![]()

Interest on Income Tax Section 234 A, B & C By Ankita Bansal

Author

CA. Ankita Bansal

PREFACE

The Indian Income Tax Act, one of the most extensive tax laws in the world, has always been burdensome in terms of compliances. A taxpayer in India needs to comply with various disclosure requirements and their timelines. The law has also created various provisions to punish the late tax payers and filers. In particular, it enforces three types of interest which are to be paid in addition to the income tax liability by defaulting taxpayer.

While it is very difficult to rule out the interests payments completely, however, it can be effectively planned out so as to enable a taxpayer to reduce their tax burden over and above 30% tax slabs and surcharges.

This article attempts to explain these interests in detail and chalk out some ways to reduce interest burden of taxpayers. It also highlights some important judgements related to the matter.

234A

Interest u/s 234A = Outstanding tax * 1% * No. of months of delay in filing

234B

Interest due to LATE DEPOSIT OF TAX

Interest u/s 234B = Outstanding tax * 1% * No. of months of delay in payment

Interest u/s 234B = Outstanding tax * 1% * No. of months of delay in payment

This interest is levied as a penalty for late filing of income tax return. This interest is levied for every month or part of the month after the due date of filing return. This return is in addition to penalty under section 234F. Thus, the act punishes the taxpayer for late filing of return in dual manner.

It is charged only on the amount of income tax outstanding as on the date of payment. As per the famous judgement of CIT v/s Pranoy Roy, the Supreme Court ruled out that interest u/s 234A cannot be levied on the amount of self-assessment tax already deposited by taxpayer.

This interest is levied as a compensation for late payment of tax to government after financial year end. It commences from the month of April and extends till the month in which tax is actually deposited. Any part of the month is rounded off as one.

However, no payment of this interest is required if tax already deposited exceeds 90% of total tax liability.

234C

|

Interest due to DEFERMENT OF ADVANCE TAX |

Interest u/s 234B = Outstanding tax * 1% * 3 months/ 1 month

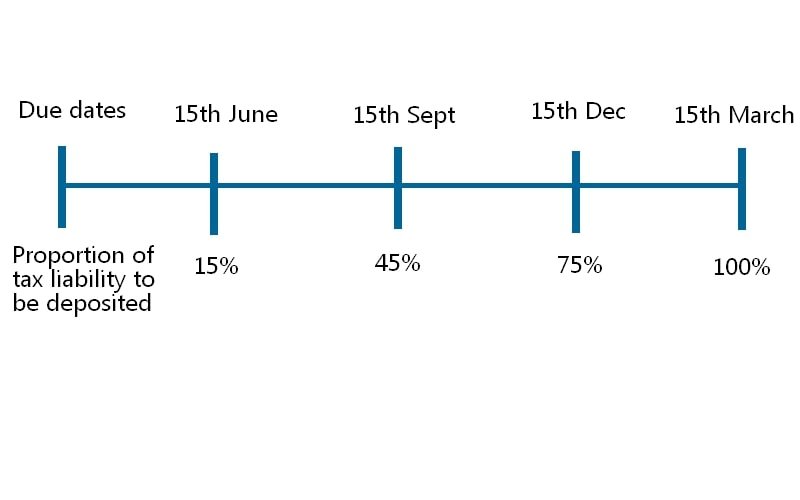

Every person whose total tax liability for a financial year exceeds Rs. 10,000 is liable to deposit instalments of advance tax. These instalments are calculated on the basis of total tax liability and if TDS already deducted exceeds the required amount of instalments, then no payment shall be required.

Any short payment of advance tax instalments attracts interest for a period of 3 months for a particular instalment. However, for last quarter, interest shall be charged for 1 month only.

In case of incomes like capital gains on sale of immovable properties or shares, it is often difficult to ascertain amounts of such income in advance, therefore, total income for computation of interest is calculated by excluding such gains. Such gains are taken into calculation only in quarter in which they arise.

Some Tips

While the taxes are already burdensome, interests can further add to it. Below are some of the tips to effectively manage interest liability:

- In case of salaried individuals, TDS is generally deducted by employer on whole of the salary income. However, for other incomes like FD Interest, TDS is generally deducted @ 10% which is less than the slab rate. Therefore, it is important to deposit tax on such incomes in advance.

- Filing of income tax return and deposit of tax are two separate events in income tax. While whole of the tax liability should be deposited at financial year end, return filing can be deferred till its respective due date.

- For incomes like capital gains, advance tax should be deposited in the quarter in which such income arises.

- In general, any delay in filing of returns beyond due date should be avoided so as to save interest under section 234 B and 234C and penalty upto Rs. 10,000 under section 234F.