![]()

BACKGROUND:

This article is in regards to the newly introduced reporting structure (“Single Master Form herein referred thereafter SMF “) by Reserve Bank of India (herein referred thereafter RBI) for the reporting of all Foreign Investments so received by “Indian Entities”

This article is in regards to the newly introduced reporting structure (“Single Master Form herein referred thereafter SMF “) by Reserve Bank of India (herein referred thereafter RBI) for the reporting of all Foreign Investments so received by “Indian Entities”

Before moving forwards, let’s begin with terminology like “Foreign Investments”.

|

Foreign Investment[1]in India is regulated in terms of clause (b) sub-section 3 of section 6 and section 47 of the Foreign Exchange Management Act, 1999 (FEMA) read with Foreign Exchange Management (Transfer or Issue of a Security by a Person resident Outside India) Regulations, 2017 issued vide Notification No. FEMA 20(R)/2017-RB dated November 7, 2017. Where, investments can be made in shares, mandatorily and fully convertible debentures and mandatorily and fully convertible preference shares of an Indian company by non-residents, subject to the pricing guidelines / valuation norms and reporting requirements amongst other requirements as prescribed under FEMA Regulations. Further any Indian Entity receiving foreign investments were required to report such transactions to RBI which was Regulated by Regulation 13 of the Foreign Exchange Management (Transfer or Issue of Security by Person Resident Outside India) Regulations, 2017 presently prescribes twelve (12) different types of forms for FDI reporting including Advance Remittance Form, Form FC-GPR, Form FC-TRS, Annual Return on Foreign Labilities and Assets, Form ESOP, Form DRR, Form LLP (I), Form LLP (II), Form Convertible Notes, Downstream Investment Form, Form LEC (FII) and Form LEC (NRI). [1] Foreign Investment’ means any investment made by a person resident outside India on a repatriable basis in capital instruments of an Indian company or to the capital of an LLP; Explanation: If a declaration is made by persons as per the provisions of the Companies Act, 2013 about a beneficial interest being held by a person resident outside India, then even though the investment may be made by a resident Indian citizen, the same shall be counted as foreign investment. Note: A person resident outside India may hold foreign investment either as Foreign Direct Investment or as Foreign Portfolio Investment in any particular Indian company. |

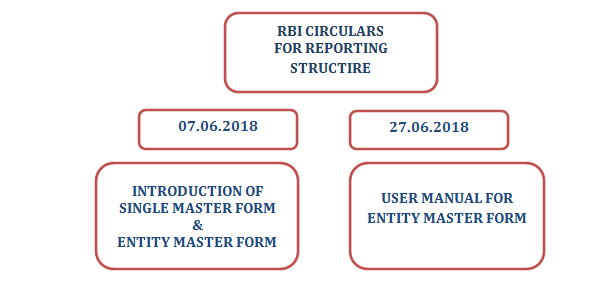

As the present “Reporting Structure” is not in integrated resulting in different and various forms for different type of foreign investments , RBI has introduced “Integrated Reporting Structure” in form of “Single Master Form” vide a RBI Circular[1], notified on the 7 June 2018with the aim of simplifying reporting under the Foreign Exchange and Management Act, 1999 (FEMA). Further On June 27th, 2018, RBI released a User Manual for Entity Master – FIRMS (User Manual)[2]which provides detailed instructions and the process for filing the Entity Master Form.

IMPLEMANTATION:

For the implementation of the above dated circulars; RBI has announced an “ONLINE APPLICATION-FIRMS” (Foreign Investment Reporting and Management System) which will available in Two Phases:

| IN THE FIRST PHASE, THE FIRST MODULE

ENTITY MASTER FORM |

|

| IN THE SECOND PHASE, THE SECOND MODULE

SINGLE MASTER FORM |

|

Note: As the “Single Master Form” will be available from 01st August, 2018; the FAQs in regards to the form will be articulated in next series

IMPORTANT POINTS: TO BE CONSIDERED; ENTITY MASTER FORM

[AVAILABLE FROM 28TH JUNE TO 12TH JULY, 20118]

[WEBSITE: Uniform Resource Locators (URL) of the application is https://firms.rbi.org.in]

Who is entity; under “Entity Master Form”?

Entities will be those, which are eligible for receiving “investments” in India, which can issue: shares, mandatorily and fully convertible debentures and mandatorily and fully convertible preference shares.

Entity here will be any of the following:

- A company within the meaning of section 1(4) of the Companies Act, 2013

- A Limited Liability Partnership (LLP) registered under the LLP Act, 2008

- A start-up which complies with the conditions laid down in Notification No. G.S.R 180(E) dated February 17, 2016 issued by Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India.

Who will fill the form?

All the entities aforesaid, being the artificial person,

- will authorise a person who will be sole person (only one person to be authorised for one entity)

- However one person can act as authorised for multiple entity

- To add/update the foreign investment details of an Entity in the Entity Master

- Hewill be entirely responsible for the data entered.

- Authority letter[1] will be requiredissued by entity for authorising personnel for such transaction.

- Authority Letter submitted by the entity user will be verified by RBI and after RBI’s approval

- While filling the Entity User Registration Form: The user should provide their own PAN No. (not the PAN No. of the company)

Creation of Entity Master Form:

| STEP I | Click on Registration form for New Entity User& Filed Description & generate LOGIN id |

| STEP II | Logging on to Entity Master incorporate following Details:

|

| STEP III | Declaration |

| STEP IV | Submissions |

Points to be noted; while incorporating details: In Foreign Investment in Company / LLP Tab.

- Enter ALL FOREIGN INVESTMENTRECEIVED by the entity since the date of incorporation: All present (as on date received) & past (any in previous year)have to be filledne after the other

- ALL FOREIGN INVESTMENT, irrespective of the fact that the regulatory reporting to RBI for the same has been made or not or whether the same has been acknowledged or not.

| STRUCTURE | TYPES OF INSTRUEMENTS

|

| In case of Company | Paid-up Capital of the company on a [fully diluted basis] |

| In case of LLP | Total Capital contribution in LLP (in INR) |

| In case of start-ups | convertible notes |

- ALL FOREIGN INVESTMENT,weather direct or indirect foreign investments details; needs to be incorporated:

“The Indian companies who have made downstream investment in another Indian company for which it is considered as indirect foreign investment in terms of Regulation 14 of Foreign Exchange Management (Transfer or issue of security by a person resident outside India) Regulations, 2017 dated November 7, 2017 and as amended from time to time, shall inform the same to the Indian investee company for the purpose of providing details of indirect foreign investment in Entity Master.”

- Details of each Issue / transfer (and not investor wise) have to be filled in this page, one after the other.After entering the details of one issue user; add the details of the next issue / transfer.

- Description of the allotment/transfer (whether Rights / Bonus / Share Swap / Merger / Demerger / ESOP/ NR to R transfer/ R to NR transfer etc).

- In case of Company: Equity Shares, CCPS, CCDs, Share Warrants, Partly Paid up Shares

- In case of LLP: Capital Contribution or Profit Share

- In case of start-ups– Convertible Notes.

- Number of Instruments / Percentage of capital contribution

- In case of company, number of capital instruments issued to the foreign investors to be provided

- In case of LLP, percentage of capital contribution received from the foreign entity to be provided.

Disclaimer: Appreciate your support and so happy to have you as reader.

This article is only knowledge sharing initiative and is not intended to be a part of any advertising. The information contained therein is of general nature and the entire contents of this document have been developed based on relevant information and are purely the views of the authors. Though the authors have made utmost efforts to provide authentic information however, the authors expressly disclaim all or any liability to any person who has read this document, or otherwise, in respect of anything, and of consequences of anything done, or omitted to be done by any such person in reliance upon the contents of this document . READER SHOULD SEEK APPROPRIATE COUNSEL FOR YOUR OWN SITUATION. AUTHOR SHALL NOT BE HELD LIABLE FOR ANY OF THE CONSEQUENCES DIRECTLY OR INDIRECTLY

- All details must be provided in one go.

- Only when all the mandatory fields have been filled, the submit button is enabled.

- The RESET button will reset the complete form.

- Once the details have been submitted the Entity user can modify the details.

- The onus of the integrity of the data entered is on the Entity user.

[3] Fully diluted basis means the total number of shares that would be outstanding if all possible sources of conversion are exercised. It includes:

- Equity shares: As equity shares

- CCDS/ CCPS: Equivalent Equity shares. (If the conversion ratio is not fixed upfront, the company may enter the maximum number of equity shares possible upon conversion in compliance with the pricing guidelines)

- Share warrants: Equivalent Equity shares considering 100% exercise upfront

- ESOPs: Equivalent Equity shares considering 100% exercise upfront

GORSIA & ASSOCIATES

GORSIA & ASSOCIATES

CS ANJALI J. GORSIA PRACTICING COMPANY SECRETARY

[button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/”]home[/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/submit-article-publish-your-articles-here/”]Submit Article [/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/discussion-on-tax-problem/”]Ask Question [/button]