![]()

Suggestion to improve Faceless Penalty Scheme:

An Excelllent Representation by KSCAA

Date: 4thJune 2021

To,

Shri. J B Mohapatra

The Chairman

Central Board of Direct Taxes,

New Delhi – 110001

Respected Sir,

SUBJECT: SUGGESTIONS TO IMPROVE THE FACELESS PENALTY SCHEME

The Karnataka State Chartered Accountants Association (R) (in short ‘KSCAA’) is an Association of Chartered Accountants, registered under the Karnataka Societies Registration Act, in the year 1957. KSCAA is primarily formed for the welfare of Chartered Accountants and represents before various regulatory authorities to resolve the problems / hardships faced by Chartered Accountants and business community.

We congratulate and applaud the efforts of the Department in striving hard to discharge its statutory duties and functions as conferred under slew of the provisions, especially u/s 119 of the Income-tax Act, 1961 (“the Act”), more so, in these testing times of COVID-19 pandemic.

We have written to your good selves on various occasions, populating issues and possible solutions which arise while discharging our duties as Accountants. In these trying times, there are some genuine concerns which could cause unwarranted difficulties and hardship to tax assessees. We at KSCAA thought it fit to bring these concerns and hardships being faced to the fore on to the table through this representation. We humbly request your good selves to please take cognizance of these issues, concerns and hardships and appeal to your good selves to provide amicable resolutions on the same.

We have seen some far-reaching and sweeping changes that have been introduced in the Direct Tax administration in last few years. One of the major change is the introduction of the Faceless Scheme, for Assessments, Appeals and Penalty. Faceless Assessment scheme was notified in 2019 followed by Faceless Appeal scheme in 2020 and Faceless Penalty scheme in 2021. This was a step in the right direction, aimed to “simplify the tax administration, ease compliance, and reduce litigation”, in the words of our Hon’ble Finance Minister during her Budget speech of 2020-21.

It is well known that any major change to an existing legislation or tax administration could present few teething troubles and unforeseen flaws in the beginning and in this regard the faceless penalty scheme is not an exception and has few maladies which we sincerely seek to bring to your kind attention. Few issues related to faceless penalty scheme which we would like to bring to your kind attention are elaborated as below which warrant immediate measures to resolve and address them.

- Penalty notices are re-issued by the concerned Faceless unit / officer without considering the responses as submitted earlier by the taxpayers or his authorised representatives. This leads to a situation where multiple penalty proceedings could be kept open under the e-assessment tab in the Income Tax Portal and thereby creating confusion and chaos in the minds of both assessees and the tax professionals alike. It is a wasteful expenditure of energy and hence a superfluous exercise to call for responses where the information sought for is already available on the records of the department.

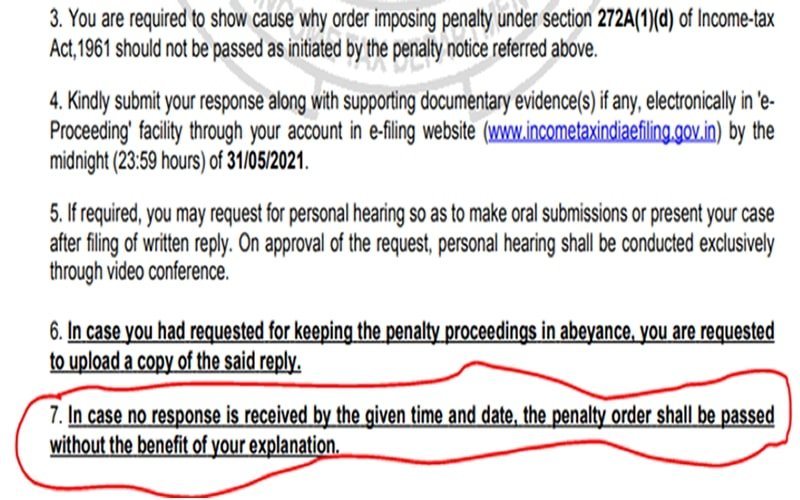

- Penalty notices (being the first notice issued by the Officer under faceless regime during the pandemic) are issued with a clause stating that penalty order shall be passed if no timely response is submitted to the first notice. This is very unfortunate and was uncalled for given the pandemic situation the entire country has been bracing and taxpayers are struggling for their survival. The relevant extract of the same is –

- Further, wherever an appeal is e-filed, the concerned must consider the same and penalty proceedings are kept in abeyance, as appeal information is easily available online. In such cases, the concerned should not pass order levying penalty take advantage of “no-response”.

- Penalty notices are issued without considering the documents already available on record. There are instances where assessment order (which is generally the basis of issue of penalty notice) is being sought from the assessee, which could potentially raise doubts on the validity and veracity of such penalty proceedings.

Aside from the above issues related to Penalty scheme, we would also like to bring few important issues which begs your kind attention and would also seek appropriate and amicable resolution steps on them-

- There are few instances where the opportunity of hearing the assessees or his authorised representative through Video Conferencing was not extended during the faceless assessment proceedings. It hereby requested to your good selves to please grant such opportunity whenever it is so requested in the case. This is in line with sub-paragraph (B) of Paragraph 1 of Notification No. 3/2021 ( No. 370142/51/2020-TPL) dated 12th January, 2021.

- Bar on adversarial orders / demand collection measures which were prevalent during Wave 1 of pandemic should be enforced again till Wave 2 of pandemic subsides.

We request your good selves to kindly consider our suggestions in the interest of a large number of assessees and tax practitioners. We are confident that your kind cognizance to the above issues will lead to better and efficient use of national resources.

We sincerely hope that your good selves would appreciate that the implementation of above suggestions will make a lot of difference to the assessees as they would not be put to undue hardship of additional compliance / procedure during these tough times of Pandemic.

We at KSCAA sincerely hope that the department, tax practitioners and assessees all 3 constituents of taxation system of our Country need to work in harmony with each other for the benefit of stakeholders at large. We believe that the pain points, issues and practical difficulties of assessees and our members along with suggestions as listed above would invite your kind consideration. We are also optimistic that your good selves would definitely make an ‘all out’ effort to ensure that the necessary steps would be taken to provide relief and resolution on all these issues.

Yours Sincerely,

for Karnataka State Chartered Accountants Association ®

President Secretary Chairman,

Representation Committee

CC to:

- Union Minister for Finance

- Union Minister of State for Finance

- Revenue Secretary, Ministry of Finance

Income Tax Act on Your Mobile Now Android Application For Income Tax Act – 1961 with Cost Inflation Index and other tools on Mobile now at following link:

Whatsapp Group at

-

https://chat.whatsapp.com/CYwsJbvzWj80xZBhDN07jv