![]()

Applicability of tax audit and presumptive taxation in case a person is carrying on both Business and Profession By R. S. Kalra

The limits specified for getting your accounts audited are different in case of business and profession. Some persons are engaged in carrying on both business and profession at the same time. Now a question may arise in the case of an assessee carrying on business and at the same time engaged in a profession as to what are the limits applicable to him under section 44AB for getting the accounts audited.

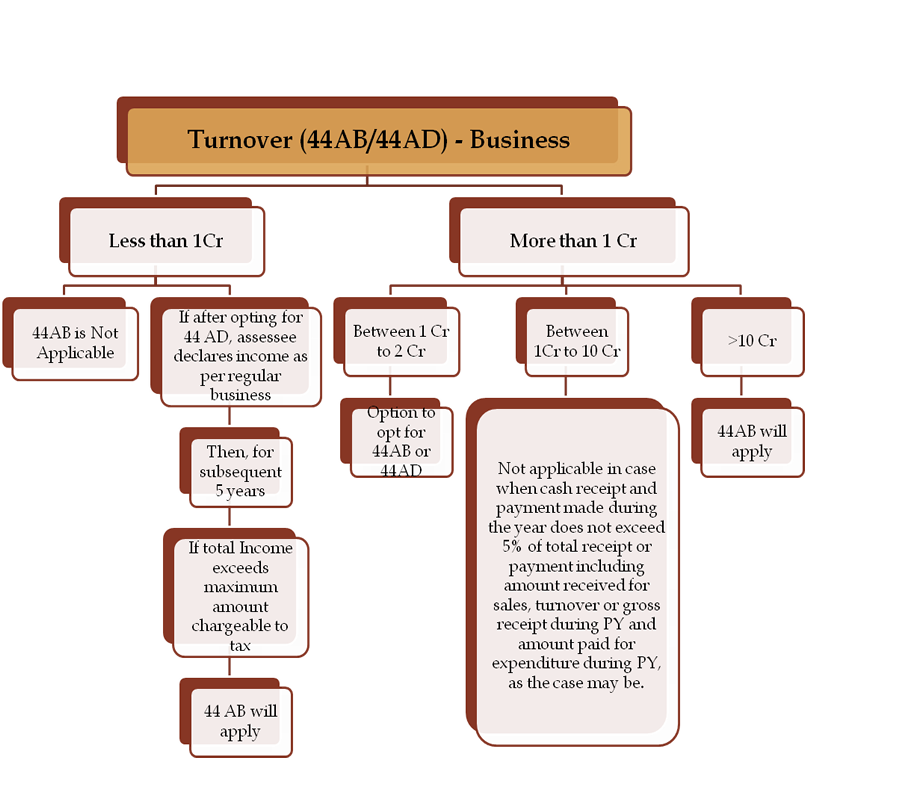

Let us first discuss the limits specified in case of a business–

Limits specified in case of a Profession –

Case where the receipts from any of his business or profession are exceeding the limits specified under Sec 44AB

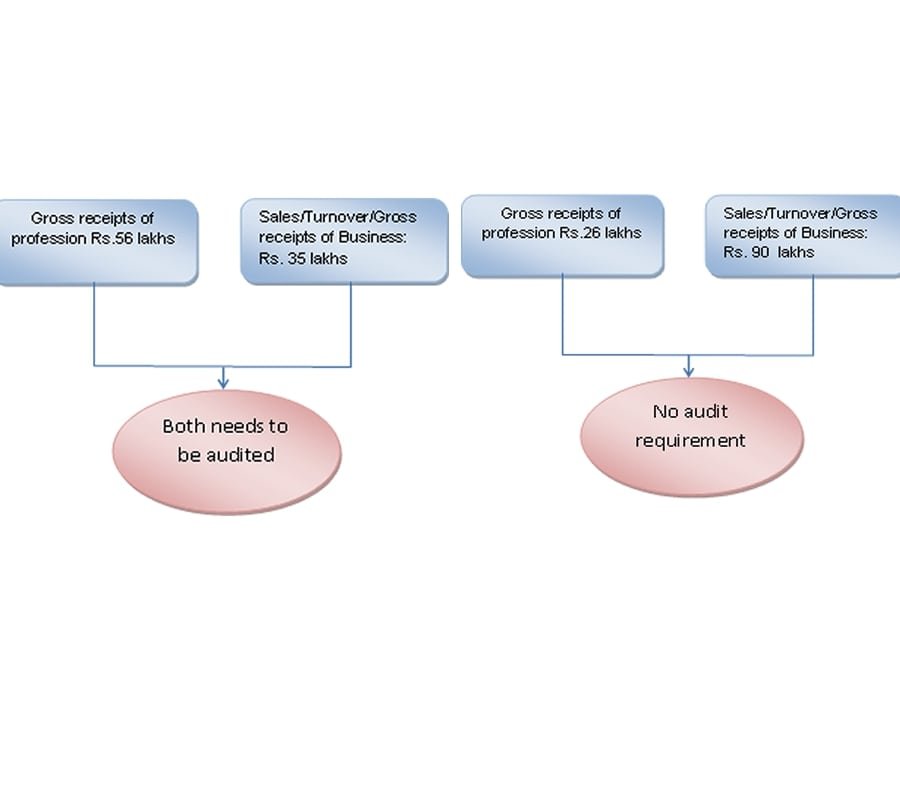

In such a case if his professional receipts are, say, rupees fifty six lacs but his total sales, turnover or gross receipts in business are, say, rupees thirty five lacs, it will be necessary for him to get his accounts of the profession and also the accounts of the business audited because the gross receipts from the profession exceed the limit of rupees fifty lacs. If however, the professional receipts are, say, rupees twenty six lacs and total sales turnover or gross receipts from business are, say, rupees ninety lacs it will not be necessary for him to get his accounts audited under the above section, because his gross receipts from the profession as well as total sales, turnover or gross receipts from the business are below the prescribed limits.

Para 5.20 of Guidance Note of ICAI

A person who is running an eligible business can opt to pay tax under the presumptive taxation scheme as per sec 44AD. However, his gross receipts or turnover should not exceed Rs.2 crores during the year and depending upon the nature of receipts, the tax will be charged on 8% or 6% on the turnover. If a person is carrying on profession, then a specific provision 44ADA can be opted by him for payment of tax on a presumptive basis. The person should be an eligible assessee as per sec 44ADA and his gross receipts or Turnover during the year should not exceed Rs.50 lacs. 50% of the above Turnover will be subject to tax under 44ADA. But in some cases an assessee is doing both business and profession simultaneously.

A person who is running an eligible business can opt to pay tax under the presumptive taxation scheme as per sec 44AD. However, his gross receipts or turnover should not exceed Rs.2 crores during the year and depending upon the nature of receipts, the tax will be charged on 8% or 6% on the turnover. If a person is carrying on profession, then a specific provision 44ADA can be opted by him for payment of tax on a presumptive basis. The person should be an eligible assessee as per sec 44ADA and his gross receipts or Turnover during the year should not exceed Rs.50 lacs. 50% of the above Turnover will be subject to tax under 44ADA. But in some cases an assessee is doing both business and profession simultaneously.

It is often seen that architects/interior designers [profession referred in Section 44AA(1)] also supply material, labour, etc. under their own name or carry on such contractor business in addition to the profession referred above. So, in such cases, these persons cannot avail the benefit of Section 44AD for contractor business or for turnover from supply of material because they are also engaged in profession as referred above and such profession is outside the purview of this scheme as referred to in subsection (6) of section 44AD. Same will be the case of doctors/medical professionals who are providing medical, nursing home, medical consultation (OPD) services and in addition to that are also carrying on business activities like medical supplies, supply of surgical goods etc.

Example: Assessee is doctor by profession but he is also engaged in medicine sale – Rs.82 lacs. His Professional Receipts are Rs.42 lacs ,Net Profit offered in profession – 26 lacs. Can he opt for Sec. 44AD?

Since profit from profession is more than 50%, he can opt for Sec. 44ADA. However, he cannot opt for Sec. 44AD since he is a professional (as per Sec.44AD(6).No Tax Audit since T/o less than 1 cr. [44AB(a)].

Example: Mr. X is a medical practitioner, having clinic and medical shop. His turnover/gross receipts are as under:

Fees from Profession – Rs.40 lacs

Sales in medical Shop- Rs.70 lacs

Advise whether sec 44AB / 44ADA is applicable to him.

Every person –

(a) carrying on business shall, if his total sales, turnover or gross receipts, as the case may be, in business exceed or exceeds one crore rupees in any previous year ; Or

(b) carrying on profession shall, if his gross receipts in profession exceed fifty lacs rupees in any previous year;

In the present case tax audit is not applicable as the gross receipts from profession and sales from business is below threshold limits specified u/s. 44AB(b) and 44AB(a).

Whether a particular activity can be classified as ‘businesses’ or ‘profession’ will depend on the facts and circumstances of each case.

The term “business” is defined in section 2(13) of the Act, as under: “Business” includes any trade, commerce, or manufacture or any adventure or concern in the nature of trade, commerce or manufacture. The word `business’ is one of wide import and it means activity carried on continuously and systematically by a person by the application of his labour or skill with a view to earning an income. The expression “business” does not necessarily mean trade or manufacture only. Whether a particular activity can be classified as “business” or “profession” will depend on the facts and circumstances of each case. Barendra Prasad Roy v ITO[1981]129ITR295(SC) Sec 2(36) defines profession to include vocation. The profession is not defined under the Act except in section 44AA (1) for maintenance of Books of account which are listed as under: – The expression “profession” involves the idea of an occupation requiring purely intellectual skill or manual skill controlled by the intellectual skill of the operator, as distinguished from an operation which is substantially the production or sale or arrangement for the production or sale, of commodities. SC has stated “The expression ‘profession’ involves the idea of an occupation requiring purely intellectual skill or manual skill controlled by the intellectual skill of the operator, as distinguished from an operation which is substantially the production or sale or arrangement for the production or sale, of commodities.” •CIT Vs. Manmohan Das (Deceased)[1966]59ITR699(SC), •CIT Vs. Ram KripalTripathi [1980]125ITR408(All).

Following have been classified to be Business as per judicial decisions:

-

Insurance Agent

-

Nursing home

-

Management consultants

-

Coaching classes

-

Stock broking

-

Dealer in shares/securities

-

Gain on sale on investments

-

Clearing, forwarding and shipping agents

-

Financial Planning Advisors

-

Group of Doctors practicing jointly as partners of a partnership firm

A person could be earning income from the above two sources, let’s a take a scenario of a doctor. He might be engaged in medical consulting and he may simultaneously be running a pharmacy. Now, being a doctor, he is an eligible assessee u/s 44ADA of the Act and he can opt the provisions of presumptive taxation. But in respect to his pharmacy which is a business, he will not be eligible to opt the provisions of sec 44AD of the Act by virtue of the restriction of sec 44AD(6) of the Act. But he will not be eligible to opt for both sections 44AD and sec 44ADA simultaneously.

Sec 44AD (6) it reads as; “The provisions of this section, notwithstanding anything contained in the foregoing provisions, shall not apply to –

(i) a person carrying on profession as referred to in sub-section (1) of section 44AA;

(ii) a person earning income like commission or brokerage; or

(iii) a person carrying on any agency business”

From the above reading, we can conclude that sec 44AD(6) neglects out of its purview of a person engaged in profession specified u/s 44AA.

From the reading of the above section, it is clear that a person who is a specified professional cannot opt sec 44AD of the Act, but there is no bar for such persons to opt sec 44ADA on their professional income .It is to be noted that in sec 44ADA of the Act there is no restriction regarding the opting for presumptive taxation. It is important to know the intent of the law makers. If such professions or other specified businesses as referred in Section 44AD(6) were also provided, by way of an exception, in the definition of “eligible business” along with the business referred in Section 44AE, instead of subsection (6)then such professions and specified businesses would have been able to avail the benefit of Section 44AD in respect of businesses like contractor business, medical supplies, patient room rent, etc. as now it will also fall under “eligible business”

Example: Whether the following persons would be considered to be engaged in business or profession for the purposes of Section 44AD and Section 44ADA

Mr. A is a yoga teacher

Mr. B is cost accountant

Mr. C is a Chartered Accountant engaged in running coaching classes is business or profession

Mr. D is a software developer who prepares and sells computer software to companies.

Mr. E is an astrologer

Solution:

Mr. A |

Yoga teacher is not a specified under section 44AA(1). So income from yoga classes would be considered as business income and he shall be eligible for section 44AD if his turnover is less than Rs.2 crores. |

Mr. B |

Cost accountant is not a specified profession under section 44AA(1). So his income would be considered as business income and he shall be eligible for section 44AD if his turnover is less than Rs.2 crores. |

Mr. C |

Income from coaching classes run by a Chartered Accountant is a return from professional activity. Profession includes vocation and teaching is a vocation |

Mr. D |

Preparing a software and selling the same to others is a business activity. In this case the professional skills are utilised for commercial purposes. |

Mr. E |

An Astrologer is not a specified under section 44AA(1). So income of Astrologer would be considered as business income and he shall be eligible for section 44AD if his turnover is less than Rs.2 crores. |

Conclusion: In the nutshell we can conclude that the provisions of Section 44AD would be applicable on person having business income or professional income from non-specified professionals under section 44AA(1). There are two different schools of thought regarding income of non-specified professionals.

First School of Thought– Sec 44ADA of the Act deals with professional income of persons specified u/s 44AA(1) of the Act. Sec 44AD(6) restricts application of sec 44AD to specified professionals u/s 44AA(1). No restriction has been provided under section 44AD regarding the professions not specified u/s 44AA(1). Hence, the professions not specified u/s 44AA(1) are also eligible for availing benefit of sec 44AD of the Act.

Second School of Thought- Some professionals are of the view, that though sec 44AD(6) does not restrict non-specified professionals, but they are not eligible to claim the benefit of declaring profit at the rate of 8%/ 6% of their receipts. Rather, they should maintain proper books of accounts and declare their income accordingly.

Due to the above divergent views, some clarification from Central Board of Direct Taxes is required in this regard.

Interplay of Sec 44AD and 44ADA of the Act

In a case, where a person carries on both business and profession, he can opt the presumptive taxation in case of his professional income u/s 44ADA of the Act and he cannot opt the presumptive taxation on his business income by virtue of sec 44AD(6) of the Act. It implies that a person who carries on both business and profession cannot opt sec 44AD and 44ADA of the Act simultaneously. Following are some of the practical scenarios which might arise where a person will be engaged in both business and profession

-

Person A is a doctor carrying on his medical practice (eligible u/s 44AA) and simultaneously selling medicines (business u/s 44AD)

-

Person B is an architect engaged in providing blueprints to buildings (eligible u/s 44AA) and simultaneously selling cement (business u/s 44AD)

-

Person C is engaged in interior decoration (eligible business u/s 44AA) and simultaneously selling other fashionable household items (business u/s 44AD) an eligible assessee as per sec 44ADA and he will be carrying an eligible business u/s 44AD.

-

Person D is a teacher (not eligible u/s 44AA) and simultaneously has a book publishing business (business u/s 44AD).

Person |

Business Turnover |

Gross Receipts of Profession |

Total |

Type of Profession |

Is Sec. 44AD Applicable? |

Is Sec. 44ADA Applicable? |

A. |

60 Lacs |

35 Lacs |

0.95 Cr |

44AA |

No |

Yes |

B. |

2.85 Cr |

32 Lacs |

3.17 Cr |

44AA |

No |

No |

C. |

75 Lacs |

65 Lacs |

1.4 Cr |

44AA |

No |

No |

D. |

90 Lacs |

35 Lacs |

1.25 Cr |

Non 44AA |

Yes |

No |

E. |

1.60 Cr |

45 Lacs |

2.05 Cr |

Non 44AA |

No |

No |

-

Person E is a teacher (not eligible u/s 44AA) and simultaneously has a bakery (business u/s 44AD).