![]()

FILLING OF GSTR 3B

GSTR 3B – Summary return of all outward and inward supply. All taxpayers have to file the return by 20th of subsequent month. We all know that filing of GSTR 3B has been extended till June 2018 so let us learn about it in more detail.

Login – Login to GST portal (www.gst.gov.in)

Return Dashboard – Click on return dashboard and select the period for which return is to be filled.

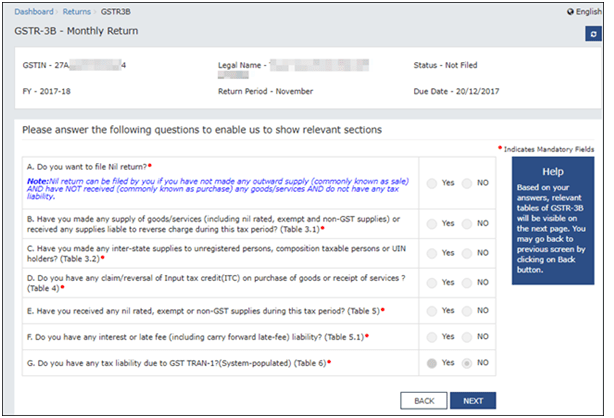

Image below will pop up and select the relevant sections applicable.

After clicking on NEXT following page will be displayed.

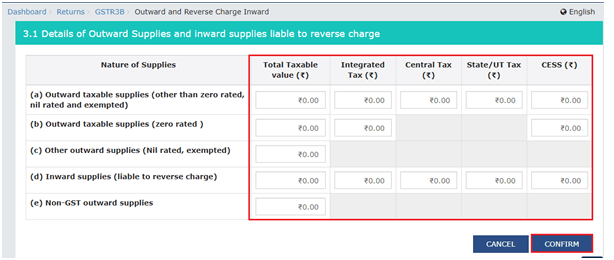

Tile 3.1 – Details of outward supplies and inward supplies liable to reverse charge. As it is a summary return consolidated amounts are required to be given.

(a) Outward taxable supplies ( other than zero rated, nil rated and exempted):

- Interstate and Intra state supplies (Total taxable value)

- IGST on interstate supplies (Integrated tax)

- CGST & SGST (Central tax & State tax)

As per recent change in portal, taxpayer needs to fill either CGST or SGST as other will be auto filled.

4. Cess, if any

(b) Outward taxable supplies (zero rated): It includes

- Taxable value of supplies outside India

- Taxable value of supplies to notified SEZ within India

- IGST on such supplies

(c) Other outward supplies (NIL rated, exempted):

- Supplies for which notified rate of tax is NIL

- Supplies which are specifically exempt under GST law

(d) Inward supplies (liable to reverse charge):

- Taxable value of inward supplies where recipient of such supply is liable to pay tax. Concept of reverse charge mechanism is given u/s 9(3) & 9(4).

(e) Non GST outward supplies

- Value of sale of goods which do not fall under the ambit of GST such as petroleum crude & petrol, High speed diesel, natural gas, electricity, alcohol for human consumption aviation turbine fuel.

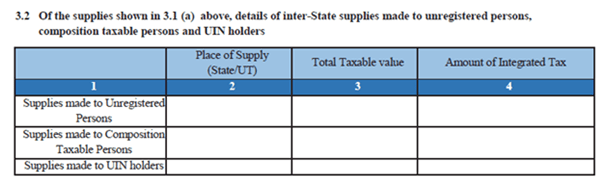

Tile 3.2: Of the supplies shown in 3.1(a) above, details of Inter-state supplies made to unregistered person, composition taxable persons and UIN holders.

It shall include interstate supplies made to –

- Unregistered persons

- Composition dealers

- Unique Identification Holder (UIN holder)

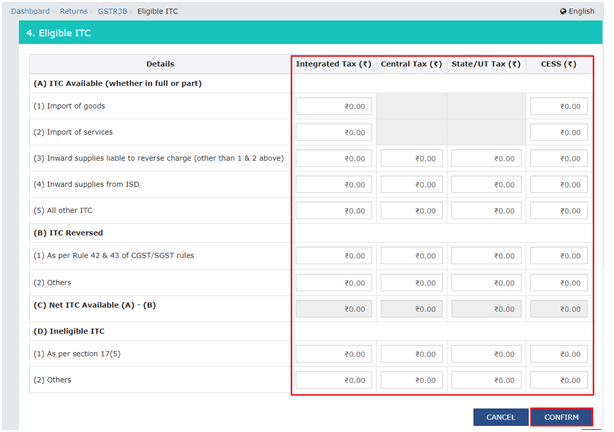

Tile 4: Eligible ITC

(a) ITC available

- Import of goods – IGST paid on goods imported and used in the course of business.

- Import of services – IGST paid on import of services which are used in the course of business.

- Inward supplies liable to reverse charge – Supply on which tax is paid by recipient of goods or services under reverse charge mechanism, credit of which is available here.

- Inward supplies from ISD (Input service distributor) – Where business has multiple units and supplies goods from all such units, ISD will allot ITC to each unit.

- All other ITC – All other ITC not mentioned above.

(b) ITC reversed

- As per Rule 42 & 43 of CGSR/SGST rules – determination of ITC where input or input services

- Used partly for business purpose and partly for other purpose

- Partly for taxable supplies (including zero rated supplies) and partly for exempt supplies

Rule 43 is applicable for capital goods.

(c) Net ITC available – Calculated as (a) – (b)

(d) Ineligible ITC – List of items on which ITC is not available is given u/s 17(5). For more detail you can refer to following link

https://thetaxtalk.com/2018/05/01/items-of-which-input-tax-credit-itc-is-not-allowable-under-gst/

Tile 5: Values of exempt, nil rated and non GST inward supplies

It shall include

- Inward supply from composition dealer

- Inward supply exempt from tax

- NIL rated inward supply

- Non GST inward supply

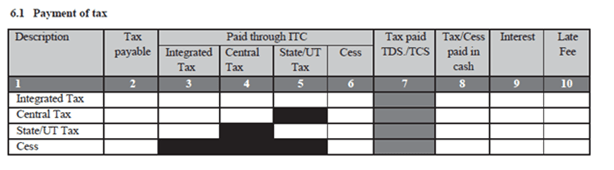

Tile 6: Payment of tax

Recent changes have been made in this part. Earlier in order to ascertain tax liability taxpayer had to submit the return. Once submitted, no changes were allowed to be made. Now current balance of ITC, balance in cash ledger, final liability will be displayed before the return is submitted.

Also taxpayer himself had to fill ITC utilized, cash to be paid and create challan for the same. Now ITC is automatically utilized, cash to be paid is calculated and also challan for amount of tax to be paid is auto generated.

Well this was the biggest challenge as there were chances of making mistake such as wrong classification of tax head or wrong amount calculated. But now taxpayer can easily fill the return without making such errors.

To offset liability click on ‘Make payment/Post credit to ledger’.

At last to file the return click on ‘Proceed to file’ and from authorized signatory drop down list select authorized signatory. Click ‘File GSTR3B with DSC’ or ‘File GSTR3B with EVC’

Points of caution:

- GSTR 3B is required to filed by registered person even if there is no sale or purchase.

- GSTR 3B once FILED cannot be revised.

- Changes can be made before making payment.

- Copy paste of amounts is NOT allowed, each amount has to be entered manually.

- Click ‘Save GSTR3B’ after details are entered to avoid data loss.

- Upon generation of GSTR 3, the difference between GSTR3 and GSTR3B will be automatically calculated. In case of upward revision taxpayer will be liable to interest on differential amount.

[button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/”]home[/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/submit-article-publish-your-articles-here/”]Submit Article [/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/discussion-on-tax-problem/”]Discussion[/button]