995 and family pension is regularly offered to tax under section 57 under other sources with standard dedn under this section 57 of maximum amount of Rs 15000 each year from Ay 1996 97 to 2020 21 ( he is in receipt of this due his wife’s demise in 1995) and he also declare his pension, interest income and rental income.

But during Fy 2020 21 relevant to asst year 2021 22 he has received lumpsum amount being arrears of family pension apart from regular family pension. Arrears pertains to 10 fy from 01012011 to 31122020.

My query is

a. Is he eligible to claim 89(1) as this section refers to Section 57 explanation (iia).

or is it capital receipt

Opinion:

1. The amount is not a capital receipt but “income” within the meaning of income under the income Tax Act.

2.Family pension is also be eligible as covered by section 89(1).

Explanation to clause (iia) of section 57 is just an explanation about family pension.

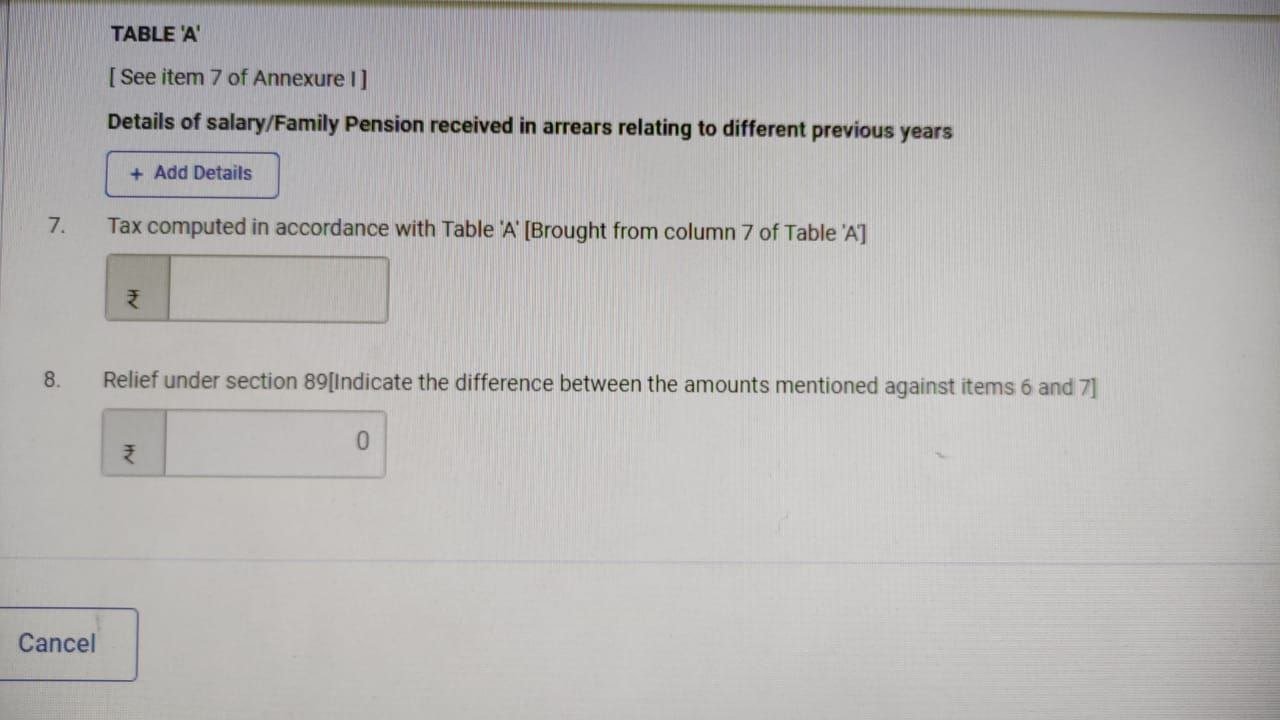

3. Section 89 of the Income Tax Act-1961 reads as under:

Relief when salary, etc., is paid in arrears or in advance.

89. Where an assessee is in receipt of a sum in the nature of salary, being paid in arrears or in advance or is in receipt, in any one financial year, of salary for more than twelve months or a payment which under the provisions of clause (3) of section 17 is a profit in lieu of salary, or is in receipt of a sum in the nature of family pension as defined in the Explanation to clause (iia) of section 57, being paid in arrears, due to which his total income is assessed at a rate higher than that at which it would otherwise have been assessed, the Assessing Officer shall, on an application made to him in this behalf, grant such relief as may be prescribed93:

Provided that no such relief shall be granted in respect of any amount received or receivable by an assessee on his voluntary retirement or termination of his service, in accordance with any scheme or schemes of voluntary retirement or in the case of a public sector company referred to in sub-clause (i) of clause (10C) of section 10, a scheme of voluntary separation, if an exemption in respect of any amount received or receivable on such voluntary retirement or termination of his service or voluntary separation has been claimed by the assessee under clause (10C) of section 10 in respect of such, or any other, assessment year.