![]()

What is Cash Credit& how it is checked?

The basic details regarding bank audit is already covered under in the previous article. You may refer link…

[button color=”” size=”” type=”outlined” target=”” link=”https://thetaxtalk.com/2018/03/17/bank-audit/”]click here[/button]

Cash Credit:

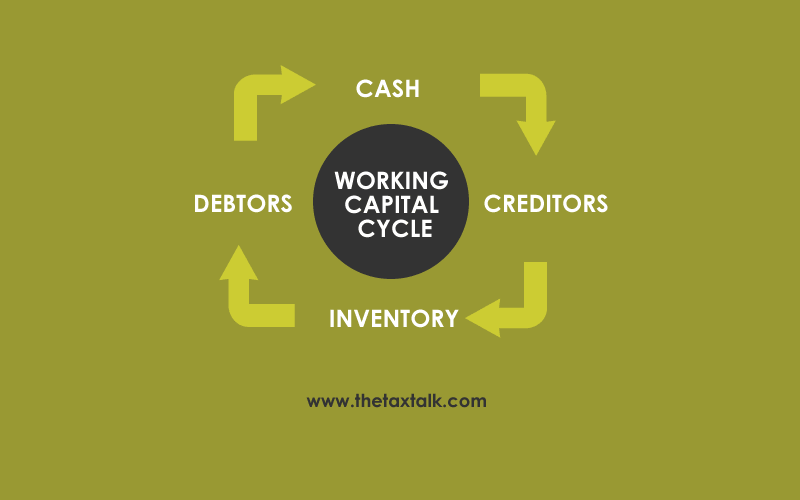

- Cash Credit is granted to borrowers to meet their working capital requirement.

- In case of CC the customer is allowed to draw the funds made available to a customer to meet the day to day working capital requirement

- CC is granted against security of stock, receivables etc., to traders, manufacturing units etc.,

- Interest is charged only on the amount of loan taken by the customer and not on the amount of credit sanctioned.

- The credit limit extended on the cash credit account is normally a percentage of the value of the security offered.

Checklist for Cash Credit:

Some Common Points for all loans:

- CIBIL of the borrower & Guarantors

- Sanction letter

- 3 years ITR of borrower & guarantors.

- Financial Statements of the firm/business/company

- Proper margin & Appropriate ROI is stipulated.

- Borrower & Guarantors’ profile with Photographs, ID & Address proof copy.

- PAN Card copy of borrower & guarantors.

- Whether charge/lien is properly created in favor of Bank.

- Check primary & collateral security details.

- Sanction is within the power of respective officer.

Other Checklist for Cash Credit:

- Pre-sanction inspection report.

- Post-sanction inspection report.

- Collateral security details

- Valuation Report (not more than 3 years old)

- Legal Opinion

- Search report

- CERSAI of collateral securities

- Check whether primary security (stock) & collateral security (buildings etc.) is adequately insured with bank clause.

- Check that stock, creditors &book debts statements submitted by the borrower is in prescribed format.

- If the stock statement is not submitted then ensure that penal interest is charged on daily basis.

- Ensure that Debtors are classified age-wise & only below 90 days (in most cases) debtors are allowed for DP purpose.

- Check that drawing power is calculated correctly.

- CA certified debtors statements/QIS are obtained quarterly/half yearly (as the case)

- Position of stock audit. (If applicable)

- Check that inspections are carried out at periodic intervals & inspection report is on record.

- Monitor the CC account, also check turnover position in the account

- Whether Annual Review is done? If pending at the time of audit.

- Check whether account requires to classify under NPA category, as per NPA norms.

Above checklist is inclusive. One may check additional points according to sanction letter and as per the norms of respective banks.

[button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/”]home[/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/submit-article-publish-your-articles-here/”]Submit Article [/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/discussion-on-tax-problem/”]Discussion[/button]