![]()

Goods Transport Agency

GOODS TRANSPORT SERVICE

AGENDA-

- Definition of GTA

- Consignment Note

- TAX under RCM

- Recipient of service under RCM

- Exemption of GST for GTA

- Registration

- POS of Transportation by GTA

- GST Rate for GTA

- ITC

GST on Transportation of Goods by Road

“ As Exemption Notification -12-2017 dated 28 June 2017 Paragraph 1 Serial No. 18- Service by way of transportation of goods by road is exempted except the services of Goods Transport Agency and courier agency”.

Definition of GTA:-

As “Notification 12-2017 dated 28 June 2017 Paragraph 2

any person who provides service in relation to transport of Goods by road and issues consignment note, by whatever name called, because consignment note is even issued by transport owners.

What is consignment Note?

- Document Issued when goods are received by GTA for the purpose of transport of goods by roads in a goods Carriage.

- Contents of Consignment Note:

- Name of the Consignor

- Name of the consignee

- Registration no. of Vehicle

- Details of Goods

- Place of Origin

- Place of destination

TAX under Reverse Charge Mechanism

As per Notification No. 13/2017- Central Tax (Rate) dated 28.06.2017, Central Government has notified the applicability of reverse charge on GTA.

Supply of services by a goods transport agency (GTA) in respect of transportation of goods by road to-

- Any factory registered under or governed by factories Act, 1948(63 of 1948); or

- Any Society registered under the Societies Registration Act, 1860 (21 of 1860) or

under any other law for the time being in force in any part of India; or - Any co-operative society establish by or under any law; or

- Any person registered under the Central Goods and Services Tax or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or

- Any-body corporate established, by or under any law; or

- Any partnership firm whether registered or not under any law including association of persons; or

- Any casual taxable person.

Recipient of services under RCM

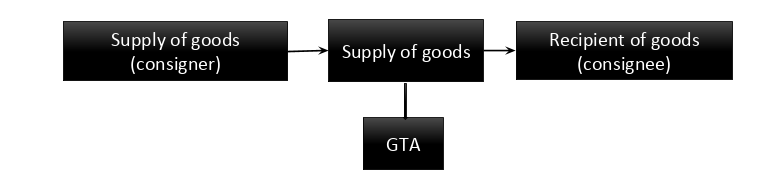

“ The person who pays or is liable to pay freight for the transportation of goods carriage, located in the taxable territory shall be treated as the person who receives the service for the purpose of this notification(notification no )”.

- The person who is liable to pay will be the service recipient and he may be either the consignor or the consignee.

- If the liability of payment of freight to GTA is of supplier of Goods (Consignor),then that supplier/Consignor will be treated as the recipient and if he is covered under aforesaid (a) to (g) category, then that supplier needs to discharge GST on reverse charge basis.

GST will not be charged under which circumstances?

- Goods transported are agricultural produce, milk, salt, food grain including flour, pulses and rice, organic manure, newspaper or magazines registered with the Registrar of Newspapers, relief materials meant for victims of natural or man-made disasters, defense or military equipment.

- If the consideration charged for transportation charges(freight) to a single consignee does not exceed Rs. 750/- for all the goods transported.

- If the consideration charged for transportation charges(freight) of a consignment in a single carriage does not exceed Rs. 1500/- .

- If the consideration charged for transportation charges(freight) does not exceed Rs. 5000/- per day for intra state supplies of goods or services or both to a registered person by a supplier (whether registered or not). (vide notification no. 8/2017-dated 28th June 2017).

Registration for GTA

“ When GTA is required to take registration?”

- As per Section 22(1) of CGST Act, 2017 “ once aggregate turnover of a GTA exceeds Rs. 20 Lakh, he is compulsorily required to take registration.

Compulsory Registration

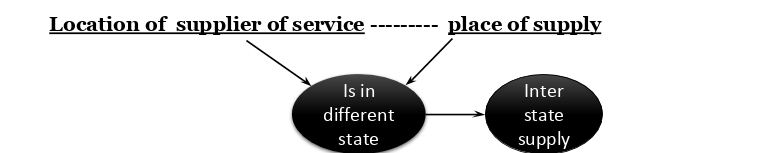

- As per section 7 of IGST where the location of supply and place of supply is in different state

Rule for Place of Supply for Transportation of goods by road by GTA

- If that supply is to a registered person, place of supply will be ‘location of such person’.

- If that supply is to a person other than a registered person, place supply will be ‘ location at which such goods are handed over for their transportation’

Registration exemption for GTA

No Registration required for person whose supplies are fully exempted:

- Section 23(1) of CGST Act, 2017 the following person is not required to take registration:

- ‘any person engaged exclusively in the business of supplying Goods or Services or both that are not liable to tax or wholly exempt from tax under this Act or under the Integrated Goods and Services Tax Act.’

- Registration is not required if GTA is exclusively supplying goods and services, The total tax on which is required to be paid by recipient under RCM, even if his turn over exceeds Rs.20 Lakh.

What accounts and records needs to maintained by GTA?

- As per section 35(2), every transporter, irrespective of whether he is a registered person or not, shall maintain records of the consignor, consignee and other relevant details of the goods in such manner as may be prescribed.

- If Transporter is not registered, then he shall submit the details regarding his business electronically on the common portal in form GST ENR-01 and upon validation of the details furnished, a unique enrollment number shall be generated and communicated to the said person.

- Any person engaged in the business of transporting goods shall maintain records of goods transported, delivered and goods stored in transit by him along with GSTN IN of the registered consignor and consignee for each of his branches.

What invoices/consignment note will be required to be issued by GTA?

Where the supplier of taxable service is a goods transport agency supplying services in relation to transportation of goods by road in a goods carriage, the said supplier shall issue a tax invoice or any other document in lieu thereof, by whatever name called, containing the :

- Gross weight of the consignment,

- Name of the consigner and consignee,

- Registration number of goods carriage in which goods are transported,

- Details of goods transported,

- Details of place of origin and destination,

- Goods and services tax identification number of the person liable for paying tax

whether as a consigner, consignee or goods transport agency and , - Other general information which are also applicable for normal invoices.

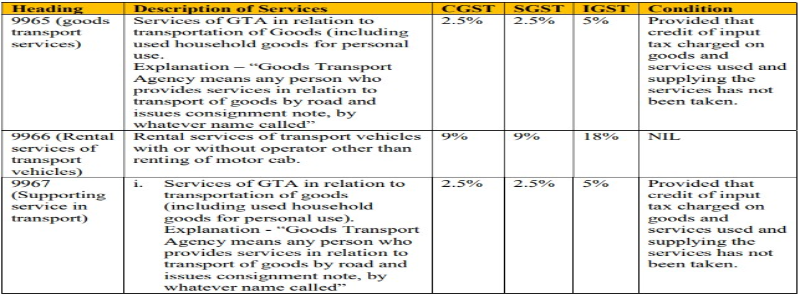

GST rate applicable to GTA

- The only rate applicable to GTA for providing services of transportation of goods by road (including used household goods for personal use) is 5%. (This will also be applicable only when the liability to pay tax comes on GTA, otherwise in most of the cases tax will be paid by recipient of service provided by GTA on RCM basis)

- GTA is not allowed to avail any credit of input taxes paid by them or charged to them for any goods or services used by them for providing transportation services.

Will GTA get any input tax credit?

- No, A Goods transport Agency will not be eligible for any input tax credit for the taxes paid. So, whatever liability arises needs to be discharged through any of the payment options allowed under the GST law.

- Recipient of services paying tax under RCM will get ITC

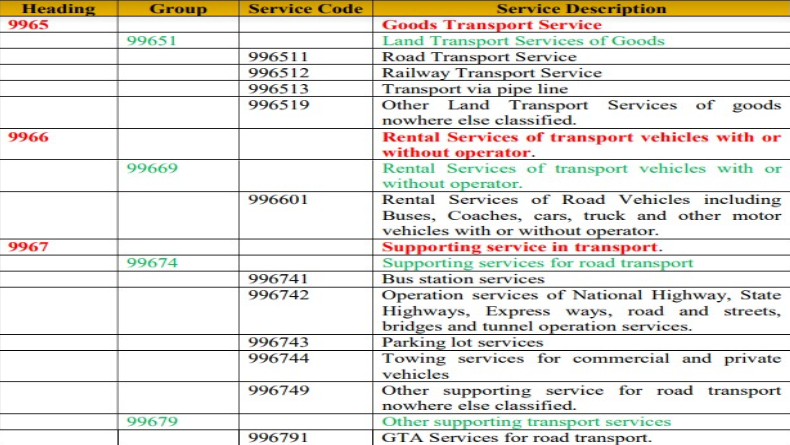

Goods Transport covered under the Headings of SAC.

[button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/”]home[/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/submit-article-publish-your-articles-here/”]Submit Article [/button] [button color=”” size=”” type=”round” target=”” link=”https://thetaxtalk.com/discussion-on-tax-problem/”]Discussion[/button]