![]()

FAQ on Filing an Appeal against Demand Order (FORM GST APL-01)

FAQ on Filing an Appeal against Demand Order (FORM GST APL-01)

-

Who can file an appeal to the Appellate Authority?

Any taxpayer or an unregistered person aggrieved by any decision or order passed against him by an adjudicating authority, may appeal to the Appellate Authority, within three months from the date on which the said decision or order is communicated to such person.

-

What are the pre-conditions to file an appeal to the Appellate Authority?

Order must be passed by the adjudicating authority for the taxpayer or an unregistered person to file an appeal to the Appellate Authority.

-

From where can I file an appeal against Demand Order?

Navigate to Services > User Services > My Applications > Application Type as Appeal to Appellate Authority > NEW APPLICATION button. Select the Order Type as Demand Order from the drop-down list.

-

What are the various Appeal statuses?

S.No. |

Description |

Status |

1 |

Appeal Form successfully filed |

Appeal Submitted |

2 |

Appeal Form successfully admitted |

Appeal admitted |

3 |

Appeal Form is Rejected |

Appeal Rejected |

4 |

When Hearing Notice is issued |

Hearing Notice issued |

5 |

When Counter Reply received against notice |

Counter reply received |

6 |

When Show cause notice is issued |

Show cause notice issued |

7 |

Appeal is confirmed/modified/rejected |

Appeal order passed |

8 |

When hearing is adjourned and next date is issued |

Adjournment granted |

9 |

When application is filed for Rectification |

Rectification request received |

10 |

When application for Rectification is rejected |

Rectification request rejected |

11 |

Appeal is order is rectified |

Rectification order passed |

-

From where can I view submitted appeal against Demand Order?

Navigate to Services > User Services > My Applications > Application Type as Appeal to Appellate Authority > From and To Date > SEARCH button.

-

What will happen if do not file appeal within the prescribed period?

The appellate authority may condone delay for a period of maximum of 1 month, if he is satisfied that the taxpayer was prevented by sufficient cause from presenting the appeal within the aforesaid period of three months and allow it to be presented within a period of one month after the expiry date of filing appeal.

-

When will I get final acknowledgment of the appeal filed?

Once an appeal against a demand order is filed, an email and SMS is sent to the taxpayer (or an unregistered person, as the case may be) and Appellate Authority.

However, final acknowledgement of the appeal filed is issued, when after electronic filing of appeal, the documents as well as Appeal with verification part is submitted to the Appellate authority, within 7 days from the electronic filing. Thereafter the appeal documents are checked and if found in order, final acknowledgment is issued. The appeal shall be treated to be filed only when the final acknowledgement, indicating the appeal number is issued.

-

Is it necessary to deposit 10% of the disputed tax?

Minimum of 10% of the disputed tax needs to be paid as pre-deposit (as per law) before filing an appeal. Lower percentage may be declared after approval from the competent authorities.

-

Is it necessary for me to have a DSC for filing the appeal?

You can file the appeal either through DSC or EVC. DSC is mandatory for companies and LLPs.

-

Whether the balance disputed amount is stayed on filing Appeal?

Yes, if Appeal filed is admitted, the GST Portal flags the balance disputed amount as non-recoverable.

-

Is it required to provide place of supply wise details for filing the appeal?

If a taxpayer has admitted any amount related to IGST head, then place of supply is required to be mentioned in the Appeal application. You can add place of supply details for more than one State.

How do I file an appeal against Assessment Non-Demand Order?

Assessment Non-Demand orders are the non-demand related Assessment orders that are issued by the proper officer to the registered and unregistered persons. Appeal can be filed against the Assessment Non-Demand order by the registered and unregistered persons on the portal.

To file an appeal against Assessment Non-Demand order issued by the proper officer, perform following steps:

-

Access the www.gst.gov.in URL. The GST Home page is displayed. Login to the GST Portal with valid credentials i.e. your User Id and Password. Click the Services> User Services> My Applications option.

2. The My Applicationspage is displayed. Select the Application Type as Appeal to Appellate Authority from the drop-down list. Click the NEW APPLICATION button.

-

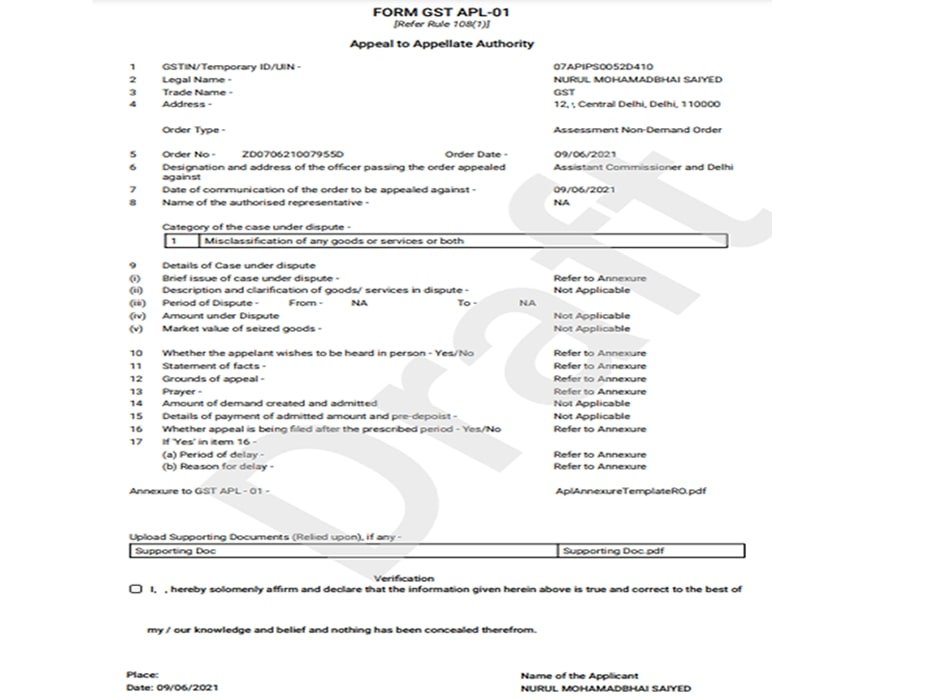

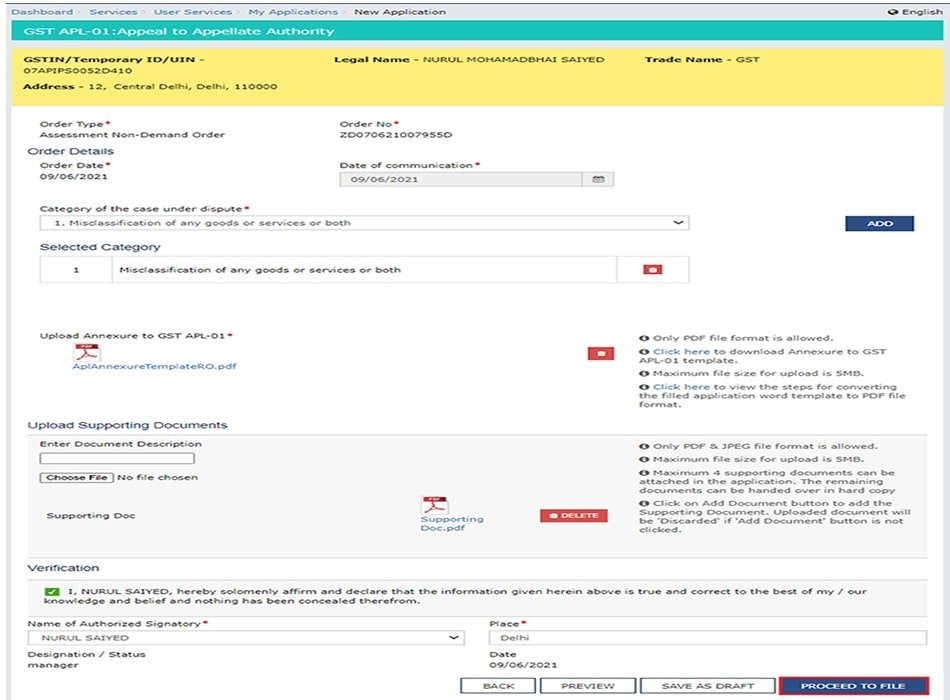

The GST APL-01: Appeal to Appellate Authoritypage is displayed.

4.Select the Order Type as Assessment Non-Demand Orderfrom the drop-down list.

5. In the Order Nofield, enter the Order Number issued by adjudicating authority. Click the SEARCHbutton.

6.The Order Detailspage is displayed.

Note: Date of Communication is displayed on the screen. However, you can edit the same.

-

Select the Category of the case under disputefrom the drop-down list.

8. Click the ADDbutton to add the selected Category of the case under dispute.

Note:

-

You can add multiple line items from the Category of the case under dispute drop-down list by clicking the ADD

-

You can click the DELETEbutton to delete the details added.

-

Click the click herelink to download the Annexure to GST APL-01 Template.

9.1. The GST APL-01 Template is downloaded. Open the downloaded template.

9.2. Click the Enable Editing button.

9.3. Enter the details.

9.4. Once you have entered the details, click on the File button in top left corner.

9.5. Click the Save As button.

9.6. Now select the location to save the file and in the File Name list, type or select a name for the document. In the Save as type list, select PDF.

9.7. Click the Save button.

Note: You should have a PDF reader installed on your computer to open the PDF file.

9.8. Click the Choose File button to upload the PDF.

Note: Up to four files in JPEG or PDF format with maximum file size of 5 MB can be uploaded as supporting documents.

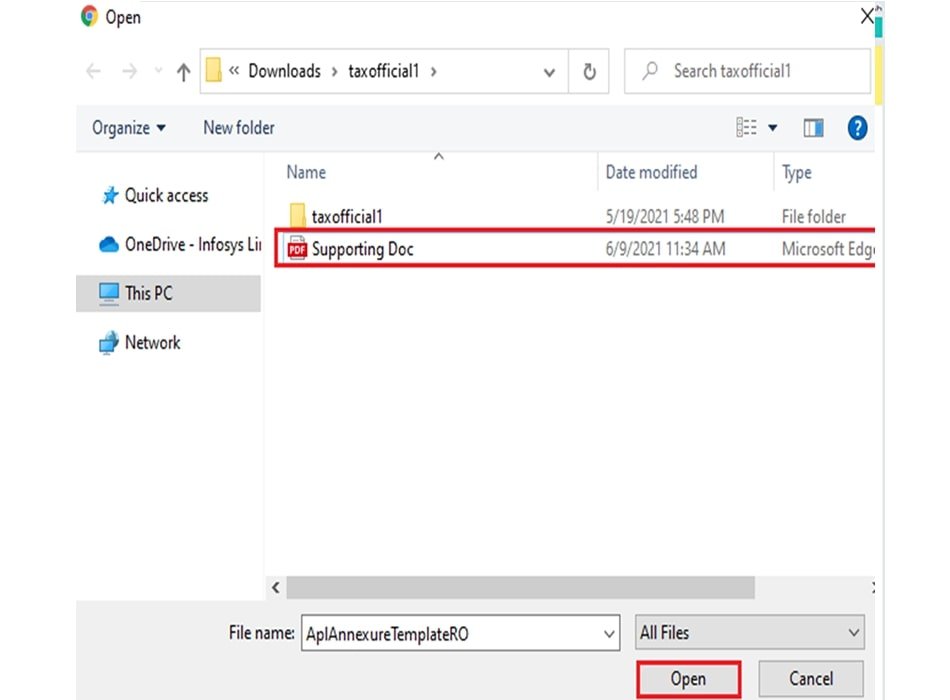

9.9. Select the PDF file which was saved and click the Open button.

9.10 The PDF file is uploaded. You can click the DELETE button to delete the uploaded PDF file, if required

-

To upload any other supporting document, enter the document description and click the Choose Filebutton.

Note:

-

Only PDF & JPEG file format is allowed.

-

Maximum file size for upload is 5MB.

-

Maximum 4 supporting documents can be attached in the application. The remaining documents can be handed over in hard copy

10.1. Select the file to be uploaded and click the Open button.

10.2. Click the ADD DOCUMENT button to add the uploaded supporting document

10.3. The PDF file is uploaded. You can click the DELETE button to delete the uploaded PDF file, if required.

-

To preview the Application before filing, Clickthe PREVIEW button.

11.1. The PDF file will be downloaded. Open the pdf file and check if all the details are correctly updated.+

-

Select the Name of the Authorized Signatoryfrom the drop-down list. Enter the Placewhere application is filled. Click the PROCEED TO FILE button.

Note: You can click the SAVE AS DRAFT option to save the application. You can retrieve saved application from Services > User Services > My Saved Applications option. Saved application will get automatically purged by the GST Portal after 15 days of first time save.

-

Click the PROCEEDbutton.

-

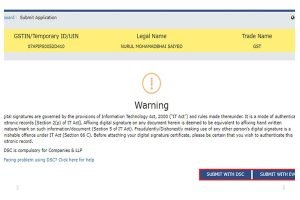

Click the SUBMIT WITH DSCorSUBMIT WITH EVC button.

14.1 In case of SUBMIT WITH DSC:

-

Select the certificate and click the SIGN button.

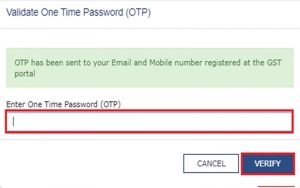

14.2 In case of SUBMIT WITH EVC:

-

Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFYbutton.

-

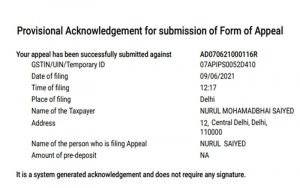

A confirmation message is displayed that form has been signed and submitted. You can click the DOWNLOADbutton to download the acknowledgement receipt.

Note: Once an appeal against assessment non-demand order is filed, an email and SMS is sent to the appellant and the Appellate Authority.

The appellant is required to submit physical copy of supporting documents along with appeal application, duly signed and verified,to the office of the appellate authority within 7 days of filing appeal on the GST Portal. Upon receipt of complete documents, the final acknowledgement will be issued to him/her by Tax Official on GST Portal.

-

Acknowledgement receipt is downloaded.