![]()

All about Form No. 15E under the Income Tax Rules , 1962

Recent Changes in Income Tax Act

Introduction:

The Central Board of Direct Taxes (CBDT) notified the new Income Tax Form 15E and Rule 29BA as per Notification No. 18/2021 Dated March. 16, 2021 for application for grant of certificate for determination of the appropriate proportion of sum (other than Salary), payable to a non-resident, chargeable in case of the recipients.

The Board notified the Income-tax (5th Amendment) Rules,2021 which seeks to amend Income-tax Rules, 1962.

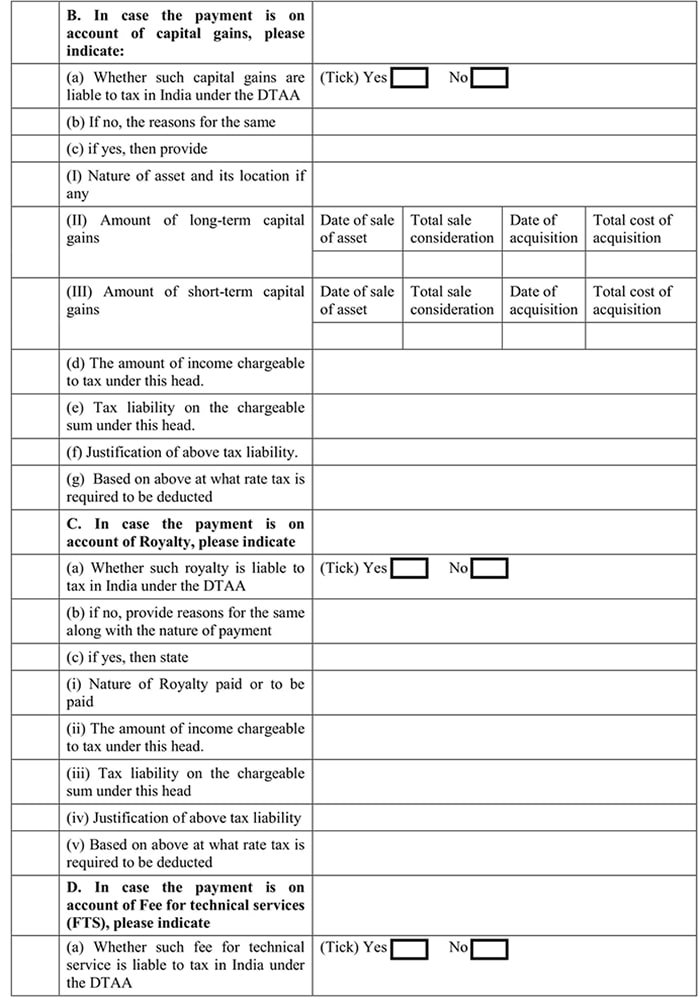

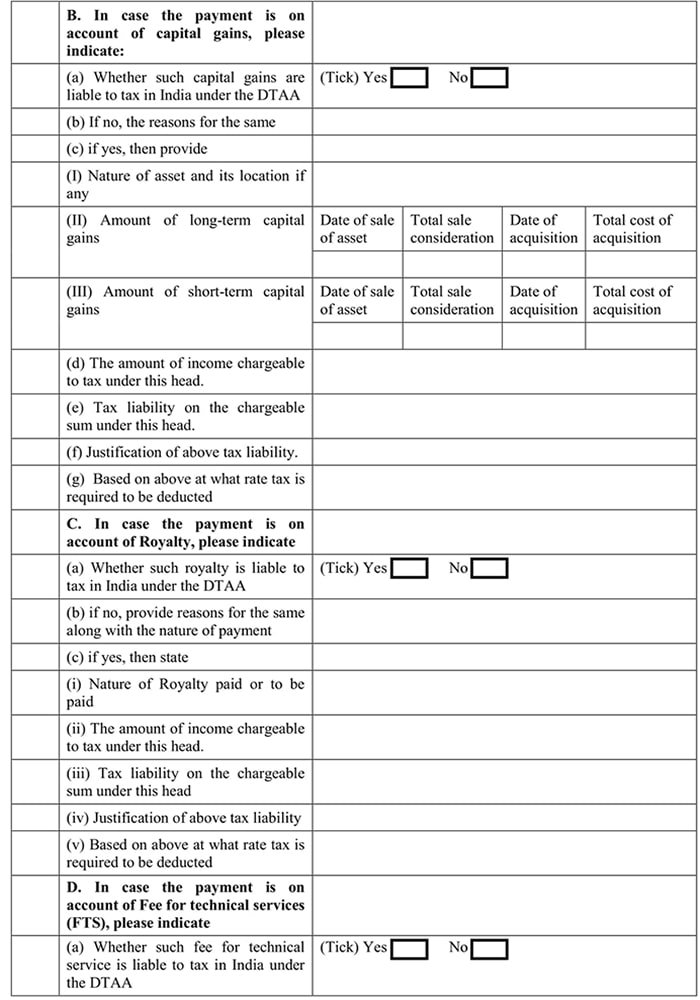

The Board has further notified the release of new Form No. 15E pertaining to application by a person for a certificate under section 195(2) and 195(7) of the Income-tax Act, 1961 for determination of appropriate proportion of sum (other than salary) payable to non-resident, chargeable to tax in case

of non-resident.

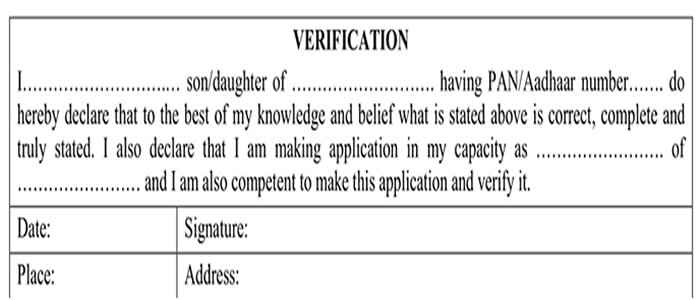

As per the new rule, an application by a person for determination of the appropriate proportion of sum chargeable in the case of the non-resident recipient under subsection (2) or sub-section (7) of section 195 shall be made in Form 15E electronically under digital signature; or through electronic verification code.

The Assessing Officer, in order to satisfy himself, shall examine whether the sum being paid or credited is chargeable to tax under the provisions of the Act read with the relevant Double Taxation Avoidance Agreement, if any, and if the sum is chargeable to a tax he shall proceed to determine the appropriate proportion of such sum chargeable to tax.

The Assessing Officer shall examine the application and on being satisfied that the whole of such sum would not be the income chargeable in case of the recipient, may issue a certificate determining the appropriate proportion of such sum chargeable under the provision of this Act, for the purposes of tax deduction under sub-section (1) of section 195.

While examining the application, the Assessing Officer shall also take into consideration, various information in relation to the recipient.

Firstly, tax payable on estimated income of the previous year relevant to the assessment year;

Secondly, tax payable on the assessed or returned or estimated income, as the case may be, of preceding four previous years;

Thirdly, existing liability under the Income-tax Act, 1961 and Wealth-tax Act, 1957;

Fourthly, advance tax payment, tax deducted at source, and tax collected at source for the assessment year relevant to the previous year till the date of making an application under sub-rule (1).

The certificate shall be valid only for the payment to non-resident named therein and for such period of the previous year as may be specified in the certificate, unless it is cancelled by the Assessing Officer at any time before the expiry of the specified period.

An application for a fresh certificate may be made, if the assessee so desires, after the expiry of the period of validity of the earlier certificate or within three months before the expiry.

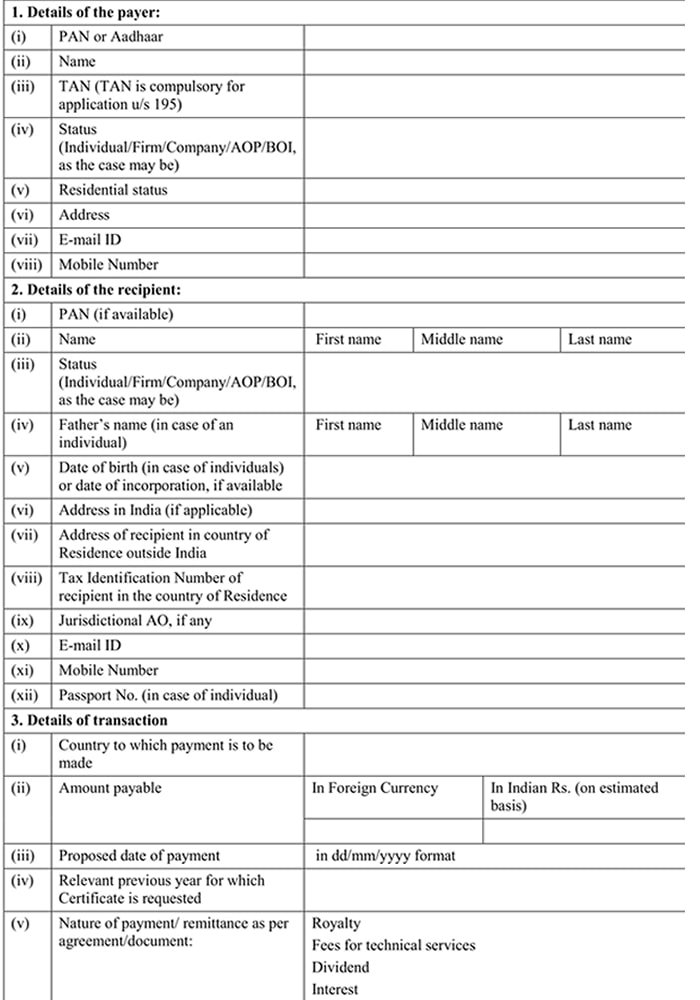

Details Required in Form 15E:

- Basic details of the payer

- Basic details of the recipient

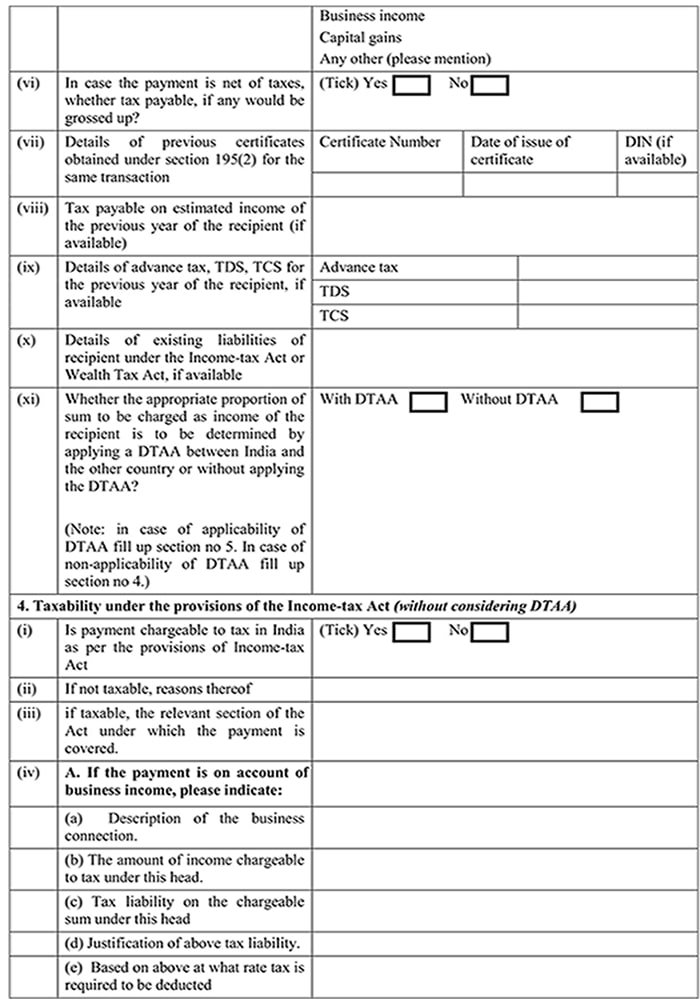

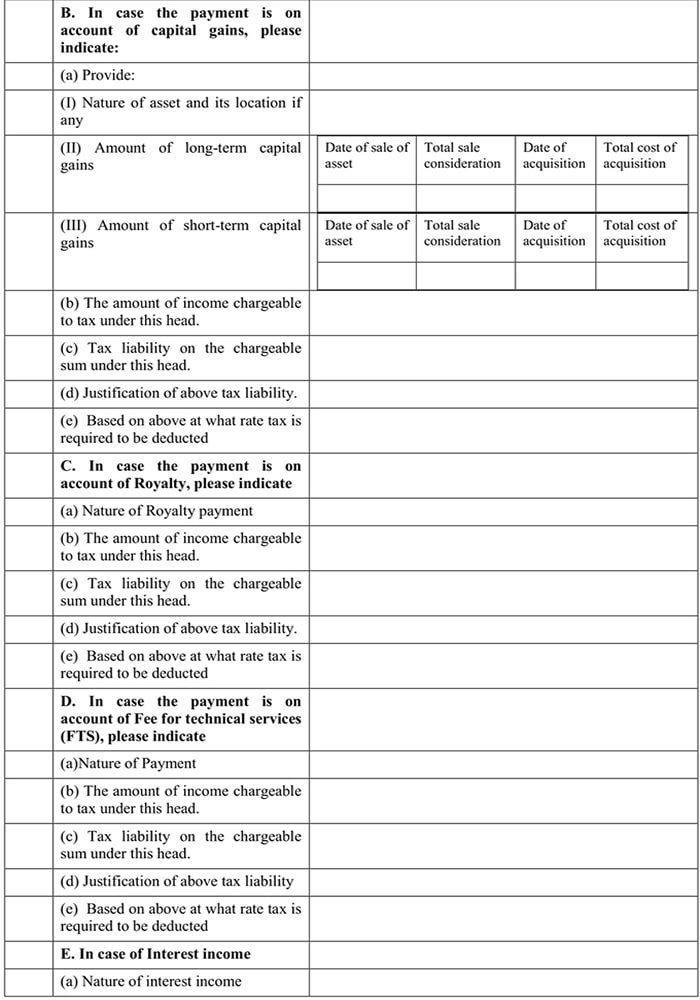

- Details of transactions

- Taxability under the Act

- Taxability under the treaty

- List of documents to be uploaded

List of Documents required for Form 15E:

- Documents such as Relevant documents such as contract for sale of goods and/or provisions for services (if any), computation of capital gains, share purchase agreement, bank payment, details of cost of acquisition, contract note (if any), share certificate (if any), etc.

- Details of assessed/returned/estimated income of payee of preceding four previous years, if available.

- Computation of estimated income chargeable to tax and Tax Liability of the previous year.

- Copy of Tax Residency Certificate and Form 10F.

- Documents in support of claim of applicability of sections 194LB/ 194LBA/194LC/194LD.

- Any other documents you wish to furnish in support of your claim.

Income Tax Act on Your Mobile Now Android Application For Income Tax Act – 1961 with Cost Inflation Index and other tools on Mobile now at following link:

Whatsapp Group at