![]()

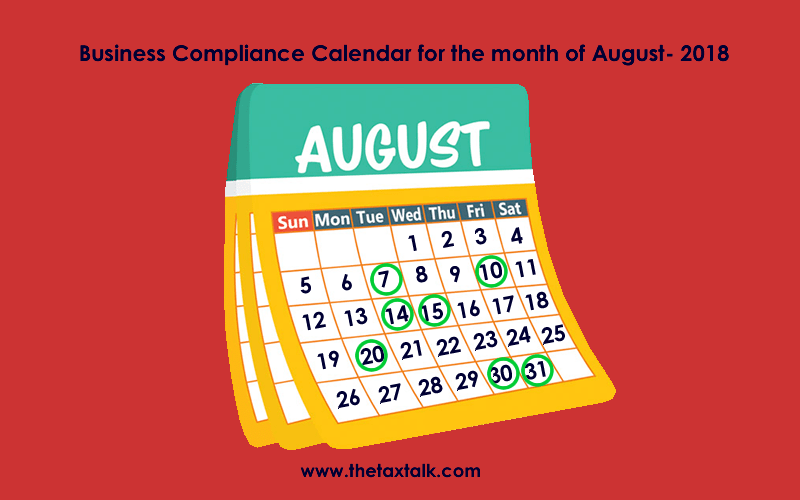

Business Compliance Calendar for the month of August – 2018

07.08.2018

– Due date for Payment of Tax deducted/Collected (TDS/TCS) in the month of July-2018. However, all sum deducted/collected by an office of the Government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan.

10.08.2018

– Monthly GST return in GSTR-1for July-2018 for registered person with aggregate turnover exceeding Rs.1.50 Cr.

14.08.2018

– Due date for issue of TDS Certificate for tax deducted under section 194-IA (TDS on Immovable property) & u/s 194IB (TDS on Certain Rent payment) in the month of June, 2018

15.08.2018

– PF for July-2018

– Monthly ESIC for July-2018

– Issue of TDS certificate for the quarter ended June 2018

– Furnishing of Form 24G (TDS) by an office of the Government where TDS for the month of July -2018 has been paid without the production of Challan.

20.08.2018

– Monthly Summary Return in GSTR-3B for the month of July-2018

30.08.2018

– Challan cum Statement with regard to TDS u/s 194IA (TDS on Immovable property) & u/s 194IB (TDS on Certain Rent payment) for July-2018

31.08.2018

– Statement in Form No.10 to be furnished to accumulate income for future application under section 10(21) or 11(2) (if the assessee is required to submit return of income on or before July 31, 2018)

– Statement by scientific research association, university, college or other association or Indian scientific research company as required by Rules 5D, 5E and 5F (if due date of submission of return of income is July 31, 2018)

– Application in Form 9A for exercising the option available under Explanation to section 11(1) to apply income of previous year in the next year or in future (if the assessee is required to submit return of income on or before July 31, 2018)

– Due date for claiming foreign tax credit, upload statement of foreign income offered for tax for the previous year 2017-18 and of foreign tax deducted or paid on such income in Form No. 67. (If the assessee is required to submit return of income on or before July 31, 2018.)

– Income Tax Return for the assessment year 2018-19 for all assessee other than

(a) Corporate – assessee or

(b) non- corporate assessee (whose books of account are required to be audited) or

(c) working partner of a firm whose accounts are required to be audited or

(d) an assessee who is required to furnish a report under section 92E.

| Special Caution:

Last Date of filling Income tax Return Extended for all assessee other than(a) corporate-assessee or (b) non-corporate assessee (whose books of account are required to be audited) or (c) working partner of a firm whose accounts are required to be audited or (d) an assessee who is required to furnish a report under section 92E 31st August 2018. Non filling within due date will attract penalty from Rs. 1000/- to Rs. 10,000/-. |

[button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/”]home[/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/submit-article-publish-your-articles-here/”]Submit Article [/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/discussion-on-tax-problem/”]Ask Question [/button]