![]()

How to reconcile purchase bills with GSTR-2A?

STEP-1: Firstly login to yourself

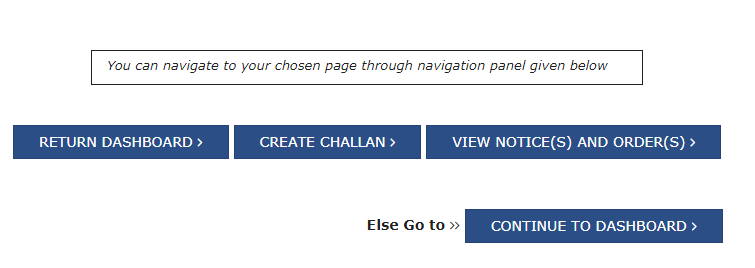

After login, following screen will appear

STEP-2: CLICK on ‘Return Dashboard’ option which is appeared in above screen,

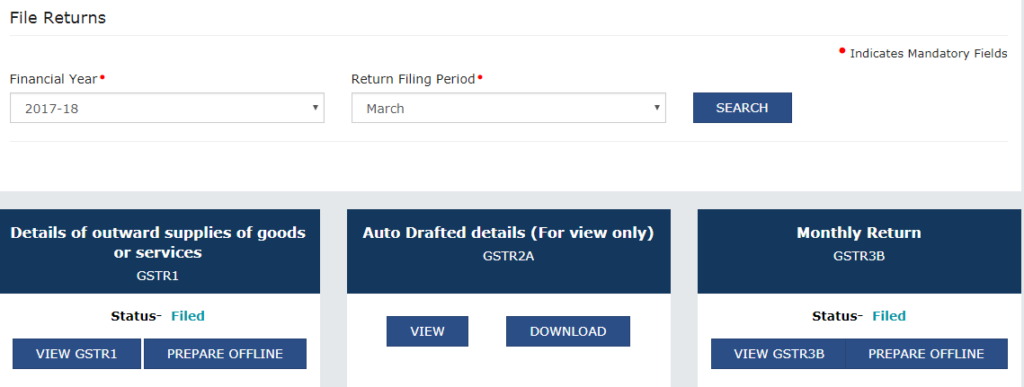

After that select the F.Y. and period to which you want information.

STEP-3: Following screen will be appeared,

You have 2 options either you Click on GSTR-2A View option or download option

STEP-4: If you click on VIEW option, following screen will be appeared

You can check the details of Invoices, Credit/Debit notes etc

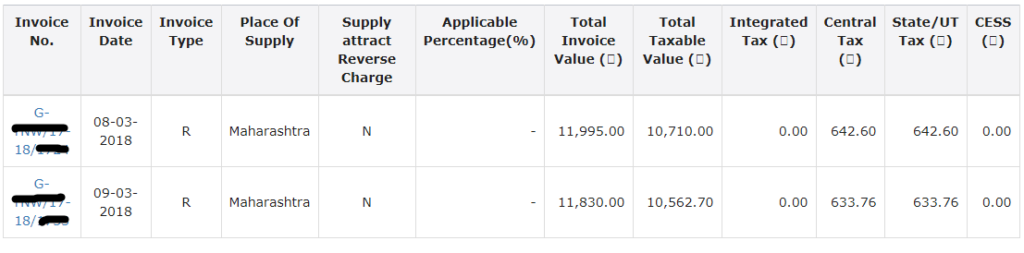

STEP-5: If you click on B2B invoices, following screen will be appeared

On the basis of following screen you can check all the details like who has filled GSTR-1, If counter party Submit status shows “YES” it means vendor has filled GSTR-1, if is shown “No” it means Vendor has not filled his GSTR-1 for that period.

STEP-6: if you want to see more details regarding bill and how much invoices are uploaded then you can click on GSTIN No. and you will get all the details of the bills with respect to that particular GSTIN No. following screen will be appeared

STEP-7: If you click on Download in Step-3, then it will gives massage that “after 20minutes file will be available”. After that you are required to click on Generate file. A ZIP file will be available for download. Downloaded file required to open in “GSTR Offline tool“which is available for download at GST site.

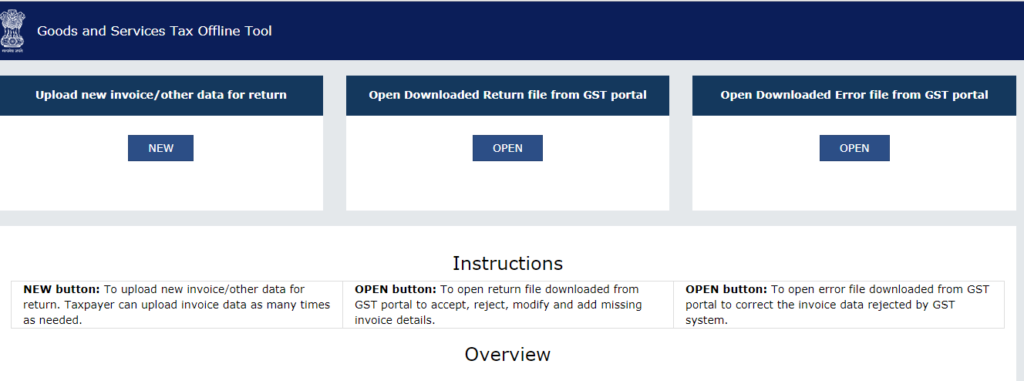

STEP-8: Following screen will be appear after opening offline tool

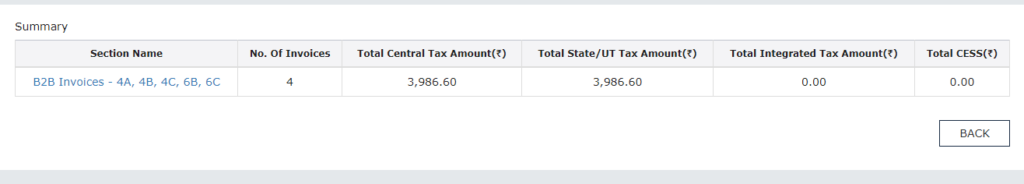

STEP-9: click on middle title as” open downloaded return file from GST portal” and browse the downloaded file. Summary will be generated as under

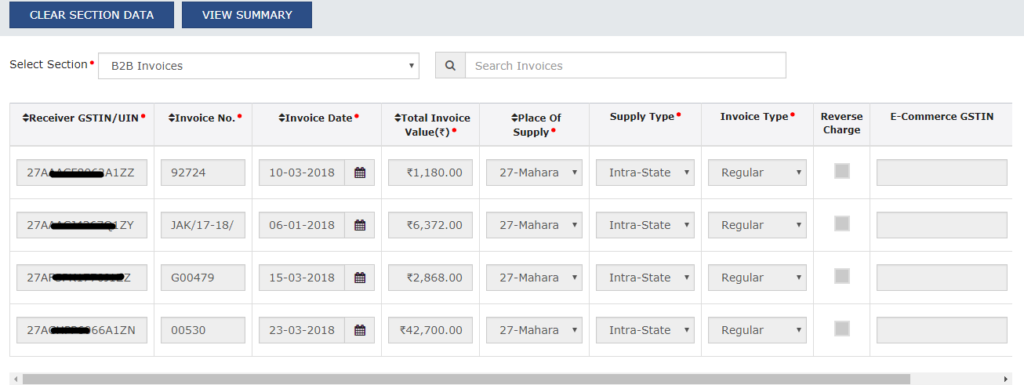

STEP-10: CLICK on “B2B Invoices-4A,4B,4C,6B,6C” bill wise details will be appear

In this way, you can reconcile your purchases recorded in the books with the GSTR-2A and if any invoice is not appeared then you can ask to vendor for why your bill not shown in GSTR-1 and take necessary action.

Note: In step-9, only browse ZIP file and not the JESON file