![]()

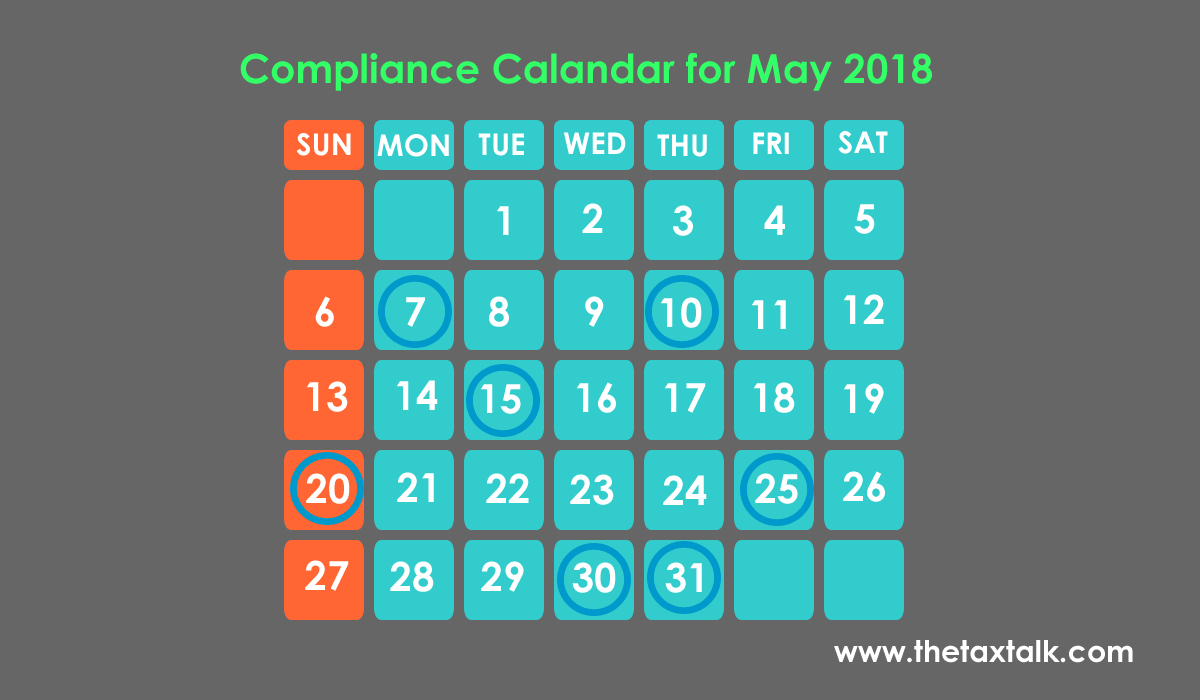

Business Compliance Calendar for the month of May 2018

07.05.2018

– Due date for Payment of Tax deducted/Collected (TDS/TCS) in the month of April-2018

10.05.2018

– Monthly GST return in GSTR-1for March-2018 for registered person with aggregate turnover exceeding Rs.1.50 Cr.

15.05.2018

– PF for April-2018

– Monthly ESIC for April-2018

– TCS Return for the Quarter ended March -2018

– Issue of TDS certificate for tax deducted in the month of March-2018

a) u/s 194IA (TDS on Immoveable property)

b) u/s 194IB (TDS on Certain Rent payment)

– Furnishing of Form 24G (TDS) by an office of the Government where TDS for the month of April -2018 has been paid without the production of Challan.

20.05.2018

– Monthly Summary Return in GSTR-3B for the month of April -2018

– Return in GSTR-5 for the month of April-2018for Non Resident Taxable Person

– Return in GSTR-5A for the month of April-2018 by Non Resident Foreign Taxpayers who have come for a short period to make supplies in India

25.05.2018

– Provident fund, Employees Deposit linked Insurance Scheme (EDLI) Return filling for April 2018

30.05.2018

– Challan cum Statement with regard to TDS u/s 194IA (TDS on Immoveable property) for April -2018

– Challan cum Statement with regard to TDS u/s 194IB (TDS on Certain Rent payment) for April-2018

– Submission of a statement in Form No.49C by Non-Resident having liaison office in India.

– Issue of TCS certificate for the quarter ended March 2018

31.05.2018

–TDS Return for the Quarter ended on March 2018

– Return of Tax deduction from contributions paid by the trustees of an approved superannuation fund

– Statement of Financial Transactions (SFT) to be furnished by person specified in rule 114E in Form No. 61A in respect of Financial Year 2017-18

– Statement of reportable account to be furnished by reporting financial institution referred in rule 114G in Form No. 61B in respect of Financial Year 2017-18

– Return in GSTR-6 for the Month of April 2018 for the Input service Distributor

– Monthly GST return in GSTR-1for April-2018 for registered person with aggregate turnover exceeding Rs.1.50 Cr.

GST Caution:

- Monthly GST return in GSTR-1 for April -2018 for registered person with aggregate turnover exceeding Rs.1.50 Cr. is required to be filled till 31st May, 2018 & not 10th June, 2018.

E-Way Bill is deferred for Intra-state transaction for goods movement of an amount exceeding Rs. 50,000/- till 31st May, 2018.